- United States

- /

- IT

- /

- NasdaqGS:RXT

Improved Revenues Required Before Rackspace Technology, Inc. (NASDAQ:RXT) Stock's 28% Jump Looks Justified

Rackspace Technology, Inc. (NASDAQ:RXT) shareholders have had their patience rewarded with a 28% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.7% in the last twelve months.

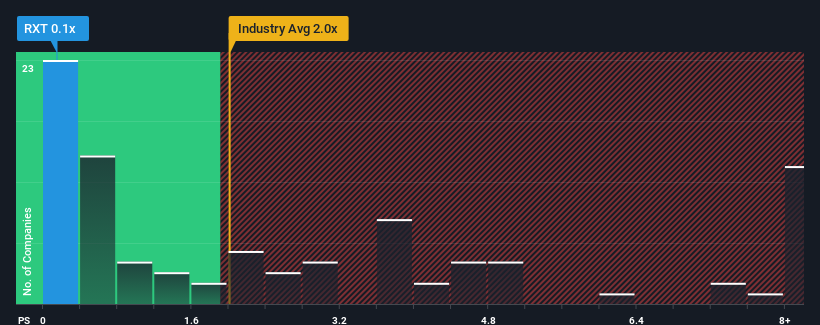

Even after such a large jump in price, it would still be understandable if you think Rackspace Technology is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in the United States' IT industry have P/S ratios above 2x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Rackspace Technology

How Rackspace Technology Has Been Performing

While the industry has experienced revenue growth lately, Rackspace Technology's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Rackspace Technology will help you uncover what's on the horizon.How Is Rackspace Technology's Revenue Growth Trending?

Rackspace Technology's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 2.8% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 16% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 4.5% as estimated by the five analysts watching the company. With the industry predicted to deliver 9.1% growth, that's a disappointing outcome.

With this information, we are not surprised that Rackspace Technology is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Rackspace Technology's P/S?

Rackspace Technology's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Rackspace Technology maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Rackspace Technology (1 is significant!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Rackspace Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RXT

Rackspace Technology

Operates as a cloud and artificial intelligence solutions company in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Very undervalued with low risk.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Endeavour Group's Future PE Expected to Climb to 15.51%

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion