- United States

- /

- Software

- /

- NasdaqGS:TEAM

Atlassian's (NASDAQ:TEAM) Co-founders have Serious 'Skin in the Game'

Shares of Atlassian Corporation Plc (NASDAQ:TEAM) rallied on Friday after the company reported second quarter financial results. The stock price gained nearly 10% after the software provider beat consensus estimates across the board and raised guidance for the current quarter.

Second quarter results at a glance:

- Revenue rose 37% YoY to $688 mln, and $46 mln better than expected.

- non-GAAP EPS of $0.5, up 35% and $0.11 ahead of consensus.

- GAAP loss per share of $0.31 compares to a net loss per share of $2.49 a year ago, and $0.03 better than expected.

- The operating margin deteriorated from 6% to minus 10%.

- Subscription revenue up 64% YoY

- Added over 10,000 net new customers, 98% of which were for cloud subscriptions.

- Revenue guidance for current quarter raised to $690-$705 mln vs $664 consensus.

This was a good set of results and the upbeat guidance suggests momentum is continuing. While Atlassian continues to grow revenue, there are one or two factors that may concern investors:

- Atlassian continues to prioritize growth over profits, which some investors may question in the current market environment.

- The company also carries a lot of debt which is unusual for a software company.

- Another area for concern is the high level of share based compensation which is impacting earnings, and is likely to lead to shareholders being diluted in the future.

The good news is that these issues are balanced by the fact that Atlassian's founder-leaders remain the company's largest shareholders. Our analysis of the ownership of the company, below, shows that the two co-founders own nearly as many shares as institutions. Let's delve deeper into each type of owner, to discover more about Atlassian.

See our latest analysis for Atlassian

What Does The Institutional Ownership Tell Us About Atlassian?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

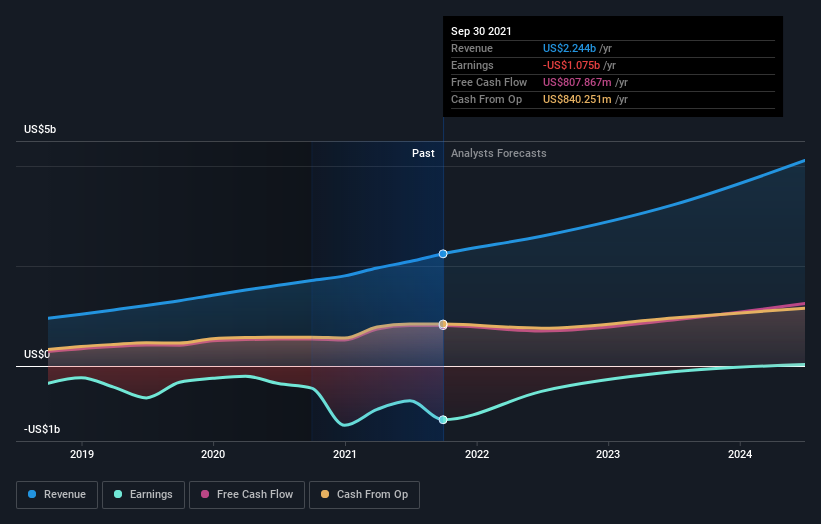

Atlassian already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Atlassian, (below). Of course, keep in mind that there are other factors to consider, too.

The largest individual shareholders are Co-Chief Executive Officers Scott Farquhar and Michael Cannon-Brookes who each own 22.5% of shares outstanding. It’s unusual for founders and management to own so much of a company of this size. Nevertheless, it’s good to have leaders with skin in the game. One point to note is that the share class structure means that the co-CEOs control nearly 90% of the voting shares despite owning less than 50% of the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

General Public Ownership

With 7.6% ownership, the general public, mostly composed of individual investors, are a relatively smaller ownership class in Atlassian. We'd generally expect to see a higher level of ownership by the general public, than this. It's not too concerning, but it is worth noting that retail investors are under-represented on the share register. This could actually be a positive catalyst if the stock becomes more popular amongst retail investors.

Our take on Atlassian

The fact that Atlassian’s co-CEO’s own a combined 45% of the company is a good sign as it means their interests should be aligned with the interest of shareholders. This is particularly relevant when looking at share based compensation at the company, and the potential for shareholder dilution. We would however be concerned if the executives award themselves shares at a rate that is higher than the rate at which other shareholders are being diluted.

This article is not intended to be a comprehensive analysis on Atlassian, but rather to highlight the shareholder structure. If you are interested in understanding the company at a deeper level, take a look at Atlassian’'s company page on Simply Wall St .

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:TEAM

Atlassian

Through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives