- United States

- /

- Software

- /

- NasdaqGS:SPSC

SPS Commerce (SPSC): Assessing Valuation Following Investor Day Growth Strategies and Analyst Updates

Reviewed by Kshitija Bhandaru

Following recent Investor Day updates, SPS Commerce (SPSC) is once again in the spotlight as management highlights continued M&A ambitions and outlines plans to leverage new technologies for market expansion.

See our latest analysis for SPS Commerce.

After a year marked by steady updates and strategic signals, SPS Commerce’s share price has largely remained stable, with a 1-year total shareholder return of -0.44%. Recent moves, including a renewed focus on M&A and investments in generative AI, have not sparked major momentum shifts. This suggests investors are waiting to see how these ambitions translate into tangible growth.

If you’re watching companies poised for their next breakthrough or hunting for strong performers in related sectors, take a moment to discover fast growing stocks with high insider ownership.

With analyst updates and fresh growth strategies in play, the question remains: is SPS Commerce now trading at an attractive discount, or has the market already factored in its future expansion potential?

Most Popular Narrative: 28.3% Undervalued

Compared to SPS Commerce’s last close at $105.93, the most-followed narrative sets fair value significantly higher, suggesting market skepticism toward growth projections or recent updates. This divergence underpins the narrative’s forward-looking calculation and hints at potent drivers not yet fully recognized by investors.

The accelerating digitalization of retail supply chains and rising compliance requirements are driving robust demand for SPS Commerce's cloud-based EDI and supply chain solutions, supporting sustained growth in new customer adds and recurring revenue. As the complexity of omni-channel retail and the need for real-time, integrated supply chain analytics increases, SPS Commerce is well positioned to expand its average revenue per user (ARPU) through expanded network connections and the cross-selling of high-value products like analytics and revenue recovery solutions.

Want the inside story behind this optimistic outlook? These projections are driven by a bold revenue and profit ramp, with analysts betting on a growth runway well above SPS Commerce’s recent pace. Which numbers power this premium? Find out what’s anchoring the largest gap between price and potential in the narrative.

Result: Fair Value of $147.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising macroeconomic uncertainty and cautious supplier spending could limit short-term revenue growth. This may challenge the optimistic outlook supporting SPS Commerce’s valuation.

Find out about the key risks to this SPS Commerce narrative.

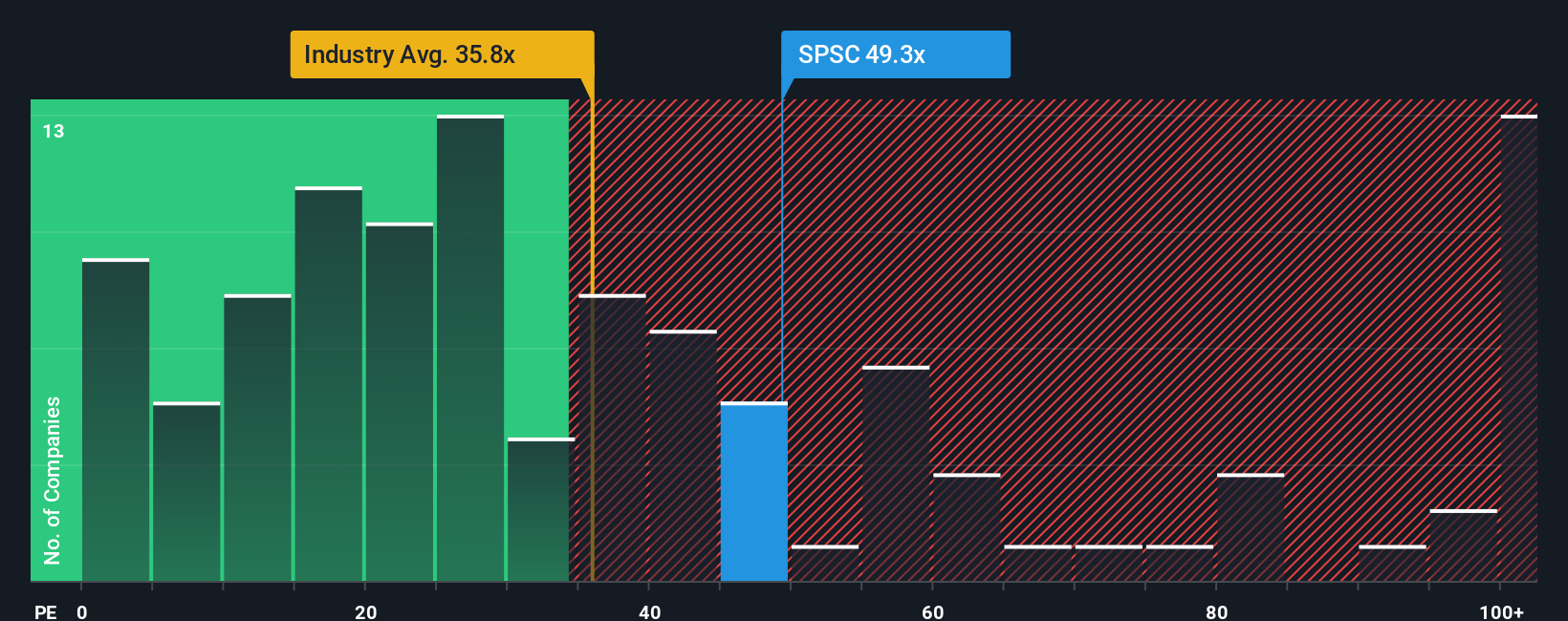

Another View: Market Multiples Tell a Cautionary Tale

Looking at SPS Commerce’s price-to-earnings ratio of 48.4x, the stock sits well above both its industry average of 35.7x and the peer group’s 17.8x. Even compared to its fair ratio of 33.7x, SPS Commerce looks expensive. This premium hints at higher expectations and increases the risk if growth stalls. Is the market being too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SPS Commerce Narrative

If you see things differently or want to dig into the data yourself, you’re free to shape your own assessment in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SPS Commerce.

Looking for More Smart Investment Opportunities?

You don’t want to miss out on standout stocks with promising upside. Act now and access curated ideas from proven strategies to strengthen your portfolio’s growth and resilience.

- Catch the momentum of companies harnessing artificial intelligence to disrupt industries by tapping into these 24 AI penny stocks before the crowd.

- Maximize your returns with steady yields. Check out these 19 dividend stocks with yields > 3% that are rewarding investors with reliable income and strong fundamentals.

- Go beyond the obvious and hunt for deep value options using these 885 undervalued stocks based on cash flows, revealing hidden gems trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SPSC

SPS Commerce

Provides cloud-based supply chain management solutions in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives