- United States

- /

- Software

- /

- NasdaqGS:SNPS

Synopsys (SNPS): Exploring Valuation as Earnings Momentum and Forecasts Drive Renewed Investor Interest

Reviewed by Simply Wall St

Most Popular Narrative: 4% Undervalued

According to community narrative, Synopsys is viewed as undervalued, trading roughly 4% below the consensus fair value. The case for further upside rests on ambitious growth projections in earnings and revenue, with AI and innovation at the center of the bullish outlook.

The launch of HAPS-200 and ZeBu-200 systems, which offer up to double the performance, is expected to strengthen Synopsys' hardware-assisted verification market position. This could drive revenue from semiconductor companies like AMD and NVIDIA. Synopsys' leadership in AI-driven Electronic Design Automation (EDA) tools and innovation in generative and agentic AI capabilities may lead to significant productivity gains for customers, potentially improving Synopsys' revenue growth and market share in the EDA industry.

Want to discover what’s fueling these bold valuation calls? The secret lies in the narrative’s reliance on aggressive growth assumptions for Synopsys’s earnings, margins, and future multiples. Find out which specific catalysts and financial expectations could be driving this premium. It may not be what you expect.

Result: Fair Value of $631.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent challenges in China and delays in completing the Ansys acquisition could quickly shift the outlook and dampen expected growth.

Find out about the key risks to this Synopsys narrative.Another View: Caution from the SWS DCF Model

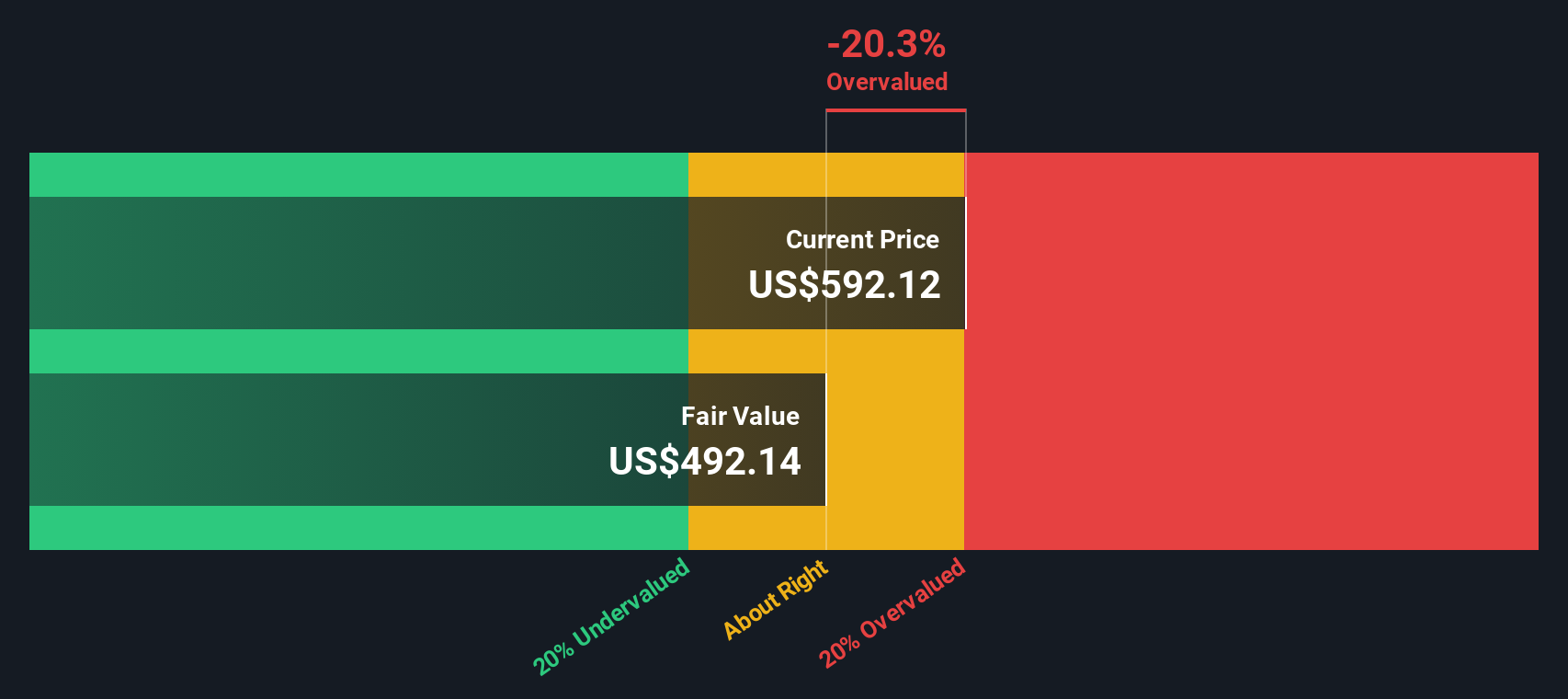

Taking a step back from market multiples, our DCF model suggests Synopsys might be overvalued at today’s prices. This perspective challenges the optimism seen elsewhere. Could the share price be running ahead of the story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Synopsys Narrative

If you think there is more to the story or would like to dig deeper into the numbers, crafting your own narrative is quick and straightforward. Most users complete one in just a few minutes, so why not do it your way?

A great starting point for your Synopsys research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Boost your investing strategy with handpicked lists tailored for today’s market. Don’t let tomorrow’s winners slip by when you could start getting ahead now.

- Capture passive income by checking out dividend stocks with yields > 3% that consistently yield over 3% and can help strengthen your portfolio’s returns.

- Unlock the promise of tomorrow by targeting AI penny stocks at the forefront of innovation and artificial intelligence breakthroughs.

- Shield your investments from hype by finding undervalued stocks based on cash flows packed with undervalued companies based on strong cash flows, offering smart entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides electronic design automation software products used to design and test integrated circuits.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives