Rackspace Technology, Inc. (NASDAQ:RXT) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. Rackspace Technology, Inc. operates as a multi cloud technology services company worldwide. The company’s loss has recently broadened since it announced a US$102m loss in the full financial year, compared to the latest trailing-twelve-month loss of US$229m, moving it further away from breakeven. Many investors are wondering about the rate at which Rackspace Technology will turn a profit, with the big question being “when will the company breakeven?” In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

View our latest analysis for Rackspace Technology

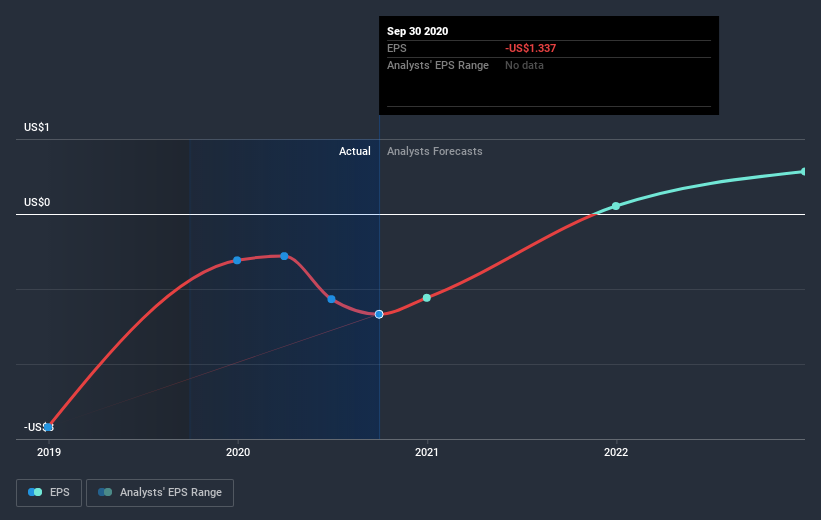

Rackspace Technology is bordering on breakeven, according to the 7 American IT analysts. They anticipate the company to incur a final loss in 2020, before generating positive profits of US$25m in 2021. Therefore, the company is expected to breakeven just over a year from now. In order to meet this breakeven date, we calculated the rate at which the company must grow year-on-year. It turns out an average annual growth rate of 112% is expected, which signals high confidence from analysts. If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

We're not going to go through company-specific developments for Rackspace Technology given that this is a high-level summary, however, take into account that generally a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

Before we wrap up, there’s one issue worth mentioning. Rackspace Technology currently has a debt-to-equity ratio of over 2x. Generally, the rule of thumb is debt shouldn’t exceed 40% of your equity, which in this case, the company has significantly overshot. A higher level of debt requires more stringent capital management which increases the risk in investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on Rackspace Technology, so if you are interested in understanding the company at a deeper level, take a look at Rackspace Technology's company page on Simply Wall St. We've also put together a list of important aspects you should look at:

- Valuation: What is Rackspace Technology worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Rackspace Technology is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Rackspace Technology’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you decide to trade Rackspace Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:RXT

Rackspace Technology

Operates as a cloud and artificial intelligence solutions company in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Very undervalued with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)