- United States

- /

- IT

- /

- NasdaqGS:SHOP

Sezzle Sues Shopify (NasdaqGS:SHOP) Alleging Antitrust Violations Over Payment Options

Reviewed by Simply Wall St

Sezzle Inc.'s recent legal challenges against Shopify (NasdaqGS:SHOP) for alleged monopolistic practices present a significant hurdle for the company. Despite this, Shopify's shares rose 17% over the past month, reflecting investor optimism buoyed by the company's inclusion in the NASDAQ-100 and strengthened partnerships with firms like Global-e Online Ltd. Additionally, broader market trends saw the S&P 500 and Nasdaq Composite reaching new highs, further supporting Shopify's price movement. The antitrust lawsuit might weigh on future sentiment, but recent product enhancements and strategic alliances have bolstered market confidence in Shopify's competitive position.

Every company has risks, and we've spotted 2 risks for Shopify you should know about.

The recent legal challenges between Sezzle Inc. and Shopify regarding allegations against Shopify may introduce uncertainties impacting market sentiments. Despite these challenges, Shopify's shares rose by 17% in the past month, indicative of investor confidence. Over the longer term, Shopify's total shareholder return over the past three years reached a notable outcome of 244.47%, demonstrating resilience and growth potential. For context, Shopify's one-year performance outpaced that of the US IT industry, which returned 38.4%, underscoring its competitive positioning. This strong performance suggests a competitive edge and effectiveness in its operational and strategic initiatives.

Looking ahead, ongoing legal proceedings could impact revenue and earnings projections depending on their outcome. Continued investments in AI and international expansion underscore growth prospects but could also strain resources if the expansion and associated costs aren’t well-managed. Shopify's share price stands at US$109.82, with analyst price targets at US$134.54, indicating potential upside. This target suggests a level of market confidence in Shopify's ability to capitalize on current and future business developments. Investors may find it prudent to closely monitor developments in Shopify's strategies and industry positioning, particularly as the legal proceedings evolve and market dynamics shift.

Review our historical performance report to gain insights into Shopify's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

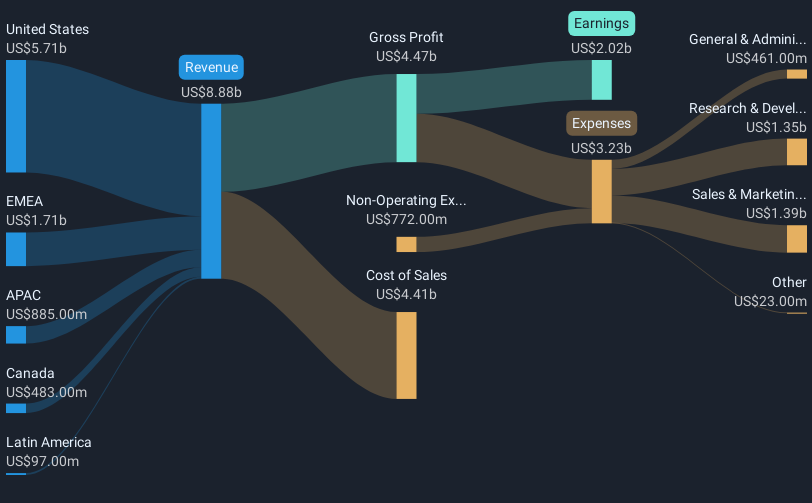

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion