- United States

- /

- Software

- /

- NasdaqGS:SPSC

SPS Commerce (SPSC): Assessing Valuation After a Recent Share Price Uptick

SPS Commerce (SPSC) has attracted attention this month thanks to its steady pace in the software sector. Recent trading activity shows a modest upward movement. This gives investors another chance to assess the company's path ahead.

See our latest analysis for SPS Commerce.

SPS Commerce’s recent share price bump comes after a rocky stretch, with a 30-day share price return of 2.78% but a year-to-date decline of over 40%. While broader tech sentiment has weighed on the sector, SPSC’s long-term track record remains positive. This is shown by a five-year total shareholder return of 28.57% even after this year’s volatility.

If this shift in momentum has you thinking bigger, it might be the perfect time to broaden your approach and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets, investors may wonder whether this represents an undervalued opportunity or if the current price accurately reflects the company’s longer-term growth prospects.

Most Popular Narrative: 23.1% Undervalued

With a narrative fair value of $142.27, SPS Commerce's recent closing price of $109.35 stands out as a relative bargain in the eyes of leading analysts. This gap highlights an optimistic outlook for the company, centered on robust fundamentals and strategic growth catalysts.

The accelerating digitalization of retail supply chains and rising compliance requirements are driving robust demand for SPS Commerce's cloud-based EDI and supply chain solutions, supporting sustained growth in new customer adds and recurring revenue. As the complexity of omni-channel retail and the need for real-time, integrated supply chain analytics increases, SPS Commerce is well positioned to expand its average revenue per user (ARPU) through expanded network connections and the cross-selling of high-value products like analytics and revenue recovery solutions.

What's fueling this big value gap? There's a bold vision embedded in the narrative, one that relies on analyst forecasts for stronger profit margins, ambitious revenue growth, and a premium earnings multiple. Want to uncover the exact assumptions underpinning that attractive target? The punchline just might surprise you.

Result: Fair Value of $142.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued macroeconomic uncertainty and increased pricing pressure from cautious supplier customers remain key risks that could slow SPS Commerce's near-term growth momentum.

Find out about the key risks to this SPS Commerce narrative.

Another View: High Price Versus Peers

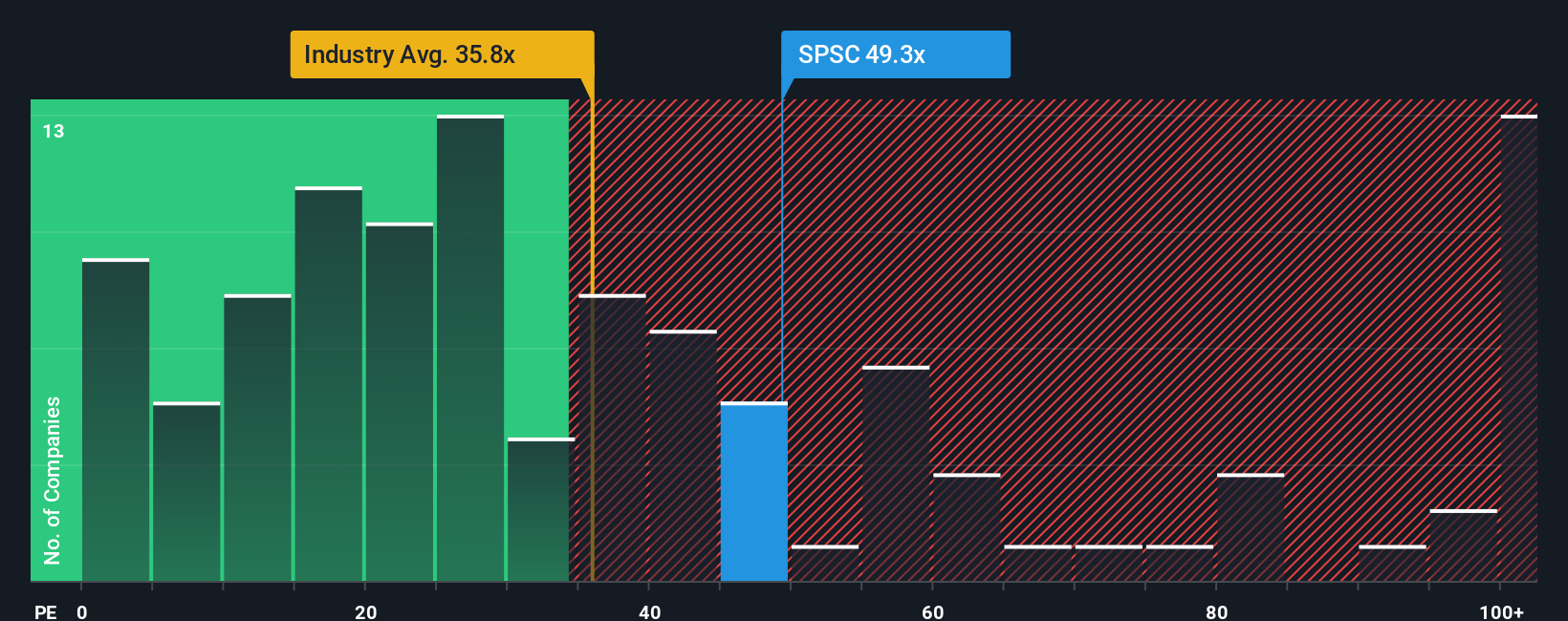

While the narrative highlights SPS Commerce’s value, looking at its price compared to earnings tells a more cautious story. SPS trades at 50 times earnings, which is much higher than the US Software industry average of 34.9 times, the peer average of 19.4 times, and even above the fair ratio of 33.8 times. This wide gap could signal valuation risk if the market’s optimism fades. Are investors betting too much on future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SPS Commerce Narrative

If you want to dig into the numbers yourself or craft your own view on SPS Commerce, it takes just a few minutes to get started. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SPS Commerce.

Looking for More Investment Ideas?

Don’t miss out on market opportunities beyond SPS Commerce. Smart investors continue to spot wins by expanding their search and checking out what’s trending now.

- Tap into the next wave of growth by searching for these 24 AI penny stocks targeting advancements in artificial intelligence and automation.

- Boost your portfolio’s income potential and steady returns when you browse these 18 dividend stocks with yields > 3% offering yields above 3%.

- Get ahead of the curve by scanning these 26 quantum computing stocks driving breakthroughs in quantum computing and transformative tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SPSC

SPS Commerce

Provides cloud-based supply chain management solutions in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Novo Nordisk - A Fundamental and Historical Valuation

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion