- United States

- /

- Software

- /

- NasdaqGM:SOUN

SoundHound AI (SOUN) Expands Voice AI Reach With Drive-Thru Innovator Acrelec Partnership

Reviewed by Simply Wall St

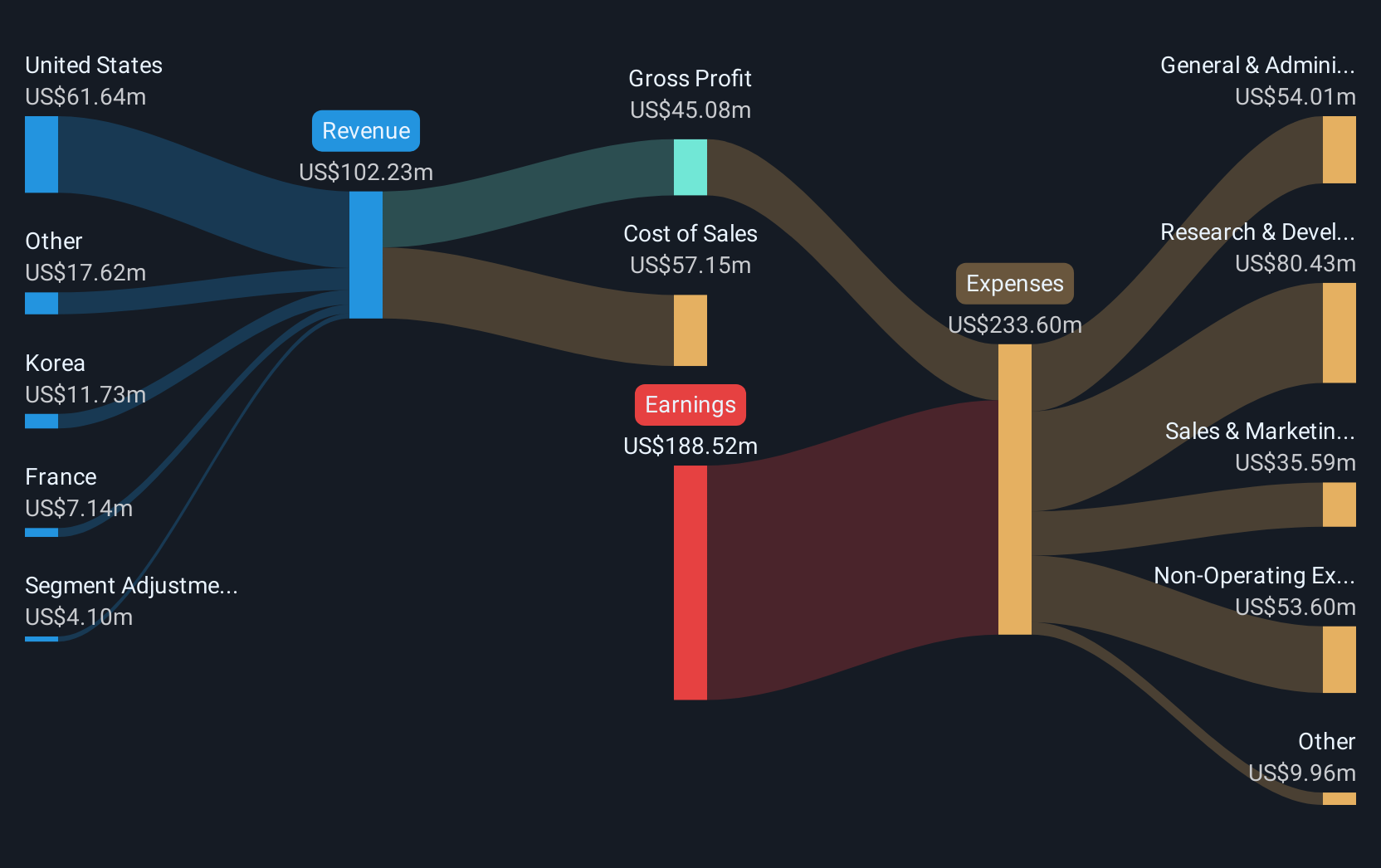

SoundHound AI (SOUN) recently announced a partnership with Acrelec to revolutionize the drive-thru experience in restaurants, a move that underscores its forward-thinking approach in the sector. This announcement coincides with a 14% price increase in the last quarter, which may have been bolstered by broader market optimism and strong earnings from major tech companies like Microsoft and Meta, as market indexes continued an upward trajectory. SoundHound's alliance with Acrelec, alongside other collaborations and robust quarterly financials, likely added supportive weight to these broader positive trends, despite the recent market fluctuations in tech stocks.

You should learn about the 3 weaknesses we've spotted with SoundHound AI.

The recent partnership between SoundHound AI and Acrelec is poised to potentially enhance the company's voice AI market position through innovative digital drive-thru solutions. This development could strengthen SoundHound's narrative of pursuing growth via diversification into new segments like voice commerce, which is expected to provide fresh revenue streams and elevate profitability. The partnership may contribute positively to SoundHound's revenue and earnings forecasts, in line with projections of robust revenue growth driven by new collaborations and offerings.

Over the past three years, SoundHound's total shareholder return, including dividends, was 173.42%. This substantial growth reflects the company's efforts despite the challenges it faces, such as dependency on partnerships and high R&D costs. When compared to the US Software industry return of 30.5% over the past year, SoundHound's recent performance is impressive. However, its highly volatile share price over the last three months suggests caution.

The share price's recent upward movement can be viewed in the context of a price target set at US$11.81, which is slightly above the current price of US$10.39. This modest discount suggests that analysts see the stock as relatively fairly valued, considering their assumptions about future earnings and revenue growth. As investors digest the implications of the Acrelec partnership, it remains to be seen if this will indeed bolster the positive growth trajectory analysts have projected for SoundHound.

Assess SoundHound AI's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SOUN

SoundHound AI

Develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers in the United States, Korea, France, Japan, Germany, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives