- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (NasdaqGS:SHOP) Enhances Global Partnership With Global-e For E-Commerce Solutions

Reviewed by Simply Wall St

Shopify (NasdaqGS:SHOP) recently renewed a major partnership with Global-e Online Ltd., focusing on enhancing its direct-to-consumer e-commerce solutions. This development, alongside Shopify's Q1 2025 earnings report showing a significant year-over-year revenue increase, likely supported the company's 35% price rise last month. Amid a generally positive market trend with the Nasdaq Composite on an upward streak, these events added momentum to Shopify's stock performance. While market conditions were favorable, the strategic partnership renewal may have specifically bolstered investor confidence, contributing to Shopify's outperformance relative to the broader tech sector.

Shopify has 1 possible red flag we think you should know about.

The recent renewal of Shopify's partnership with Global-e Online Ltd. has potential implications for future growth narratives. By enhancing direct-to-consumer e-commerce solutions, Shopify may further solidify its position in the international market, aligning with its expansion strategy. Over the past three years, Shopify's total market return reached a very large 209.05%, showcasing its capacity for growth. In the past year, however, Shopify's stock performed more favorably relative to the broader U.S. IT industry, with significant returns that outpaced industry averages, reflecting investor optimism in its recent strategies.

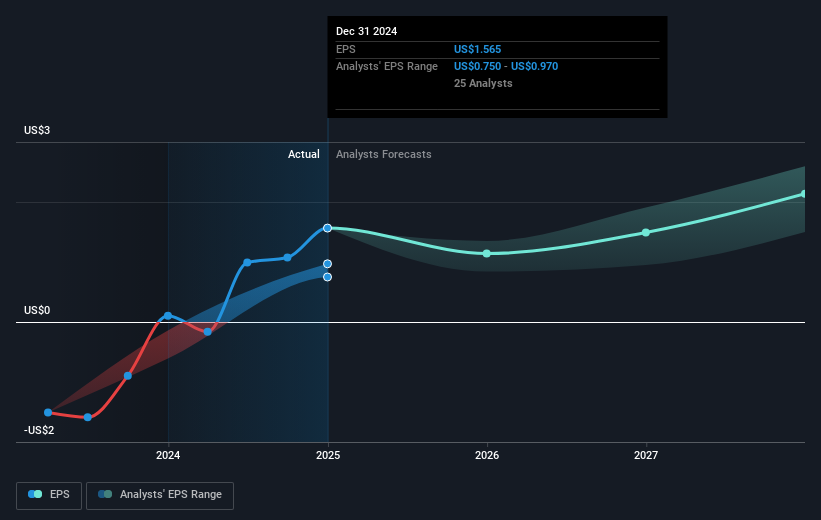

The renewed partnership could positively influence Shopify's revenue and earnings forecasts, considering the focus on merchant efficiency enhancements via new AI capabilities. This aligns with analyst expectations of 21.9% annual revenue growth over three years, despite anticipated profit margin contractions. With a current share price of US$109.82, Shopify is trading at a nearly 18.4% discount to the consensus analyst price target of US$134.54. This suggests room for potential appreciation, though differences in analyst predictions highlight the uncertainty in future valuations. Such factors are crucial as they determine how market sentiment might evolve concerning Shopify's long-term prospects.

Navigate through the intricacies of Shopify with our comprehensive balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives