- United States

- /

- Software

- /

- NasdaqGM:SOUN

SoundHound AI (SOUN): Reassessing a Premium-Valued Stock After Recent Share Price Volatility

Reviewed by Simply Wall St

SoundHound AI (SOUN) has had a choppy run lately, with the stock roughly flat over the past month but still down sharply over the past 3 months, which naturally raises valuation questions.

See our latest analysis for SoundHound AI.

At the current share price of $11.27, SoundHound AI’s 90 day share price return of negative 37.6 percent and one year total shareholder return of negative 44.8 percent suggest fading momentum after an earlier speculative surge, even as investors still weigh its long term AI growth story.

If SoundHound’s recent swings have you rethinking concentration risk in one name, it could be worth exploring other high growth tech and AI stocks that may offer different growth and risk profiles.

With growth still robust but losses deep and the share price well off its highs, investors face a familiar question: is SoundHound AI a misunderstood bargain, or is the market already pricing in its future expansion?

Most Popular Narrative Narrative: 33.5% Undervalued

With SoundHound AI last closing at $11.27 against a narrative fair value of $16.94, the spread reflects aggressive expectations for future scale and profitability.

Strategic partnerships and integrations with automotive OEMs (including global and Chinese brands), restaurant tech providers, and enterprise channel partners are accelerating user adoption, market penetration, and expanding monetization opportunities. This further supports future topline and earnings growth through network effects.

Curious how fast growing contracts, rising margins, and a premium future earnings multiple combine to justify that upside gap? The full narrative breaks down the bold revenue path, margin reset, and valuation leap that underpin this target.

Result: Fair Value of $16.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy ongoing losses and uneven enterprise deal timing could quickly undermine the bullish case if growth slows or key contracts are delayed.

Find out about the key risks to this SoundHound AI narrative.

Another Way to Look at Valuation

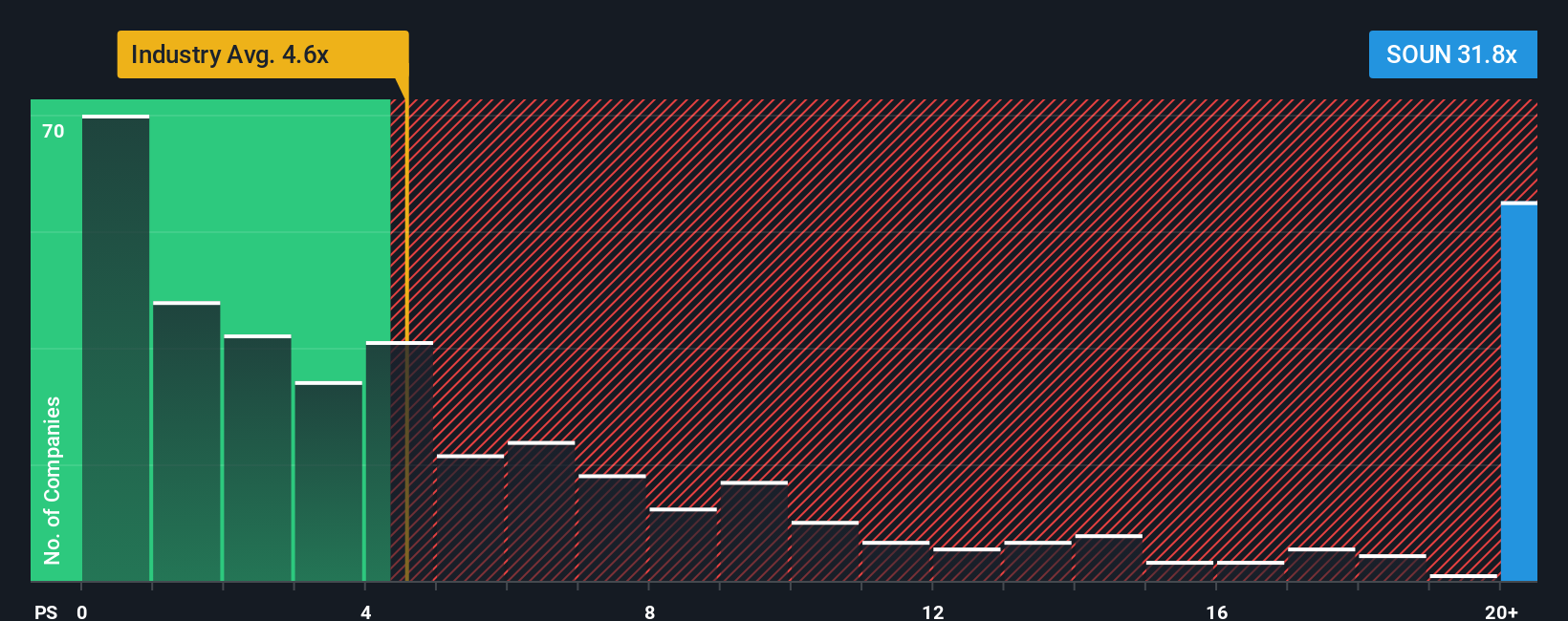

While the narrative fair value suggests upside, the market is already paying a steep price based on sales. SoundHound AI trades on a price-to-sales ratio of 31.9 times, far richer than the US Software industry at 5 times, its peer average at 17.7 times, and even its own fair ratio of 5.9 times. That kind of gap can close painfully if growth or sentiment disappoints, so how comfortable are you paying such a premium for a still unprofitable story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SoundHound AI Narrative

If this perspective does not quite align with your own or you prefer digging into the numbers yourself, you can build a narrative in minutes: Do it your way.

A great starting point for your SoundHound AI research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about growing your wealth, do not stop at one stock when you can quickly scan targeted opportunities others might overlook on Simply Wall Street.

- Capture potential upside early by reviewing these 24 AI penny stocks that could ride the next major wave in artificial intelligence.

- Strengthen your portfolio foundation with these 901 undervalued stocks based on cash flows that may offer quality businesses at marked down prices.

- Turbocharge your search for high risk, high reward names through these 3630 penny stocks with strong financials before the crowd pays attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SOUN

SoundHound AI

Develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers in the United States, Korea, France, Japan, Germany, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion