- United States

- /

- IT

- /

- NasdaqCM:RSSS

Our View On Research Solutions' (NASDAQ:RSSS) CEO Pay

This article will reflect on the compensation paid to Peter Derycz who has served as CEO of Research Solutions, Inc. (NASDAQ:RSSS) since 2006. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Research Solutions.

Check out our latest analysis for Research Solutions

Comparing Research Solutions, Inc.'s CEO Compensation With the industry

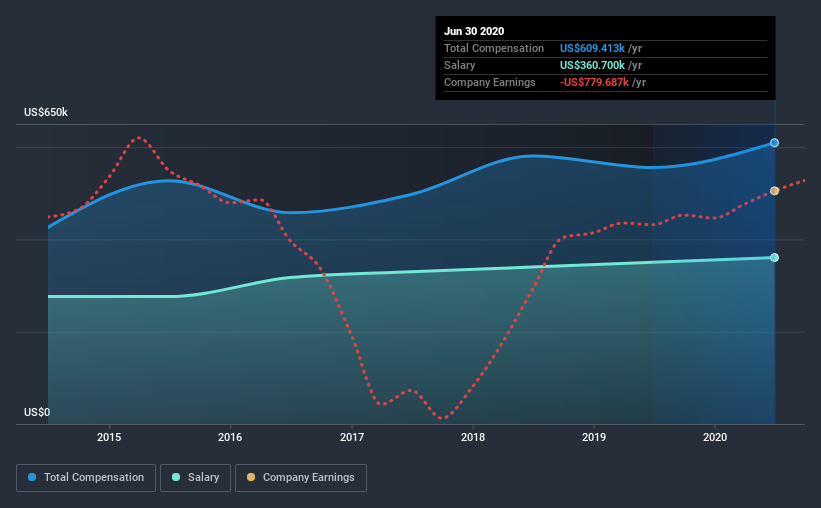

According to our data, Research Solutions, Inc. has a market capitalization of US$57m, and paid its CEO total annual compensation worth US$609k over the year to June 2020. We note that's an increase of 9.6% above last year. We note that the salary portion, which stands at US$360.7k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$345k. Accordingly, our analysis reveals that Research Solutions, Inc. pays Peter Derycz north of the industry median. What's more, Peter Derycz holds US$8.2m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Talking in terms of the industry, salary represented approximately 14% of total compensation out of all the companies we analyzed, while other remuneration made up 86% of the pie. Research Solutions pays out 59% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Research Solutions, Inc.'s Growth Numbers

Over the past three years, Research Solutions, Inc. has seen its earnings per share (EPS) grow by 54% per year. In the last year, its revenue is up 6.0%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Research Solutions, Inc. Been A Good Investment?

We think that the total shareholder return of 89%, over three years, would leave most Research Solutions, Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

As we touched on above, Research Solutions, Inc. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, Research Solutions has produced strong EPS growth and shareholder returns over the last three years. As a result of the excellent all-round performance of the company, we believe CEO compensation is fair. Given the strong history of shareholder returns, the shareholders are probably very happy with Peter's performance.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Research Solutions that you should be aware of before investing.

Important note: Research Solutions is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Research Solutions or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:RSSS

Research Solutions

Through its subsidiaries, provides research cloud-based software-as-a-service software platform and related services to corporate, academic, government and individual researchers in the United States, Europe, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

UiPath Inc. (PATH): Agentic AI Pivot and Milestone Profits Set the Stage for Q4 Results

AeroVironment (AVAV): Q3 Earnings Miss Balanced by Record Backlog and BlueHalo Integration

Franco-Nevada Corporation (TSX: FNV): Premier Streaming Moat Braces for Q4 Results as Diversification Strategy Accelerates

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks