- United States

- /

- Software

- /

- NasdaqGM:RPD

Rapid7, Inc.'s (NASDAQ:RPD) Earnings Haven't Escaped The Attention Of Investors

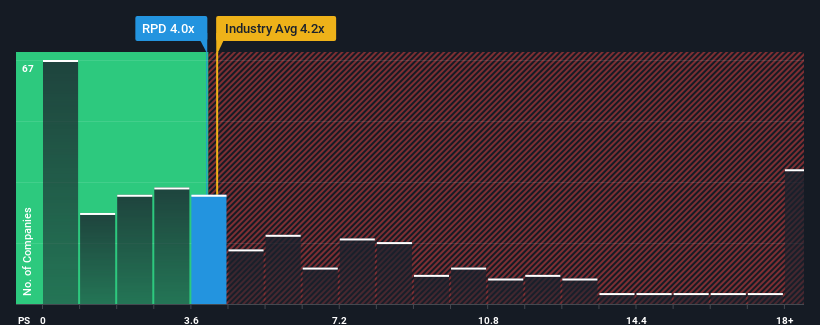

There wouldn't be many who think Rapid7, Inc.'s (NASDAQ:RPD) price-to-sales (or "P/S") ratio of 4x is worth a mention when the median P/S for the Software industry in the United States is similar at about 4.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Rapid7

How Rapid7 Has Been Performing

Recent times have been advantageous for Rapid7 as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Rapid7's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Rapid7's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The strong recent performance means it was also able to grow revenue by 104% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 13% as estimated by the analysts watching the company. With the industry predicted to deliver 13% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Rapid7 is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Rapid7's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Rapid7's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Software industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Rapid7 (1 shouldn't be ignored!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives