- United States

- /

- Software

- /

- NasdaqGS:SPLK

Strong week for Splunk (NASDAQ:SPLK) shareholders doesn't alleviate pain of three-year loss

Splunk Inc. (NASDAQ:SPLK) shareholders will doubtless be very grateful to see the share price up 49% in the last quarter. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 34% in the last three years, significantly under-performing the market.

While the stock has risen 12% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Splunk

Given that Splunk didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years, Splunk saw its revenue grow by 12% per year, compound. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 10% per year, for three years. So the market has definitely lost some love for the stock. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

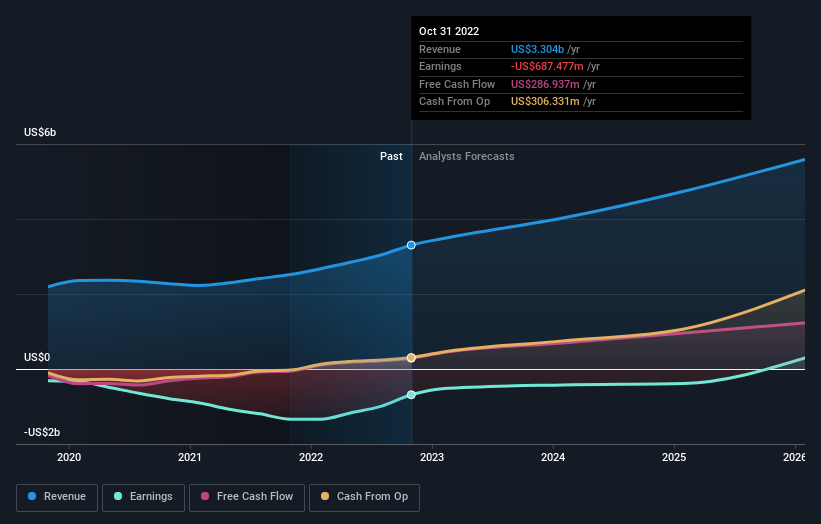

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Splunk is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

We regret to report that Splunk shareholders are down 9.2% for the year. Unfortunately, that's worse than the broader market decline of 7.0%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Splunk that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SPLK

Splunk

Splunk Inc., together with its subsidiaries, develops and markets cloud services and licensed software solutions in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Shell PLC (SHEL): The Integrated Energy Arbitrage – Driving Record Buybacks and High-Margin LNG in 2026.

VanEck Semiconductor ETF (SMH): The Silicon Supercycle – Capturing the AI Infrastructure Multiplier in 2026.

Carpenter Technology Corp (CRS): The Titanium Titan – Forging the High-Performance Future of Aerospace in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks