- United States

- /

- Software

- /

- NasdaqGS:TTAN

How Attractive Is ServiceTitan After Shares Fall 11% in the Past Month?

Reviewed by Bailey Pemberton

ServiceTitan stock has caught the eye of many investors lately, and with good reason. If you are standing on the sidelines trying to decide your next move, you are not alone. After climbing earlier in the year, the stock most recently closed at $101.67, but momentum seems to have cooled off. ServiceTitan is down 3.2% over the past week and off by 10.8% in the last month. Still, year-to-date, the performance is basically flat, clocking in at a small gain of 0.2%.

Some of these fluctuations echo broader shifts in the software sector and evolving market sentiment around growth names like ServiceTitan. As investors weigh the company’s growth prospects and its position in a competitive landscape, there has been an increased focus on valuation, which is a key ingredient when deciphering whether now is the time to buy, sell, or hold. According to our standard valuation checks, ServiceTitan is undervalued in just 1 out of 6 categories, earning a value score of 1. In other words, it does not look like a classic bargain based on these metrics.

But what do those valuation approaches actually tell us, and is there a smarter way to gauge what ServiceTitan is worth today? Next, let’s break down these conventional valuation methods, and then, at the end, reveal a more insightful approach to making sense of ServiceTitan’s true value.

ServiceTitan scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ServiceTitan Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and discounting them back to today’s dollars. This approach aims to determine what ServiceTitan may truly be worth based on cash flows it is expected to generate over the coming years.

Currently, ServiceTitan’s annual Free Cash Flow sits at around $9.33 million. Analysts provide specific cash flow projections for the next few years. For longer timeframes, Simply Wall St extrapolates those trends. By 2028, projected annual free cash flow rises sharply to $112.5 million. Their ten-year outlook places estimated annual figures well above $200 million towards 2035.

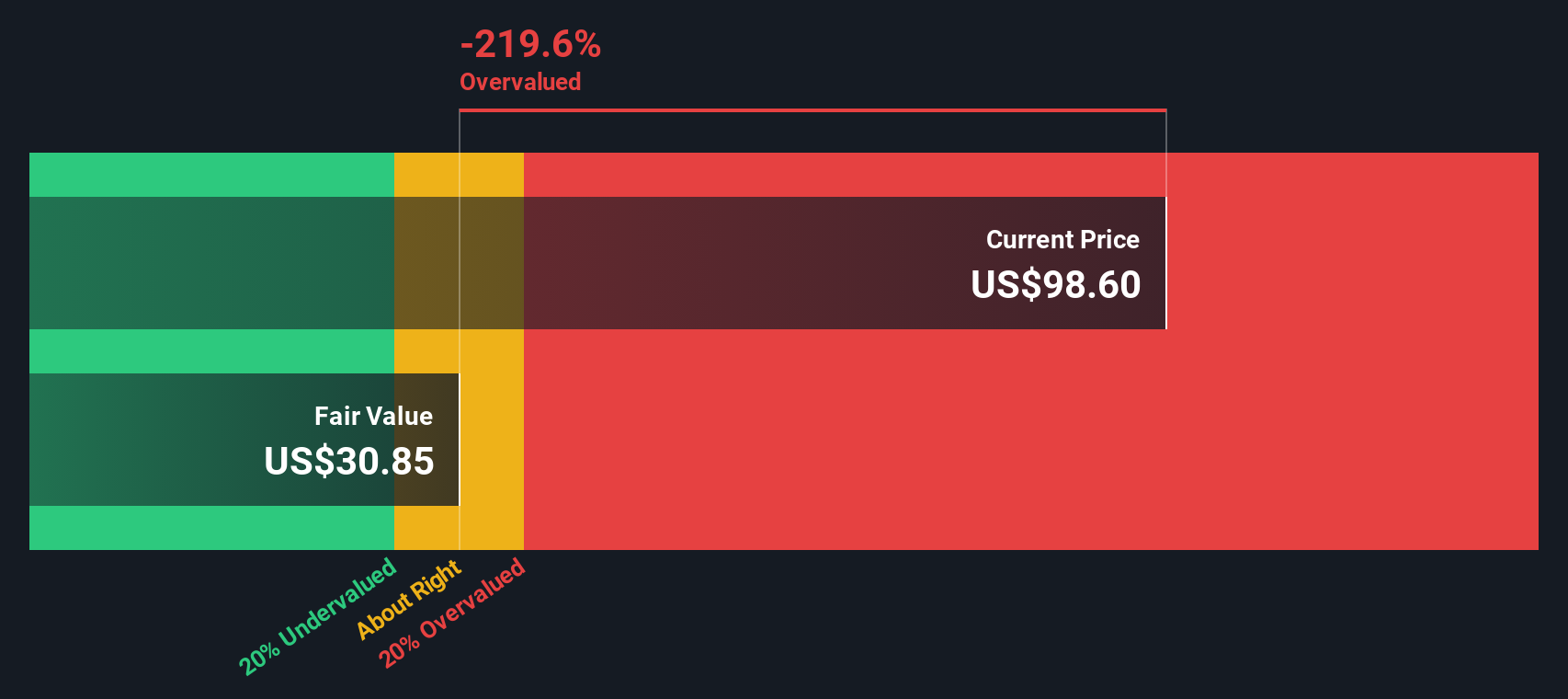

Based on these projections, the DCF model calculates an estimated intrinsic value of $30.73 per share for ServiceTitan. With the stock recently trading at $101.67, this implies the shares are approximately 230.9% overvalued against their calculated fair value. In short, while ServiceTitan’s long-term growth could be impressive, the current price appears to bake in a lot of optimism already.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ServiceTitan may be overvalued by 230.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ServiceTitan Price vs Sales (P/S)

For fast-growing software companies like ServiceTitan, the Price-to-Sales (P/S) ratio is often the preferred valuation tool, especially when earnings are volatile or negative. The P/S ratio helps investors compare what the market is willing to pay for each dollar of company sales, making it useful for companies that are still reinvesting heavily in growth.

It is important to remember, though, that a “normal” or “fair” P/S ratio for a company depends on expectations for future growth and the risks attached to achieving that growth. The higher the company’s anticipated sales growth and the lower the perceived risk, the more investors are willing to pay for its sales today.

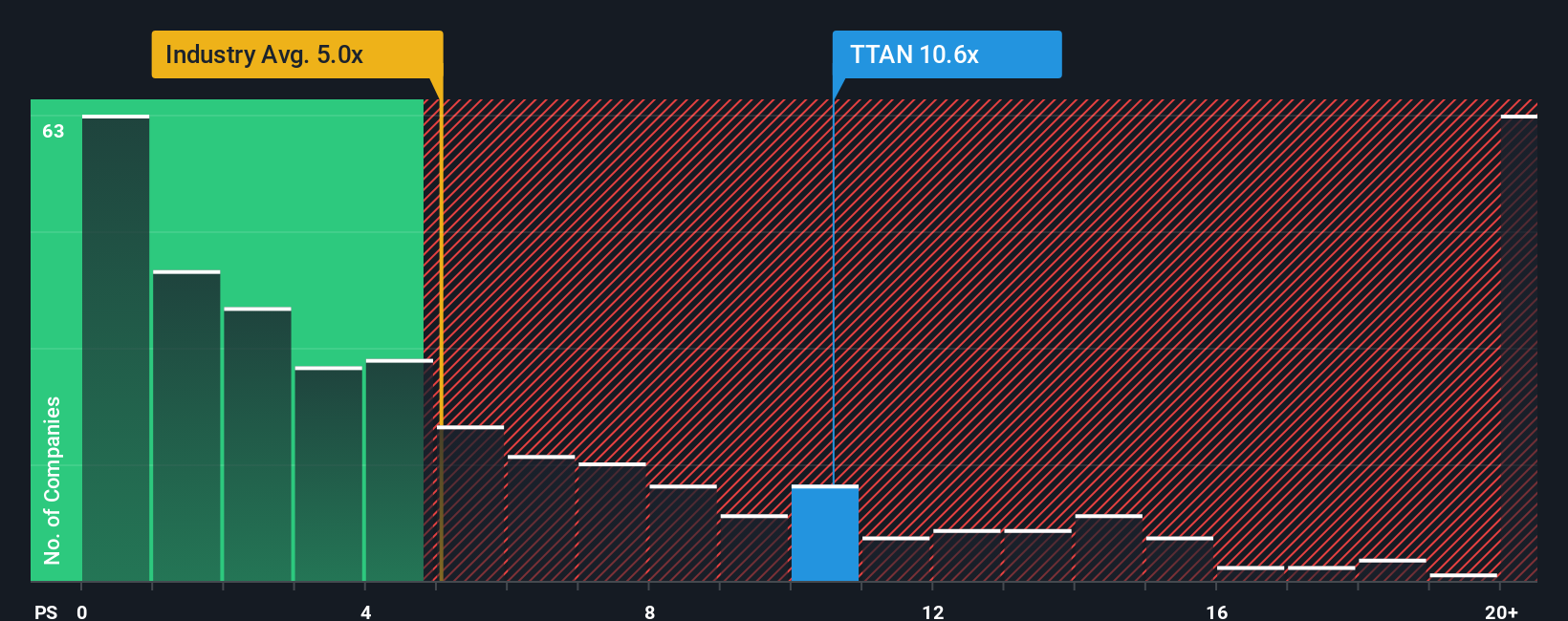

Currently, ServiceTitan is trading on a P/S ratio of 10.91x. This is well above both the industry average of 5.29x and the peer average of 5.94x, signaling that investors are paying a premium compared to other software names. However, Simply Wall St’s proprietary “Fair Ratio” model suggests a fair P/S of 6.73x for ServiceTitan. The Fair Ratio is designed to go beyond basic peer or industry comparisons. It incorporates specific company growth prospects, risk profile, profit margins, industry context, and market cap, making it a more holistic benchmark for fair value.

Comparing ServiceTitan’s actual P/S of 10.91x to its Fair Ratio of 6.73x, the stock appears to be priced significantly above what is justified by its fundamentals and unique characteristics.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ServiceTitan Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is the story you assign to a company—your perspective on what its future could look like, based on your own estimates of its future revenue, earnings, margins, and ultimately, its fair value. By connecting the company’s journey to the numbers behind it, Narratives allow investors to map a story through financial forecasts and tie them to a fair value.

Narratives are designed to be simple and accessible for everyone. On Simply Wall St's Community page, used by millions of investors, you can instantly compare your Narrative to others. This approach enables smarter and more personalized investment decisions. By comparing your calculated Fair Value to the current Price, Narratives help you decide when it might be time to buy or sell, with all data and stories updated automatically when new news or earnings are released.

For example, using ServiceTitan, you might see one investor’s Narrative expecting significant growth with a fair value of $150, while another sees more risk and estimates fair value closer to $30. This demonstrates just how differently investors can interpret the same company’s prospects.

Do you think there's more to the story for ServiceTitan? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTAN

ServiceTitan

Provides an end-to-end cloud-based software platform in the United States and Canada.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives