- United States

- /

- Software

- /

- NasdaqCM:TAOX

TAO Synergies (NASDAQ:TAOX) Is In A Good Position To Deliver On Growth Plans

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. By way of example, TAO Synergies (NASDAQ:TAOX) has seen its share price rise 144% over the last year, delighting many shareholders. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

In light of its strong share price run, we think now is a good time to investigate how risky TAO Synergies' cash burn is. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

How Long Is TAO Synergies' Cash Runway?

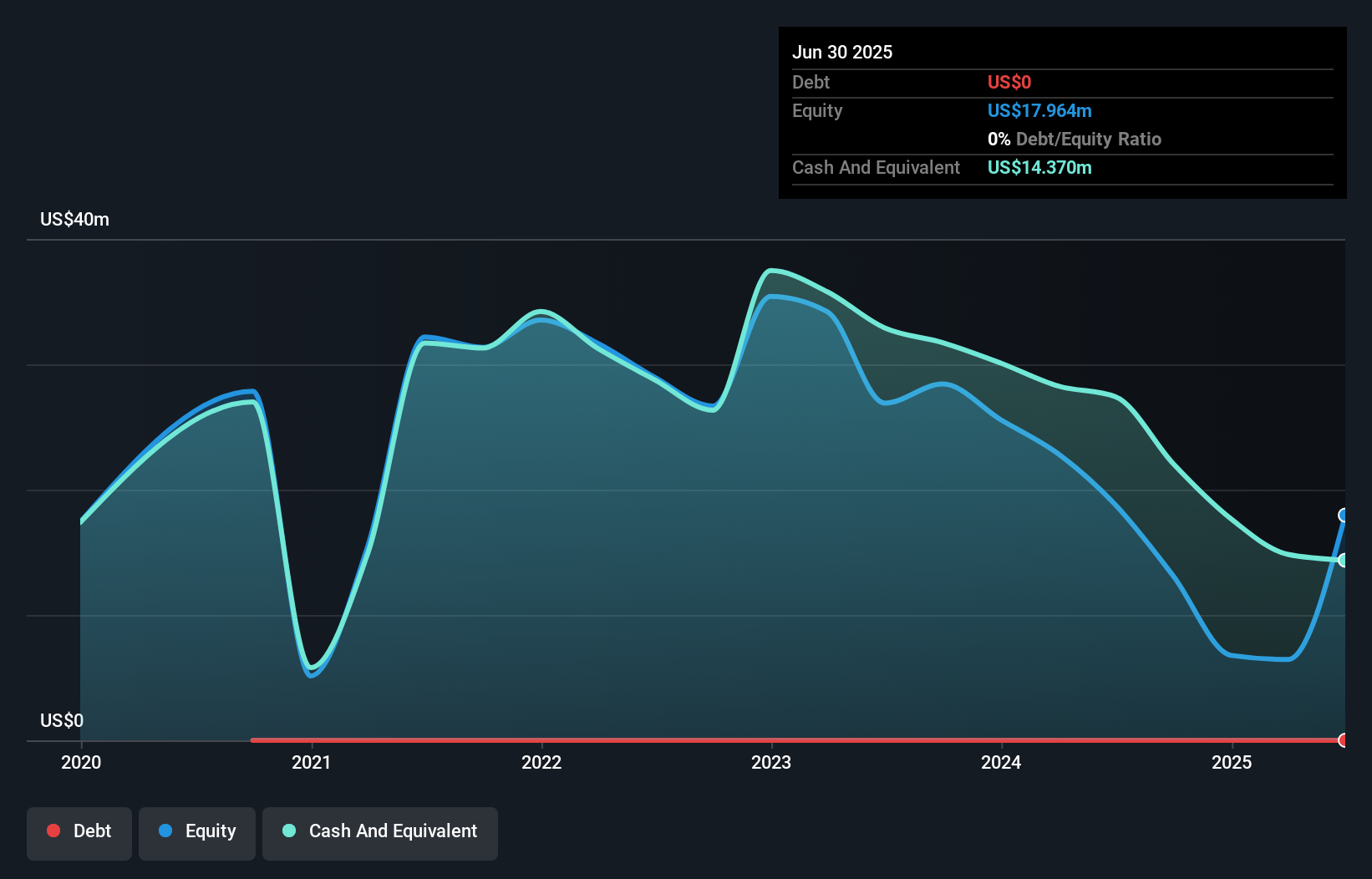

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When TAO Synergies last reported its June 2025 balance sheet in August 2025, it had zero debt and cash worth US$14m. Looking at the last year, the company burnt through US$4.9m. Therefore, from June 2025 it had 2.9 years of cash runway. Arguably, that's a prudent and sensible length of runway to have. The image below shows how its cash balance has been changing over the last few years.

View our latest analysis for TAO Synergies

How Is TAO Synergies' Cash Burn Changing Over Time?

In our view, TAO Synergies doesn't yet produce significant amounts of operating revenue, since it reported just US$4.0k in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. It seems likely that the business is content with its current spending, as the cash burn rate stayed steady over the last twelve months. TAO Synergies makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For TAO Synergies To Raise More Cash For Growth?

Since its cash burn is increasing (albeit only slightly), TAO Synergies shareholders should still be mindful of the possibility it will require more cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

TAO Synergies' cash burn of US$4.9m is about 21% of its US$24m market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

So, Should We Worry About TAO Synergies' Cash Burn?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought TAO Synergies' cash runway was relatively promising. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Separately, we looked at different risks affecting the company and spotted 5 warning signs for TAO Synergies (of which 4 can't be ignored!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if TAO Synergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TAOX

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.