- United States

- /

- Software

- /

- NasdaqGS:TRMB

Trimble (TRMB) Margin Compression Challenges Bullish Growth Narratives After FY 2025 Results

Trimble (TRMB) FY 2025 results set the stage for a margins debate

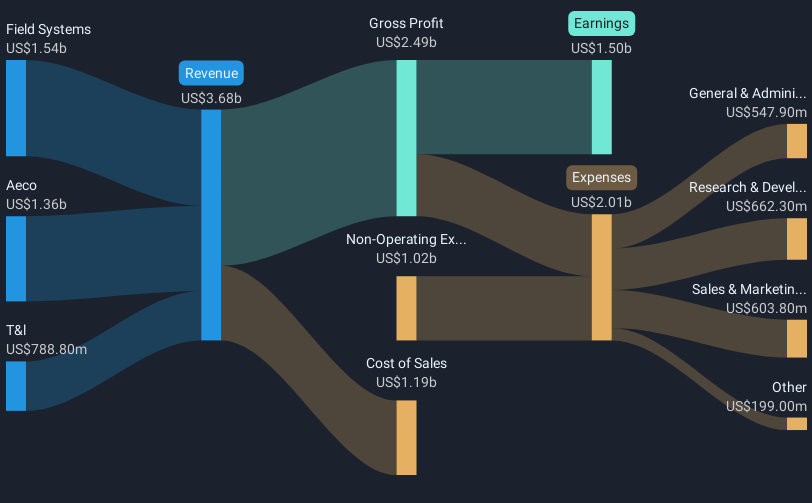

Trimble (TRMB) closed FY 2025 with fourth quarter revenue of US$969.8 million and basic EPS of US$0.66, putting concrete numbers around its latest report for investors watching both the top and bottom line. The company has seen quarterly revenue move from US$875.8 million in Q3 FY 2024 to US$901.2 million in Q3 FY 2025 and US$969.8 million in Q4 FY 2025, while basic EPS has gone from US$0.17 in Q3 FY 2024 to US$0.47 in Q3 FY 2025 and US$0.66 in Q4 FY 2025. This gives a clear view of how sales and earnings have tracked through the year. With trailing net profit margin sitting well below the prior year's level, this earnings print puts the spotlight squarely on how much of that revenue the company is able to keep as profit.

See our full analysis for Trimble.With the headline numbers on the table, the next step is to set these results against the prevailing stories around Trimble. This means looking at where the data backs consensus narratives and where the recent margin picture might tell a different story.

See what the community is saying about Trimble

Margins: 11.8% Now vs 40.8% Before

- Net profit margin over the last year was 11.8%, compared with 40.8% in the prior year, while trailing twelve month revenue sat at US$3.6b and net income at US$424 million.

- Bears worry that a margin profile like 11.8% cannot support the more optimistic story about Trimble. Even so, the consensus narrative still highlights subscription and cloud tools as potential support for profitability:

- Consensus commentary points to a higher mix of recurring software and subscription revenue as a positive for margins over time, which sits in contrast to the recent margin compression in the data.

- The same consensus view suggests operational changes and acquisitions could help profitability, while the latest margin numbers push readers to ask how quickly that improvement might show up in reported results.

EPS Build Through FY 2025

- Across FY 2025, basic EPS went from US$0.27 in Q1 to US$0.66 in Q4, alongside quarterly net income between US$66.7 million and US$156.6 million on revenue between US$840.6 million and US$969.8 million.

- Supporters of the bullish story point to earnings growth forecasts of about 19.8% per year and a five year trailing earnings growth rate of roughly 15.2% per year, and they compare that backdrop with the recent quarterly EPS trend:

- Consensus narrative talks about subscription models and broader adoption of cloud based software as drivers of recurring earnings, while the steady EPS build through FY 2025 gives bulls concrete quarterly data to reference.

- At the same time, the fact that earnings were negative over the most recent year in the analysis data means readers may want to look closely at how much of the EPS line reflects the core business versus any one off effects.

Bulls looking at the step up in EPS and the focus on recurring software income may want to see how the full bullish case lines up with these FY 2025 numbers: 🐂 Trimble Bull Case

Premium P/E With Mixed Signals

- Trimble is trading on a trailing P/E of 38.7x versus peers at 32.8x and the US Software industry at 28x, while a DCF fair value of US$80.58 sits above the current share price of US$68.88 and analysts' targets cluster around US$96.75 according to the provided data.

- Skeptics focus on the lower 11.8% net margin and the premium P/E, while the consensus narrative and valuation data point in a different direction:

- Critics highlight that paying 38.7x earnings for a company with a net margin well below the prior year's 40.8% requires confidence in the forecasted 19.8% earnings growth and revenue growth of 7.2% per year.

- On the other hand, the combination of a DCF fair value above market and analyst targets at US$96.75 provides a reference point for readers who want to weigh whether the premium multiple is supported by the longer term story set out in the consensus narrative.

If you are weighing that premium P/E against the margin reset and the analyst upside case, it can help to see how the cautious arguments stack up in one place: 🐻 Trimble Bear Case

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Trimble on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this data gives you a different angle, shape your own Trimble story in just a few minutes with Do it your way

A great starting point for your Trimble research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Trimble's compressed 11.8% net margin against the prior 40.8% level and its premium 38.7x P/E highlight profitability pressure relative to the price being paid.

If that mix of thinner margins and a premium multiple feels uncomfortable, you might want to shift your attention to 51 high quality undervalued stocks that aim to pair stronger value signals with more attractive pricing today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMB

Trimble

Provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Inotiv NAMs Test Center

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.