- United States

- /

- IT

- /

- NasdaqCM:TSSI

Is TSS (TSSI) Redefining Its Capital Allocation Playbook With New Term Loan Amendment?

Reviewed by Sasha Jovanovic

- On September 17, 2025, VTC, L.L.C., a wholly owned subsidiary of TSS, Inc., completed an amendment to its credit agreement with Susser Bank, adding an incremental US$5,000,000 term loan to its existing US$20,000,000 facility with identical terms.

- This move replenishes cash reserves used for capital expenditures and ties long-term investments to matching long-term debt, signaling a shift in TSS’s financial management approach.

- We'll explore how the decision to replenish cash reserves with a new US$5 million term loan reframes TSS's investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is TSS' Investment Narrative?

For anyone considering TSS as an investment, belief in the company’s ability to harness recent momentum while managing growth risks is key. Following a turbulent three months in its share price, TSS secured an incremental US$5 million loan through its VTC subsidiary, building on earlier efforts to strengthen finances for capacity expansion and AI-related projects. This latest move replenishes cash previously spent on long-term investments and aligns capital structure with the company’s stated growth ambitions. While this doesn’t fundamentally change the main near-term catalysts, such as execution on rising revenues and improved profitability, it could help TSS weather operational surprises by boosting liquidity. However, ongoing risks like high valuation relative to peers and recent insider selling remain, and the debt increase may prompt greater scrutiny of capital allocation and future earnings quality. Yet, significant insider selling in recent months raises questions investors shouldn’t ignore.

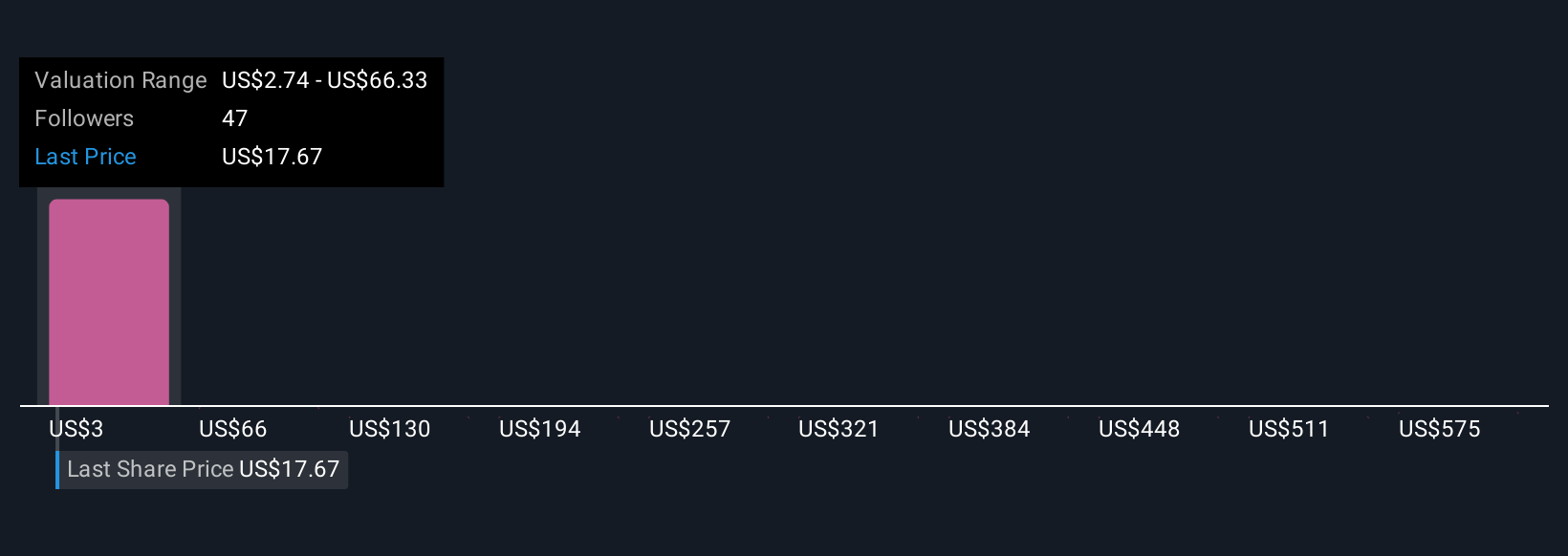

TSS' shares have been on the rise but are still potentially undervalued by 39%. Find out what it's worth.Exploring Other Perspectives

Explore 21 other fair value estimates on TSS - why the stock might be a potential multi-bagger!

Build Your Own TSS Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TSS research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TSS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TSS' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TSSI

TSS

Engages in the planning, design, deployment, maintenance, refresh, and take-back of end-user and enterprise systems in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives