- United States

- /

- IT

- /

- NasdaqGS:RXT

These Return Metrics Don't Make Rackspace Technology (NASDAQ:RXT) Look Too Strong

What financial metrics can indicate to us that a company is maturing or even in decline? When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. And from a first read, things don't look too good at Rackspace Technology (NASDAQ:RXT), so let's see why.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Rackspace Technology:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.013 = US$52m ÷ (US$4.8b - US$791m) (Based on the trailing twelve months to March 2023).

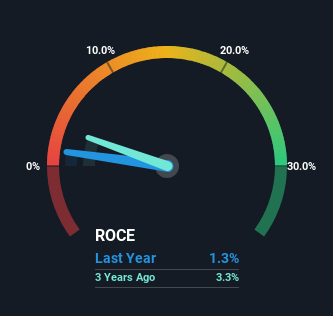

So, Rackspace Technology has an ROCE of 1.3%. Ultimately, that's a low return and it under-performs the IT industry average of 14%.

Check out our latest analysis for Rackspace Technology

In the above chart we have measured Rackspace Technology's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

SWOT Analysis for Rackspace Technology

- No major strengths identified for RXT.

- Interest payments on debt are not well covered.

- Shareholders have been diluted in the past year.

- Forecast to reduce losses next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio and estimated fair value.

- Debt is not well covered by operating cash flow.

- Not expected to become profitable over the next 3 years.

What Can We Tell From Rackspace Technology's ROCE Trend?

The trend of ROCE at Rackspace Technology is showing some signs of weakness. Unfortunately, returns have declined substantially over the last four years to the 1.3% we see today. On top of that, the business is utilizing 29% less capital within its operations. The fact that both are shrinking is an indication that the business is going through some tough times. If these underlying trends continue, we wouldn't be too optimistic going forward.

The Bottom Line

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. Long term shareholders who've owned the stock over the last year have experienced a 62% depreciation in their investment, so it appears the market might not like these trends either. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

Rackspace Technology does come with some risks though, we found 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant...

While Rackspace Technology isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RXT

Rackspace Technology

Operates as a cloud and artificial intelligence solutions company in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Very undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Future PE of 12.8x Shines Bright for FactSet Growth

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Quintessential serial acquirer

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.