- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (NasdaqGS:SHOP) Enhances ECommerce With AI-Powered Integration And Real-Time Protocol

Reviewed by Simply Wall St

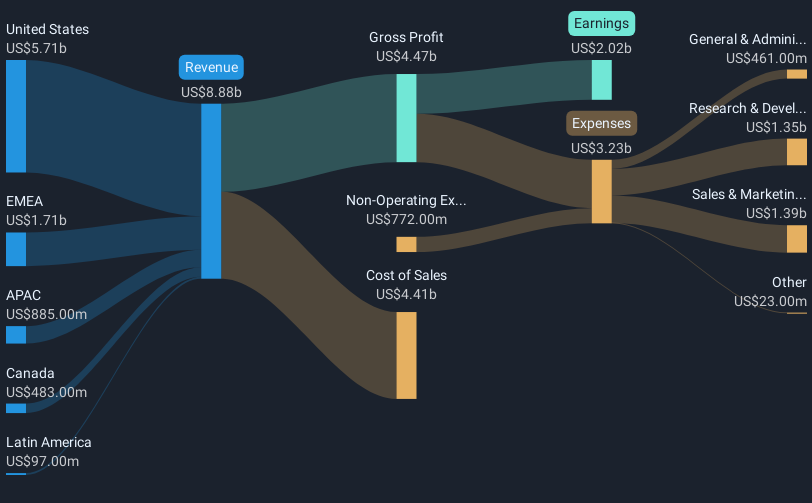

Shopify (NasdaqGS:SHOP) recently experienced a noteworthy price increase of 23%, aligning with several significant enhancements in their business operations. The integration of ai12z's AI-powered eCommerce functionality and real-time data connectivity aimed at enhancing user engagement likely supported a positive market sentiment. These developments came amid Shopify's inclusion in the NASDAQ-100 Index and various strategic partnerships, such as with Akeneo and Sovos, which strengthened its platform and global reach. While these events provided some momentum, the stock's movement is generally consistent with broader market gains, which have also been positive over the past year.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments at Shopify, including the integration of AI-powered eCommerce features and strategic partnerships, are expected to bolster the company's operational capabilities. This aligns with Shopify's focus on expanding its global reach and advancing its technology to enhance merchant efficiency. These enhancements potentially support revenue growth and could lead to improved earnings and operational margins. Over a longer-term horizon, Shopify's total returns, including share price appreciation and dividends, have been substantial, achieving a 247.37% increase over the past three years. This robust growth suggests strong market support and reflects the company's strategic initiatives.

When comparing the company's recent one-year return to the broader market, Shopify has experienced superior performance, surpassing the US market's 12.6% return and the US IT industry's 36.9% gain within the same timeframe. This outperformance highlights the positive reception of Shopify's recent business enhancements and strategic decisions. The consensus analyst price target for Shopify stands at US$115.18, with the current share price slightly below this at US$109.82, indicating a relatively small discount to the expected valuation. However, analysts have set a higher consensus price target of US$134.54, suggesting potential upside if Shopify continues to meet growth expectations in revenue and earnings, especially as they aim for an annual revenue growth of 17.3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives