- United States

- /

- Software

- /

- NasdaqGS:TEAM

What Does Atlassian’s 14% Drop Mean for Its 2025 Valuation?

Reviewed by Simply Wall St

Thinking about what to do with your Atlassian stock? You are definitely not alone. After all, with software companies constantly making headlines and market sentiment swinging quickly, it is smart to pause and really look at where TEAM stands right now. In the last month, the stock price has been on a bit of a rollercoaster, down about 14%. But if you zoom out, things start to look a little brighter: over the past year, Atlassian’s total return is up more than 5%, even after a bumpy run through this broader tech selloff.

Part of the story here is the broader evolution in how investors view risk and growth. Atlassian, famous for its collaboration tools used by teams all over the world, is still seeing over 14% annual revenue growth, and net income growth that would make most companies envious. These numbers are helping to anchor investor confidence, even while the mood across many tech names has shifted toward caution. Still, there is a gap between the current share price and where analysts think it should be. By some estimates, the stock trades at a 36.5% discount to its intrinsic value, and an even wider 55% discount to analyst price targets.

If you are trying to figure out whether Atlassian is undervalued, you are in luck: based on six different valuation checks, the company scores a 4, meaning it meets four out of six undervalued criteria. In the next section, we will break down those valuation approaches and see what they tell us about TEAM. Be sure to read on, because there is another useful way to get a handle on valuation that we will share toward the end.

Atlassian delivered 5.2% returns over the last year. See how this stacks up to the rest of the Software industry.Approach 1: Atlassian Cash Flows

The discounted cash flow (DCF) model works by projecting a company’s future cash flows and then discounting those back to today, providing an estimate of what the business is worth at present. For Atlassian, this approach focuses on the amount of free cash the company generates and how that is expected to grow over time.

Currently, Atlassian’s latest twelve-month free cash flow stands at $1.42 billion. Analysts expect this figure to continue rising, reaching $3.33 billion by 2030. These future cash flows, after being adjusted for risk and time, are factored into the DCF valuation.

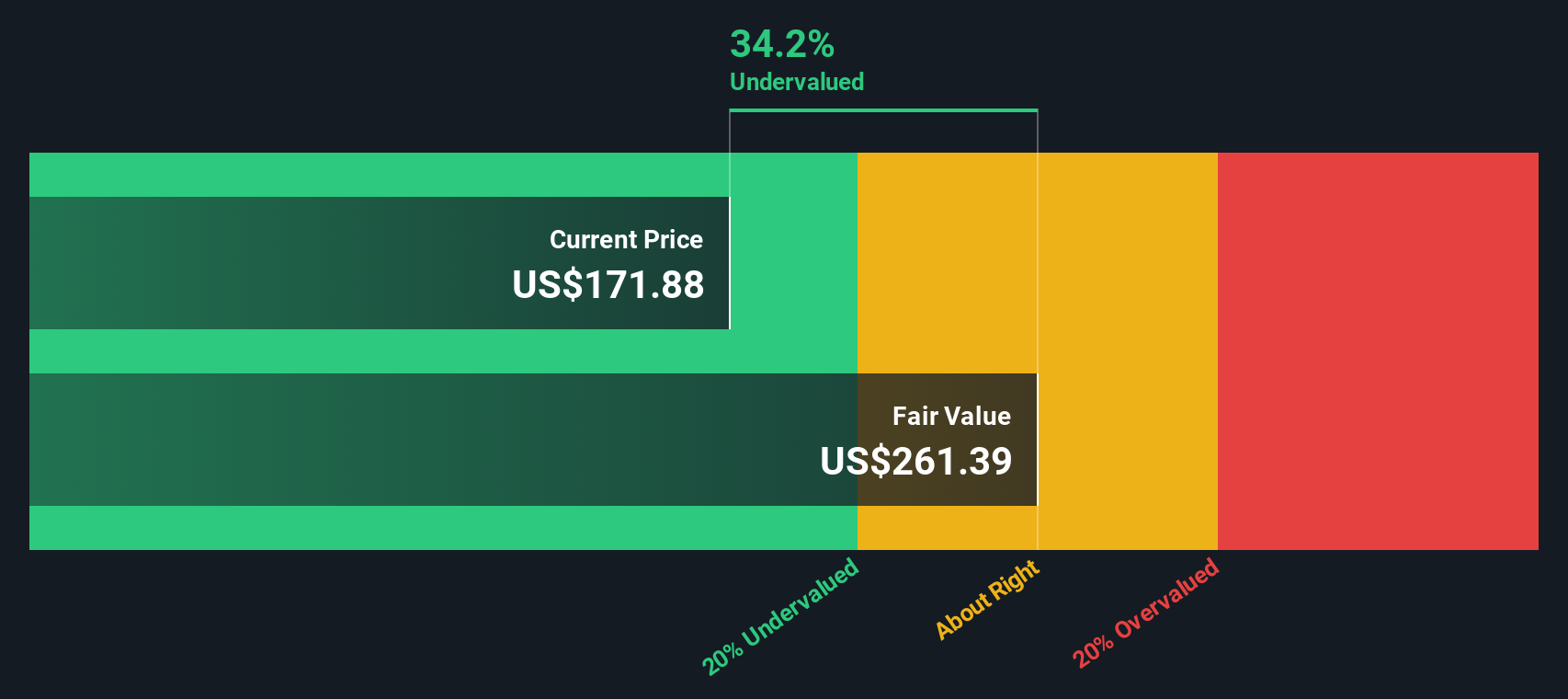

Based on these projections, the DCF model estimates Atlassian’s intrinsic value at $262.47 per share. When compared to the current share price, the stock is considered 36.5% undervalued according to this framework. In other words, the market price is much lower than what the company’s long-term cash generation indicates it could be worth.

Result: UNDERVALUED

Approach 2: Atlassian Price vs Sales

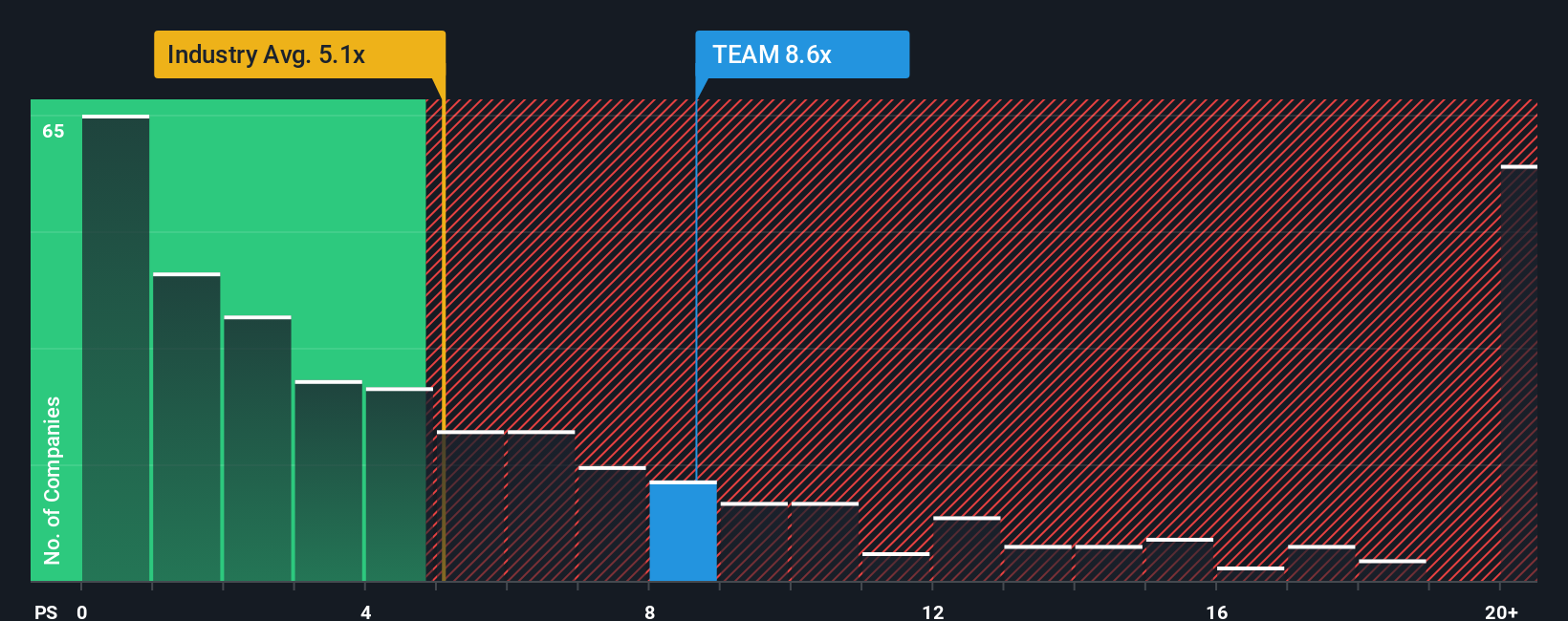

The price-to-sales (P/S) ratio is a popular way to value companies in the software industry, especially when profitability is secondary to growth and recurring revenue. For businesses like Atlassian that are still reinvesting for future expansion, the P/S ratio provides a clear lens into how the market values each dollar of revenue generated.

Growth expectations and perceived risks play a major role in determining what a fair P/S multiple should be. Companies with high growth potential and resilient business models often justify higher P/S ratios. In contrast, firms facing steadier growth or more uncertainty tend to trade at lower multiples. Comparing these ratios helps investors assess whether a stock's price reflects optimism, caution, or something in between.

Currently, Atlassian trades at a P/S ratio of 8.38x. This is below both the industry average of 4.84x and the peer average of 11.59x. To provide additional context, Simply Wall St calculates a Fair Ratio for Atlassian at 14.03x, taking into account its growth, margins, scale, and risk profile. Since the actual multiple is well below this Fair Ratio, the stock appears undervalued on this basis.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Atlassian Narrative

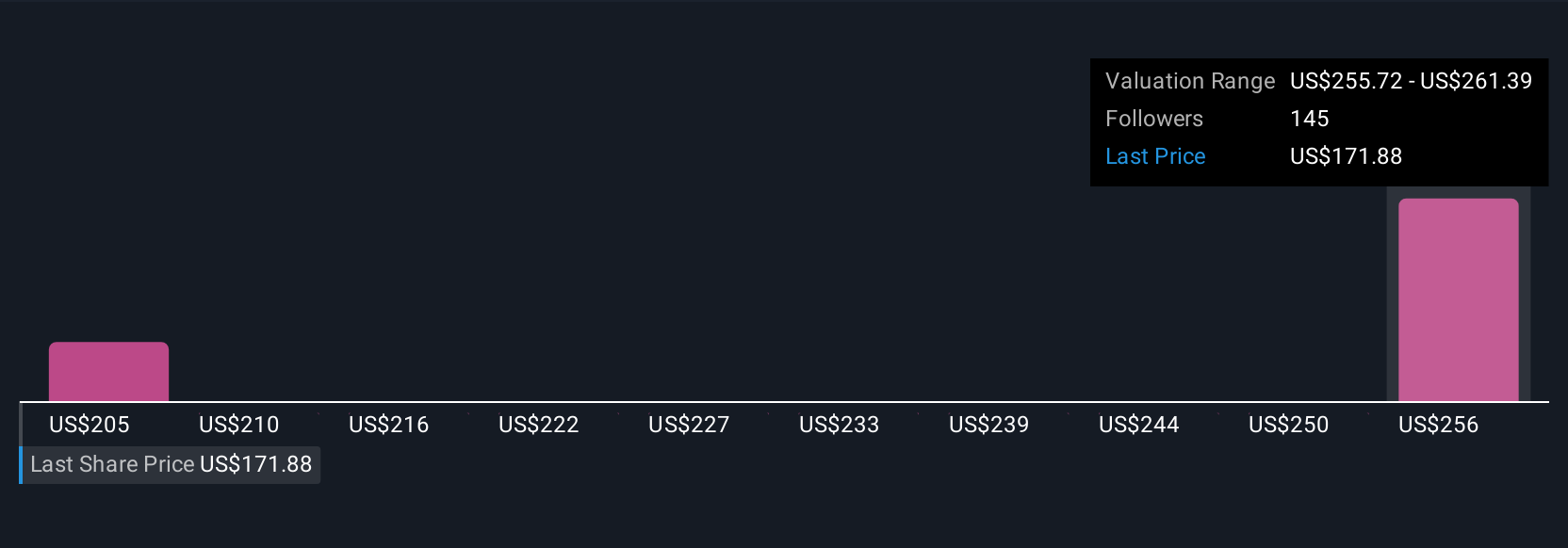

Narratives offer a smarter and more dynamic way to approach investing by connecting your understanding of a company’s story, including its business model, products, and strategic moves, to a set of future financial assumptions and, ultimately, a fair value estimate for the stock.

Instead of relying solely on numbers or analyst targets, a Narrative allows you to set your own expectations for Atlassian’s long-term revenue, earnings, and margins, effectively explaining the reasoning behind why the stock could be worth more or less than it is today.

On the Simply Wall St platform, Narratives serve as a fast, accessible tool used by millions of investors to craft and share their investment perspectives. This makes it easier to transform your research into a clear, actionable viewpoint.

Because Narratives tie your forecast to a fair value and then compare it to the live market price, they help you decide at a glance whether Atlassian is a buy, hold, or sell based on your own story.

Narratives update automatically when new news, earnings results, or company guidance is released, so your estimates and fair value stay current as the market changes.

For example, one Atlassian investor’s Narrative might indicate a bullish $480 price target based on rapid AI monetization, while another might see $196 as fair value due to slower enterprise migrations and more measured growth.

Do you think there's more to the story for Atlassian? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Provides a collaboration software that enables organizations to connect all teams through a system of work that unlocks productivity at scale worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives