- United States

- /

- Software

- /

- NasdaqGS:TENB

Tenable Holdings, Inc.'s (NASDAQ:TENB) Business Is Trailing The Industry But Its Shares Aren't

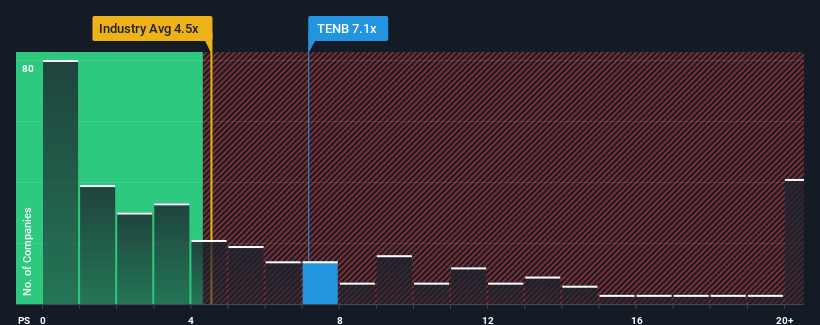

Tenable Holdings, Inc.'s (NASDAQ:TENB) price-to-sales (or "P/S") ratio of 7.1x might make it look like a strong sell right now compared to the Software industry in the United States, where around half of the companies have P/S ratios below 4.5x and even P/S below 1.8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Tenable Holdings

What Does Tenable Holdings' P/S Mean For Shareholders?

Tenable Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Tenable Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Tenable Holdings?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Tenable Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. The strong recent performance means it was also able to grow revenue by 84% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 16% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 17% per year, which is not materially different.

With this information, we find it interesting that Tenable Holdings is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Tenable Holdings' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given Tenable Holdings' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Plus, you should also learn about these 2 warning signs we've spotted with Tenable Holdings.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tenable Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TENB

Tenable Holdings

Provides cyber exposure management solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026