- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (NasdaqGS:SHOP) Q1 Revenue Increases to US$2,360 Million Despite Higher Net Loss

Reviewed by Simply Wall St

Shopify (NasdaqGS:SHOP) reported substantial sales and revenue growth for Q1 2025, coupled with an increase in net losses, reflecting financial challenges amid expansion. The recent 20% climb in Shopify's shares over the past month may be partly attributed to these earnings results, providing evidence of market optimism. Additionally, Shopify’s partnership with Affirm to expand global payment options could have bolstered investor confidence. This momentum contrasts with broader market movements, as technology stocks generally advanced following the significant U.S.-U.K. trade agreement announcement, contributing further to tech sector gains.

We've spotted 2 risks for Shopify you should be aware of.

The recent 20% surge in Shopify's share price highlights investor optimism following robust Q1 2025 sales and revenue growth, despite widening net losses. This momentum, bolstered by Shopify's partnership with Affirm to expand payment options, is in line with positive market sentiment towards the tech sector, driven by the latest U.S.-U.K. trade agreement. Nonetheless, the longer-term context shows a staggering 196.62% total shareholder return over the past three years—a performance significantly outpacing typical industry and market benchmarks for the same period.

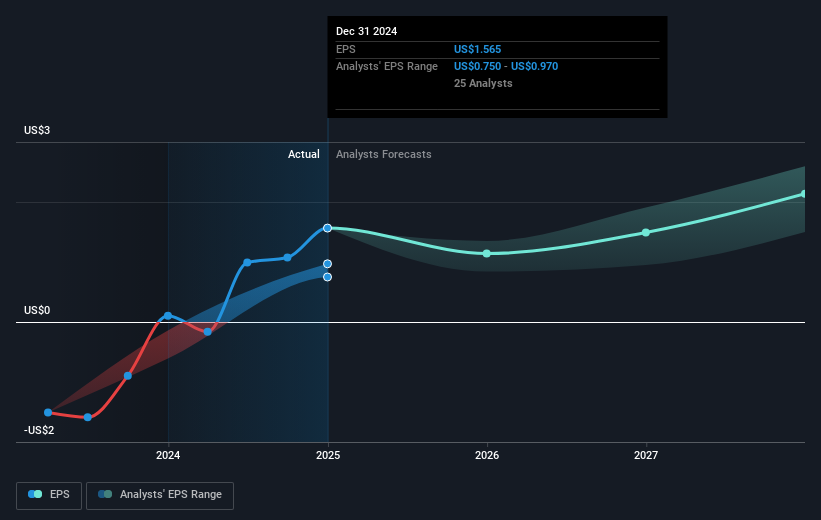

Looking ahead, Shopify's announcements and strategic partnerships with major brands like FC Barcelona and Reebok underscore efforts to fortify its market position, which may positively impact revenue and earnings forecasts. With ambitious international expansion plans and investments in AI enhancing merchant efficiency, analysts are projecting Shopify's revenue to grow by 21.9% annually over the next three years. However, competitive pressures and execution challenges could affect the ability to meet these targets, if not managed efficiently.

Despite the recent price movement, Shopify's current share price of US$109.82 reflects a 0.24% discount to the consensus analyst price target of US$116.96. To align with the analyst expectations by 2028, Shopify would need to achieve earnings of US$2.7 billion with a PE ratio of 82.3x, higher than today's PE of 70.4x. Clearly, investors must weigh this optimism against the company's current valuation metrics to formulate a well-rounded investment view.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives