- United States

- /

- Software

- /

- NasdaqGS:SPNS

Sapiens International (NasdaqGS:SPNS): Assessing Valuation Following Strong Year-to-Date Share Price Gains

Reviewed by Simply Wall St

Sapiens International (NasdaqGS:SPNS) stock has been in focus lately, catching the attention of investors curious about its steady trajectory over the past few months. Share price shifts offer a window into investors’ evolving expectations and market sentiment.

See our latest analysis for Sapiens International.

Momentum around Sapiens International has quietly built over the past year, with share price returns surging 65.6% year-to-date and a one-year total shareholder return of 55.3% pointing to renewed optimism from investors about its growth prospects. Moves like these suggest confidence is picking up for the long term, even if recent days have shown steady performance.

If this upswing gets you thinking about new opportunities, now could be a great chance to broaden your search and discover fast growing stocks with high insider ownership

With shares soaring more than 65 percent this year, it is time to ask whether Sapiens International is still trading at a bargain or if the market has already accounted for its ongoing growth, leaving little room for upside.

Most Popular Narrative: 16% Overvalued

With Sapiens International’s most widely followed narrative assigning a fair value of $37.25, the latest closing price of $43.21 sits significantly higher. This setup invites closer scrutiny into what is driving such a premium and whether the justification stacks up.

The expansion of Sapiens' insurance platform, especially with successful contract wins and platform implementations, is expected to drive revenue growth by enhancing their market position and adding new customers. Increasing cloud adoption, with a goal to transition over 60% of customers to their SaaS model within five years, can lead to higher margins and increased recurring revenue, positively impacting net margins and ARR.

Curious how a major technology overhaul, recurring revenue bets, and bold margin assumptions come together to shape this valuation? One misstep could tilt the balance, while an earnings surge could quickly rewrite the script. The narrative’s fair value calculation hides a series of aggressive growth targets and future profitability moves. But do you know which levers the consensus expects Sapiens to pull?

Result: Fair Value of $37.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, modest revenue growth and challenges in shifting customers to SaaS could quickly undermine this optimistic outlook if these catalysts do not deliver as hoped.

Find out about the key risks to this Sapiens International narrative.

Another View: Market Multiples Tell a Different Story

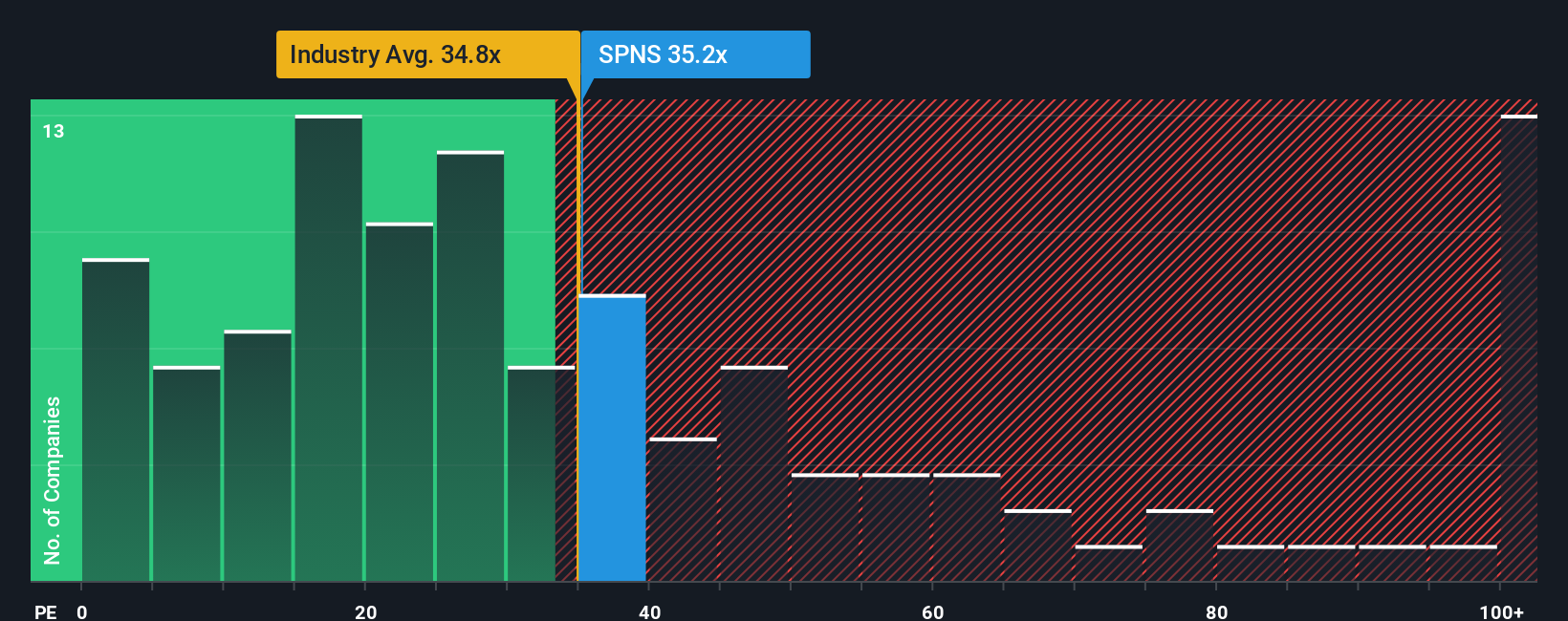

Sapiens International trades at a price-to-earnings ratio of 35.3 times, which is higher than the US Software industry’s average of 32.1 and exceeds its fair ratio of 27.7. This gap suggests that investors are betting on ongoing outperformance, but does this leave little margin for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sapiens International Narrative

If you prefer to dig into the details yourself and shape an outlook that fits your own research, you can craft your own story in just a few minutes, Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Sapiens International.

Looking for More Investment Ideas?

Serious investors do not stick to just one story. Give yourself an edge and size up fresh opportunities you might otherwise miss by using the Simply Wall Street Screener.

- Catch overlooked growth potential by reviewing these 3591 penny stocks with strong financials, which highlight companies with strong financials and ambitious expansion plans.

- Boost your income strategy and secure steady yields with these 15 dividend stocks with yields > 3%, featuring stocks offering above-average dividends over 3 percent.

- Position yourself ahead of innovation waves by exploring these 28 AI penny stocks, which focus on companies at the forefront of artificial intelligence breakthroughs and industry transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SPNS

Sapiens International

Provides software solutions for the insurance industry in North America, the United Kingdom, Europe and internationally.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives