- United States

- /

- Software

- /

- NasdaqCM:SMSI

Imagine Owning Smith Micro Software And Trying To Stomach The 78% Share Price Drop

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Smith Micro Software, Inc. (NASDAQ:SMSI) during the five years that saw its share price drop a whopping 78%. Furthermore, it's down 11% in about a quarter. That's not much fun for holders.

Check out our latest analysis for Smith Micro Software

Smith Micro Software isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Smith Micro Software reduced its trailing twelve month revenue by 13% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 26% per year in that period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

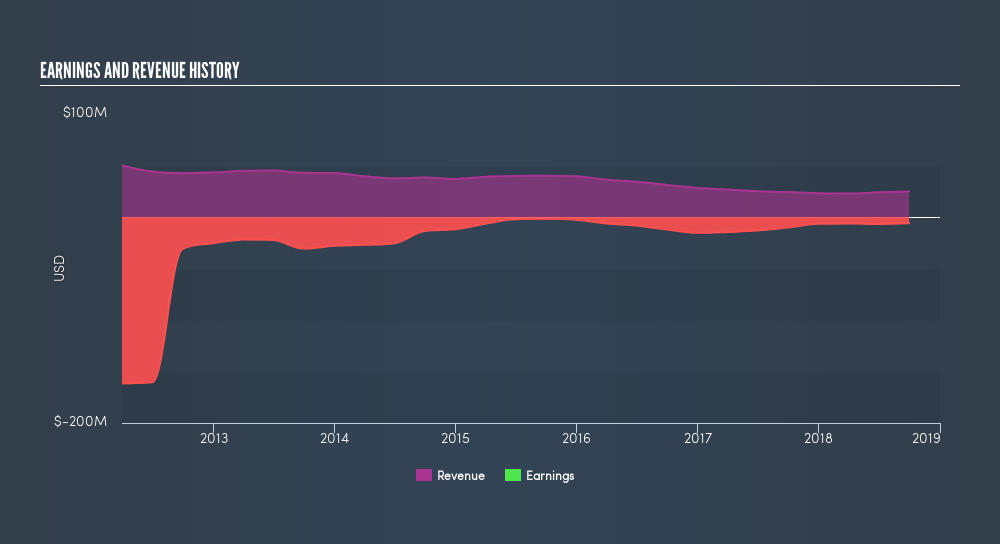

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

This free interactive report on Smith Micro Software's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Smith Micro Software shareholders have received a total shareholder return of 9.5% over one year. Notably the five-year annualised TSR loss of 26% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:SMSI

Smith Micro Software

Develops and sells software solutions to simplify and enhance the mobile experience to wireless and cable service providers in the Americas, Europe, the Middle East, and Africa.

Undervalued moderate.

Market Insights

Community Narratives