- United States

- /

- Software

- /

- NasdaqCM:SMSI

A Piece Of The Puzzle Missing From Smith Micro Software, Inc.'s (NASDAQ:SMSI) 70% Share Price Climb

Those holding Smith Micro Software, Inc. (NASDAQ:SMSI) shares would be relieved that the share price has rebounded 70% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 89% share price decline over the last year.

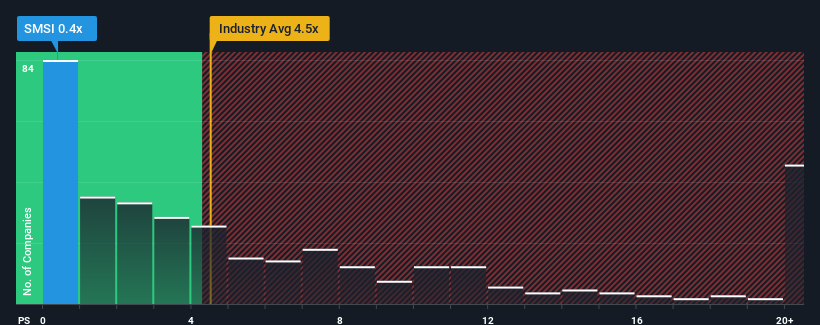

In spite of the firm bounce in price, Smith Micro Software's price-to-sales (or "P/S") ratio of 0.4x might still make it look like a strong buy right now compared to the wider Software industry in the United States, where around half of the companies have P/S ratios above 4.5x and even P/S above 11x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Smith Micro Software

What Does Smith Micro Software's Recent Performance Look Like?

Smith Micro Software hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Smith Micro Software.How Is Smith Micro Software's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Smith Micro Software's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's top line. As a result, revenue from three years ago have also fallen 42% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 22% per year over the next three years. That's shaping up to be materially higher than the 20% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Smith Micro Software's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Smith Micro Software's P/S

Smith Micro Software's recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Smith Micro Software currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Smith Micro Software (of which 1 doesn't sit too well with us!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SMSI

Smith Micro Software

Develops and sells software solutions to simplify and enhance the mobile experience to wireless and cable service providers in the Americas, Europe, the Middle East, and Africa.

Undervalued with mediocre balance sheet.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

Intuit Stock: When Financial Software Becomes the Operating System for Small Business

Meta’s Bold Bet on AI Pays Off

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).