- United States

- /

- Software

- /

- NasdaqCM:SNCR

Synchronoss Technologies, Inc. (NASDAQ:SNCR) Held Back By Insufficient Growth Even After Shares Climb 26%

Despite an already strong run, Synchronoss Technologies, Inc. (NASDAQ:SNCR) shares have been powering on, with a gain of 26% in the last thirty days. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

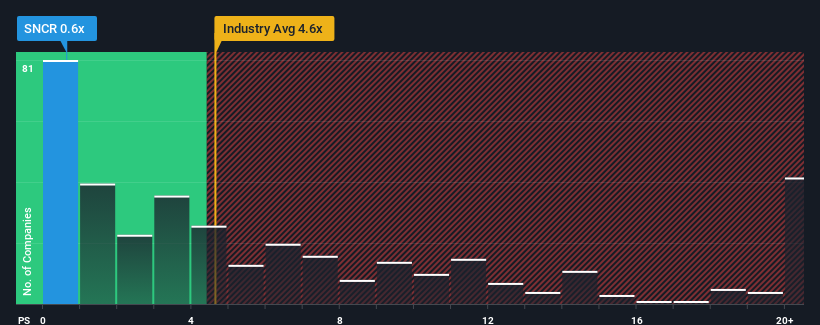

In spite of the firm bounce in price, Synchronoss Technologies may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.6x and even P/S higher than 12x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Synchronoss Technologies

What Does Synchronoss Technologies' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Synchronoss Technologies has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Synchronoss Technologies' future stacks up against the industry? In that case, our free report is a great place to start.How Is Synchronoss Technologies' Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Synchronoss Technologies' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. Still, lamentably revenue has fallen 41% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 6.2% during the coming year according to the three analysts following the company. With the industry predicted to deliver 14% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Synchronoss Technologies' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Synchronoss Technologies' P/S

Synchronoss Technologies' recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Synchronoss Technologies' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Synchronoss Technologies, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Synchronoss Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SNCR

Synchronoss Technologies

Provides white label cloud software and services in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Why I invest in Sofina (Dividend growth)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.