- United States

- /

- Software

- /

- NasdaqCM:SMSI

We Wouldn't Rely On Smith Micro Software's (NASDAQ:SMSI) Statutory Earnings As A Guide

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Smith Micro Software (NASDAQ:SMSI).

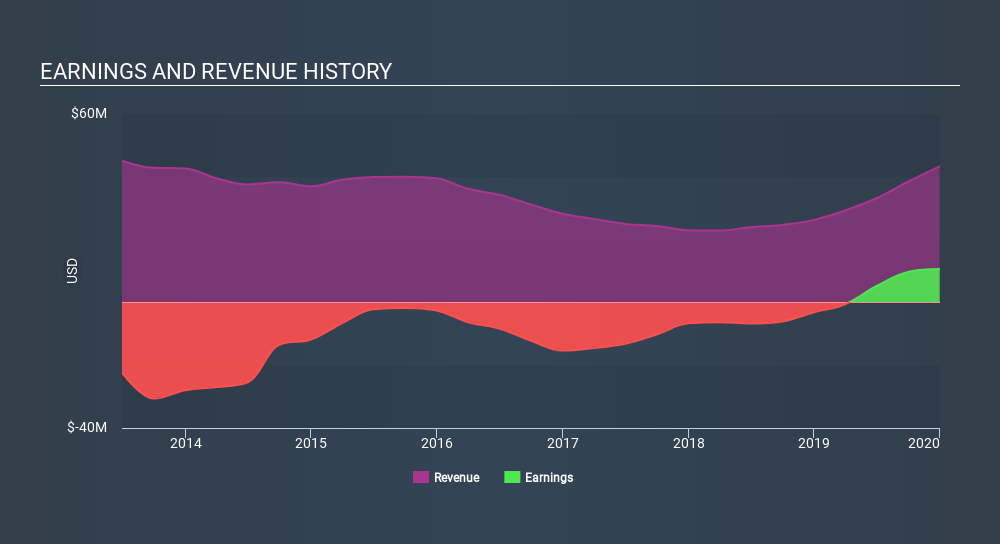

While Smith Micro Software was able to generate revenue of US$43.3m in the last twelve months, we think its profit result of US$10.6m was more important. The good news is that the company managed to grow its revenue over the last three years, and also move from loss-making to profitable.

See our latest analysis for Smith Micro Software

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. In this article we will consider how Smith Micro Software's decision to issue new shares in the company has impacted returns to shareholders. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Smith Micro Software expanded the number of shares on issue by 55% over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Smith Micro Software's EPS by clicking here.

A Look At The Impact Of Smith Micro Software's Dilution on Its Earnings Per Share (EPS).

Three years ago, Smith Micro Software lost money. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

If Smith Micro Software's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Smith Micro Software's Profit Performance

Over the last year Smith Micro Software issued new shares and so, there's a noteworthy divergence between EPS and net income growth. For this reason, we think that Smith Micro Software's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. The good news is that it earned a profit in the last twelve months, despite its previous loss. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Be aware that Smith Micro Software is showing 2 warning signs in our investment analysis and 1 of those can't be ignored...

Today we've zoomed in on a single data point to better understand the nature of Smith Micro Software's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:SMSI

Smith Micro Software

Develops and sells software solutions to simplify and enhance the mobile experience to wireless and cable service providers in the Americas, Europe, the Middle East, and Africa.

Undervalued moderate.

Market Insights

Community Narratives