- United States

- /

- Software

- /

- NasdaqGM:SOUN

SoundHound AI (SOUN): Assessing Valuation After New In-Car Voice Assistant Partnership with Parkopedia

Reviewed by Simply Wall St

SoundHound AI (SOUN) announced an expanded partnership with Parkopedia to introduce a voice-controlled in-car parking assistant. This new feature allows drivers to easily find, compare, and pay for parking using intuitive voice commands.

See our latest analysis for SoundHound AI.

Amid the exciting rollout of its new in-car parking assistant, SoundHound AI’s share price tells a story of volatility and resilience. While the stock has fallen sharply this year, posting a year-to-date share price return of -40.23% and a bumpy 30-day return of -28.57%, it is up 29.4% on a total shareholder return basis over the past 12 months, with a total return of 792.6% over three years. New partnerships and steady revenue growth have kept sentiment lively, even as the stock weathers major swings and shifting expectations around AI valuations.

On the hunt for more potential breakouts? After seeing SoundHound’s latest move, it could be the perfect moment to check out See the full list for free..

With a recent string of rapid revenue gains but mounting losses, the question looms: is SoundHound AI undervalued given its growth trajectory, or is the market already factoring in all of its future potential?

Most Popular Narrative: 28.9% Undervalued

SoundHound AI closed at $12.05, while the most popular narrative assigns a fair value closer to $16.94. This narrative points to a major growth inflection and expansion into new markets as key drivers behind the valuation.

Strategic partnerships and integrations with automotive OEMs (including global and Chinese brands), restaurant tech providers, and enterprise channel partners are accelerating user adoption, market penetration, and expanding monetization opportunities. These factors further support future topline and earnings growth through network effects.

Curious why this narrative is so bullish? The expectation centers on the potential for rapid growth and an ambitious turnaround in profit margins. Want to uncover which core financial changes the narrative suggests will drive SoundHound’s climb? Explore further to see which metrics are viewed as supporting this significant fair value estimate.

Result: Fair Value of $16.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued heavy spending and unpredictable earnings could undermine the bullish outlook if profitability remains elusive or if expenses outpace revenue growth.

Find out about the key risks to this SoundHound AI narrative.

Another View: Multiples Paint a Cautious Picture

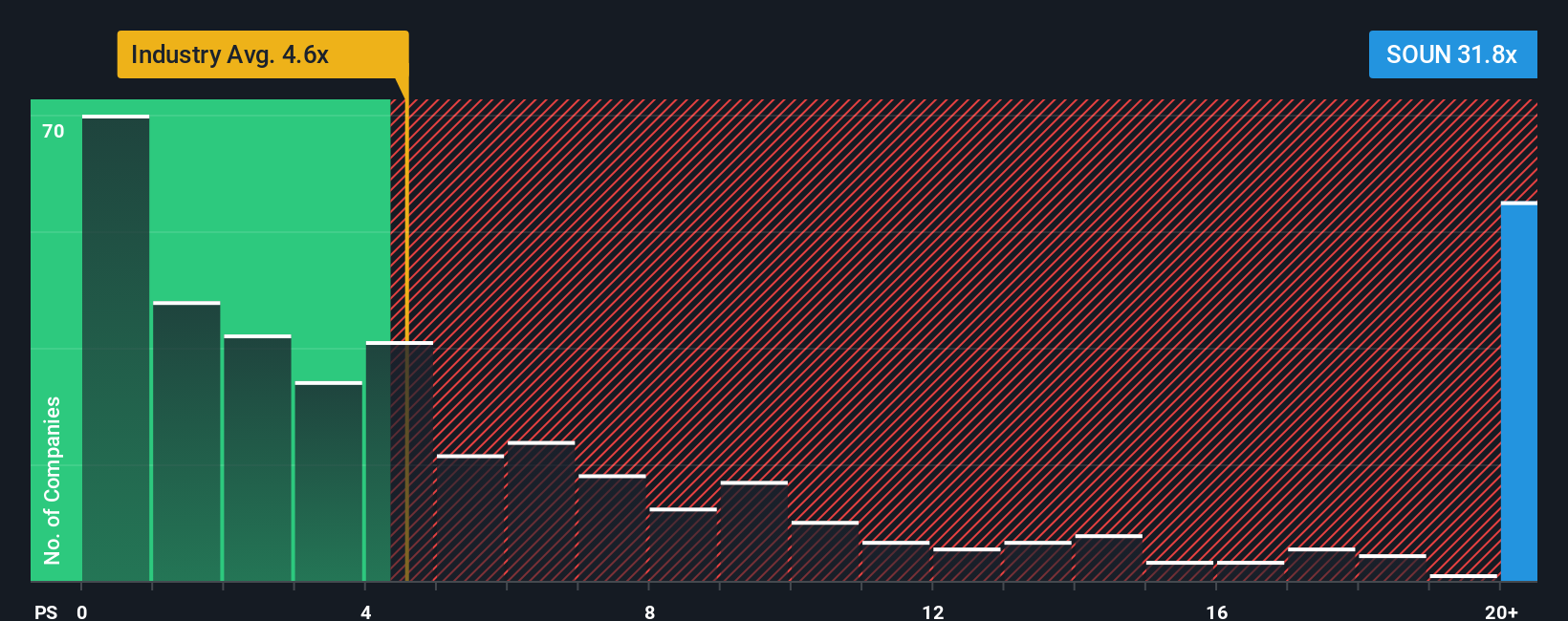

Taking a closer look at market-based valuation, SoundHound AI trades at a price-to-sales ratio of 34.1x. This far exceeds the US Software industry average of 4.9x and its peer average of 21.9x. Even compared to its estimated fair ratio of 9.1x, the current premium is hard to ignore, raising practical questions about valuation risk if growth expectations falter. Could this elevated multiple signal vulnerability, or simply reflect the market's confidence in future top-line gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SoundHound AI Narrative

If you want to bring your own perspective or dig into the numbers personally, you can analyze the figures and assemble your own narrative in just a few minutes. Do it your way

A great starting point for your SoundHound AI research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for More High-Potential Opportunities?

Smart investors never settle for just one idea. Broaden your portfolio and unlock more potential winners tailored to your interests in just a few clicks.

- Tap into the surge of future innovation by scanning these 25 AI penny stocks that are shaping the next significant developments in artificial intelligence.

- Get ahead of the market with these 914 undervalued stocks based on cash flows featuring robust fundamentals and attractive pricing, suited for savvy investors.

- Maximize your passive income strategy by targeting these 15 dividend stocks with yields > 3% currently offering yields over 3% along with steady performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SOUN

SoundHound AI

Develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers in the United States, Korea, France, Japan, Germany, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026