- United States

- /

- IT

- /

- NasdaqCM:RSSS

Shareholders Will Probably Hold Off On Increasing Research Solutions, Inc.'s (NASDAQ:RSSS) CEO Compensation For The Time Being

Key Insights

- Research Solutions' Annual General Meeting to take place on 12th of November

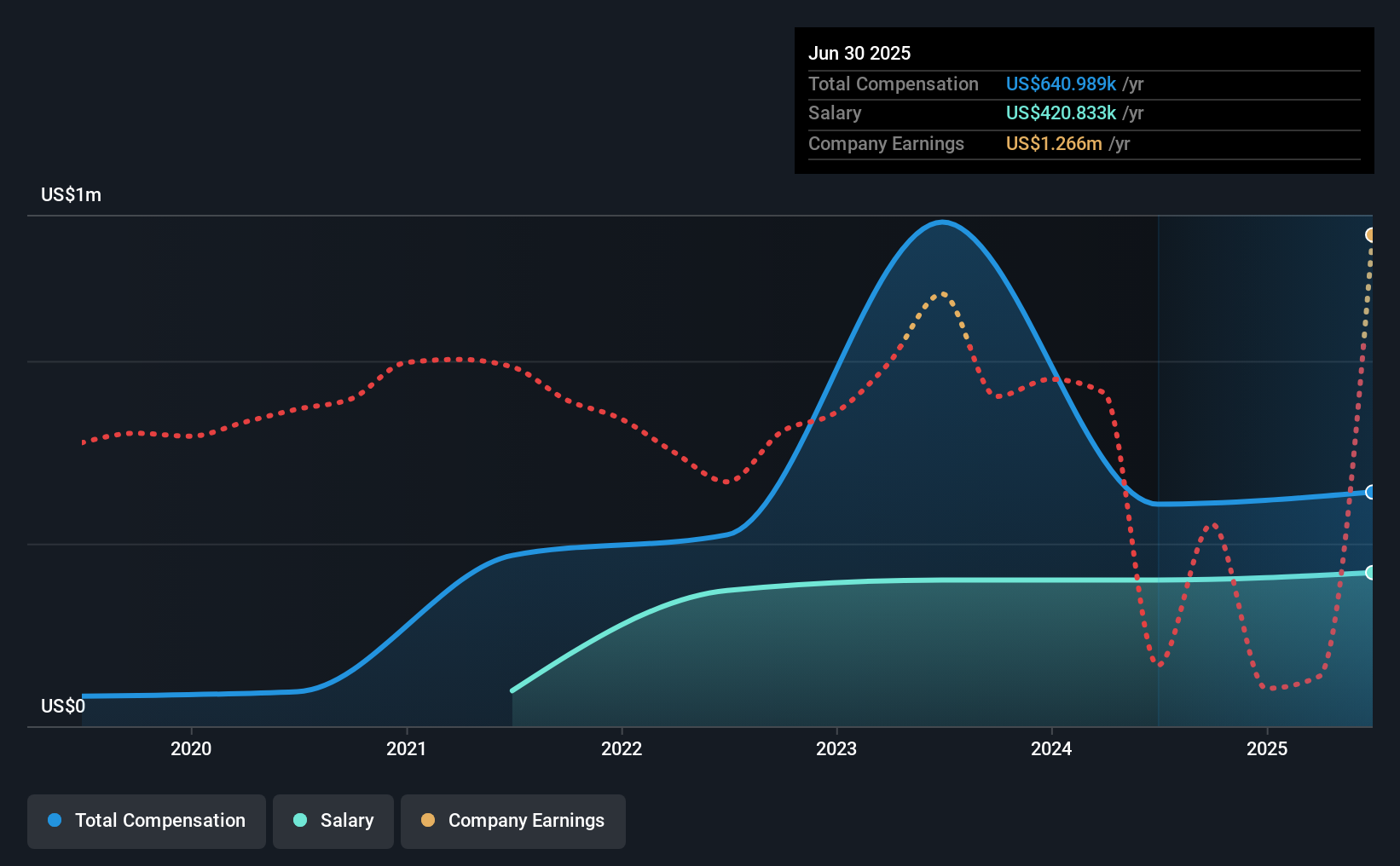

- Salary of US$420.8k is part of CEO Roy Olivier's total remuneration

- The total compensation is 69% higher than the average for the industry

- Over the past three years, Research Solutions' EPS fell by 29% and over the past three years, the total shareholder return was 60%

Despite strong share price growth of 60% for Research Solutions, Inc. (NASDAQ:RSSS) over the last few years, earnings growth has been disappointing, which suggests something is amiss. The upcoming AGM on 12th of November may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Research Solutions

Comparing Research Solutions, Inc.'s CEO Compensation With The Industry

According to our data, Research Solutions, Inc. has a market capitalization of US$100m, and paid its CEO total annual compensation worth US$641k over the year to June 2025. That's just a smallish increase of 5.5% on last year. In particular, the salary of US$420.8k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the American IT industry with market capitalizations under US$200m, the reported median total CEO compensation was US$379k. This suggests that Roy Olivier is paid more than the median for the industry. What's more, Roy Olivier holds US$951k worth of shares in the company in their own name.

Speaking on an industry level, nearly 14% of total compensation represents salary, while the remainder of 86% is other remuneration. Research Solutions is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Research Solutions, Inc.'s Growth Numbers

Research Solutions, Inc. has reduced its earnings per share by 29% a year over the last three years. It achieved revenue growth of 9.9% over the last year.

Few shareholders would be pleased to read that EPS have declined. The fairly low revenue growth fails to impress given that the EPS is down. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Research Solutions, Inc. Been A Good Investment?

We think that the total shareholder return of 60%, over three years, would leave most Research Solutions, Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Research Solutions that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RSSS

Research Solutions

Through its subsidiaries, provides research cloud-based software-as-a-service software platform and related services to corporate, academic, government and individual researchers in the United States, Europe, and internationally.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Future PE of 12.8x Shines Bright for FactSet Growth

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Quintessential serial acquirer

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.