- United States

- /

- Software

- /

- NasdaqCM:SMSI

It's Down 28% But Smith Micro Software, Inc. (NASDAQ:SMSI) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the Smith Micro Software, Inc. (NASDAQ:SMSI) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 76% share price decline.

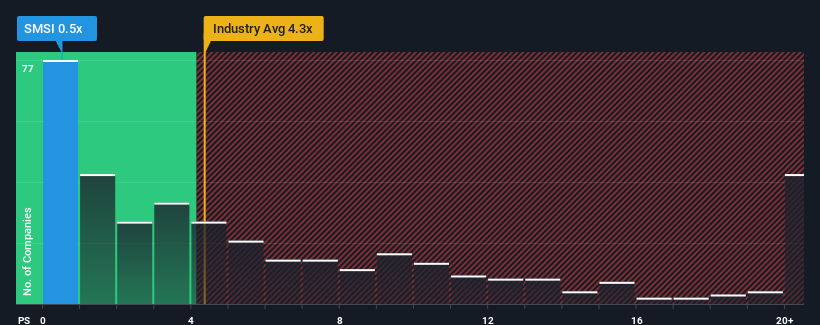

After such a large drop in price, Smith Micro Software may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.3x and even P/S higher than 11x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Smith Micro Software

What Does Smith Micro Software's Recent Performance Look Like?

Smith Micro Software could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Smith Micro Software.Is There Any Revenue Growth Forecasted For Smith Micro Software?

Smith Micro Software's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. The last three years don't look nice either as the company has shrunk revenue by 20% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 16% each year as estimated by the four analysts watching the company. With the industry predicted to deliver 15% growth per annum, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Smith Micro Software's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Smith Micro Software's P/S?

Having almost fallen off a cliff, Smith Micro Software's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Smith Micro Software currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You need to take note of risks, for example - Smith Micro Software has 5 warning signs (and 1 which is concerning) we think you should know about.

If these risks are making you reconsider your opinion on Smith Micro Software, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SMSI

Smith Micro Software

Develops and sells software solutions to simplify and enhance the mobile experience to wireless and cable service providers in the Americas, Europe, the Middle East, and Africa.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Meta Platforms Inc (META): The AI Infrastructure Pivot – Monetizing the Next Frontier in 2026.

Enlight Renewable Energy Ltd. (ENLT): Scaling the Global Green Grid – A 2026 Powerhouse.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Nu holdings will continue to disrupt the South American banking market