- United States

- /

- Software

- /

- NasdaqCM:SMSI

Smith Micro Software (NasdaqCM:SMSI) Announces New Leadership with COO-CFO Appointment

Smith Micro Software (NasdaqCM:SMSI) recently experienced a significant leadership transition with the appointment of Tim Huffmyer as both COO and CFO, which might relate to its 27% stock price increase over the last quarter. During this period, the company also launched SafePath 8, a family safety platform incorporating AI features. Simultaneously, Smith Micro reported lower sales in its Q1 earnings, but managed a significantly reduced net loss compared to the previous year. These corporate developments emerged amidst a broader upward trend in the market, reflecting investor hopes buoyed by strong tech earnings and trade negotiation progress.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

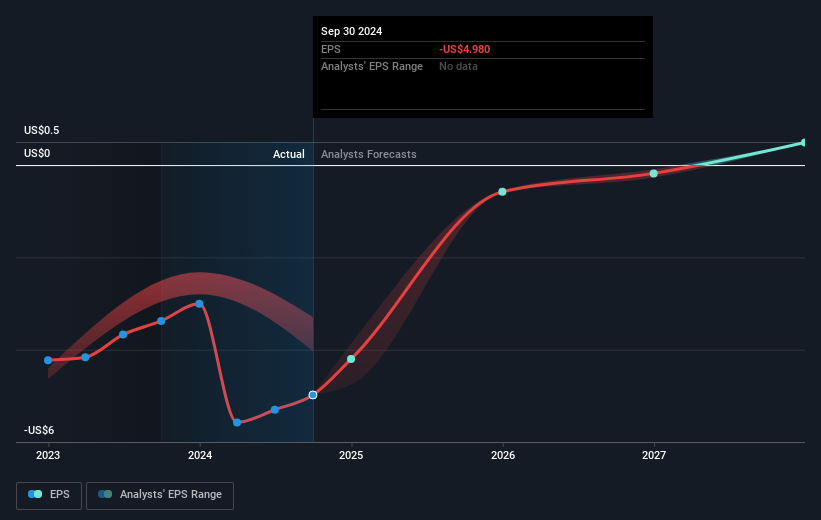

Over the past year, Smith Micro Software's total shareholder return, including share price and dividends, was a 58.30% decline. In comparison, the company underperformed the US Software industry, which saw an 18.5% return, and the broader US market, which returned 11.2% during the same period. This underperformance highlights the challenges the company faced as it navigated the impacts of lower sales and ongoing unprofitability.

The recent leadership changes, including Tim Huffmyer's dual appointment as COO and CFO, and the launch of SafePath 8 could potentially influence future revenue and earnings forecasts, as these developments aim to enhance operational efficiency and product offerings. However, despite the 27% stock price increase in the last quarter, the current share price remains significantly below the consensus analyst price target of US$4.00. This indicates that while the market may be reacting positively to company actions, there's a substantial gap to the estimated fair value, reflecting uncertainty in achieving projected growth and profitability amid existing financial challenges, such as the auditors’ going concern doubts.

Understand Smith Micro Software's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMSI

Smith Micro Software

Develops and sells software solutions to simplify and enhance the mobile experience to wireless and cable service providers in the Americas, Europe, the Middle East, and Africa.

Undervalued with mediocre balance sheet.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Why did Novo Nordisk flop?

Xero: Growth Was Priced In — Execution Is Not

Rio Tinto (RIO): Cash Machine with a China Beta Problem — and a Copper Glow-Up

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks