- United States

- /

- Software

- /

- NasdaqGS:SPLK

Is Splunk (NASDAQ:SPLK) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Splunk Inc. (NASDAQ:SPLK) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Splunk

How Much Debt Does Splunk Carry?

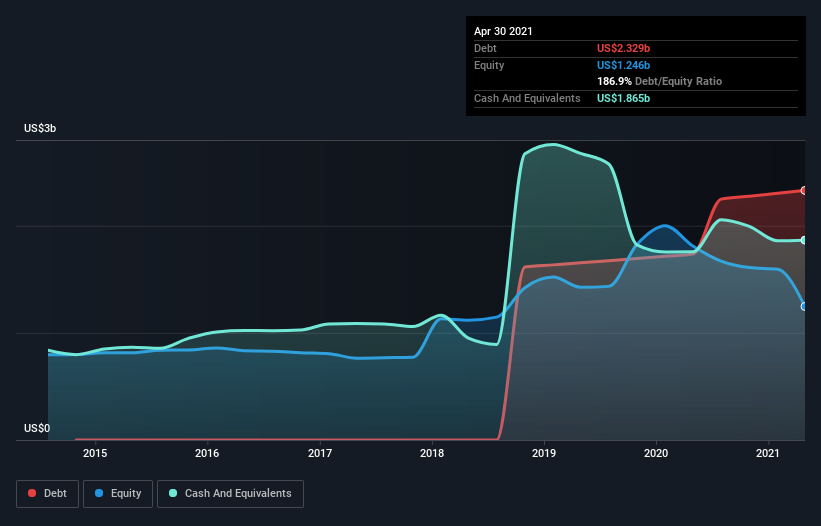

The image below, which you can click on for greater detail, shows that at April 2021 Splunk had debt of US$2.27b, up from US$1.74b in one year. However, it also had US$1.87b in cash, and so its net debt is US$399.7m.

How Healthy Is Splunk's Balance Sheet?

The latest balance sheet data shows that Splunk had liabilities of US$1.40b due within a year, and liabilities of US$2.65b falling due after that. Offsetting this, it had US$1.87b in cash and US$775.9m in receivables that were due within 12 months. So it has liabilities totalling US$1.41b more than its cash and near-term receivables, combined.

Since publicly traded Splunk shares are worth a very impressive total of US$21.2b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Splunk's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Splunk made a loss at the EBIT level, and saw its revenue drop to US$2.3b, which is a fall of 3.0%. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months Splunk produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at US$861m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through US$204m of cash over the last year. So suffice it to say we do consider the stock to be risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Splunk is showing 2 warning signs in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Splunk, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:SPLK

Splunk

Splunk Inc., together with its subsidiaries, develops and markets cloud services and licensed software solutions in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Expect Computer Age Management Services to reach a future P/E of 34x

CSL Limited: Temporary Headwinds for a Long-Term Healthcare Leader

What IREN's decision to buy over 50,000 NVIDIA GPUs could mean for its future

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026