- United States

- /

- Software

- /

- NasdaqGS:ROP

How Raised Revenue Guidance and Strong Q2 Results at Roper (ROP) Have Changed Its Investment Story

Reviewed by Simply Wall St

- Roper Technologies reported results for the second quarter and first half of 2025 earlier this month, posting higher quarterly sales of US$1.94 billion and net income of US$378.3 million, up from the year before.

- Alongside these results, the company raised its full-year total revenue growth outlook, signaling strengthened operational momentum and an upgraded view on its performance for the rest of the year.

- We'll examine how Roper's raised revenue growth outlook could influence the company's investment narrative and long-term growth assumptions.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Roper Technologies Investment Narrative Recap

To be a Roper Technologies shareholder, you generally need to believe the company can continue delivering recurring, stable growth by integrating and scaling niche software platforms across under-digitized sectors. The recent upward revision to Roper’s 2025 revenue outlook is encouraging and points to underlying business strength; however, this does not materially allay the key short-term risk that organic growth in existing verticals could slow if these end-markets approach saturation.

Among recent company announcements, the decision to increase total revenue growth guidance from 12% to 13% stands out as most relevant. This higher target reflects management’s confidence in maintaining operational momentum, which may reinforce current investor expectations tied to Roper’s organic and acquisition-driven expansion pipeline.

Yet, despite raised guidance, investors should not overlook the continued risk that market saturation in key verticals could …

Read the full narrative on Roper Technologies (it's free!)

Roper Technologies' outlook anticipates $10.0 billion in revenue and $2.1 billion in earnings by 2028. Achieving this requires an annual revenue growth rate of 10.1% and an increase in earnings of $0.6 billion from the current $1.5 billion.

Uncover how Roper Technologies' forecasts yield a $630.04 fair value, a 12% upside to its current price.

Exploring Other Perspectives

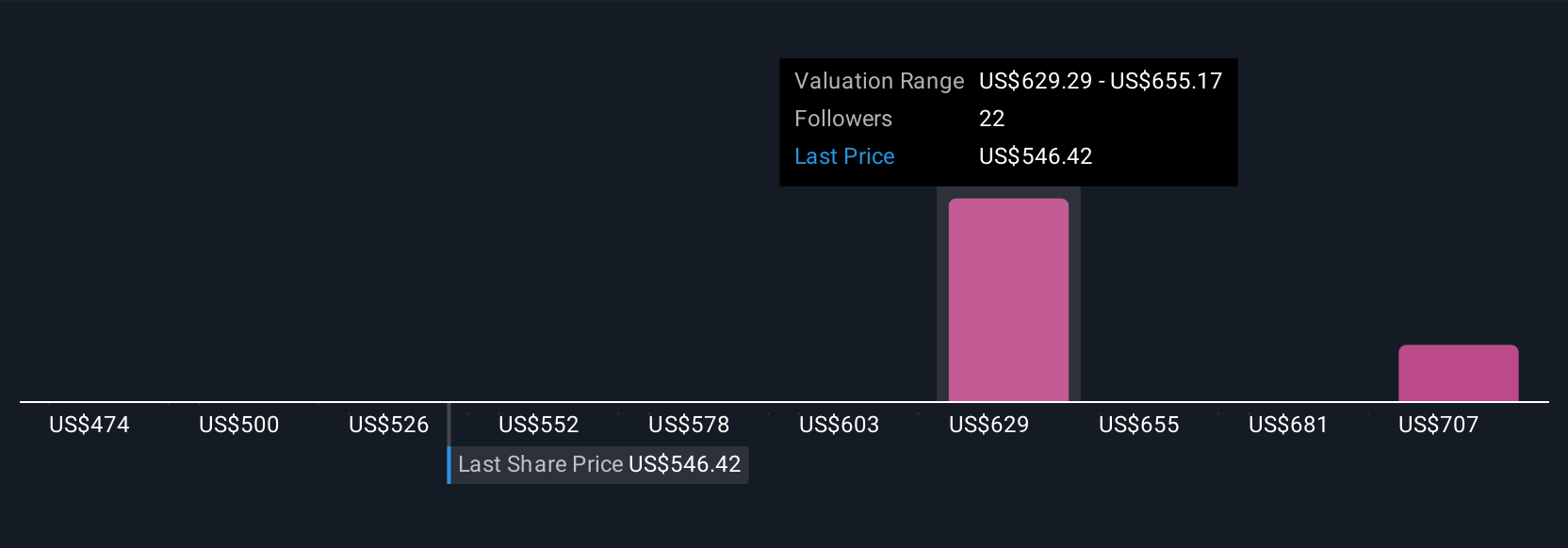

Retail investors in the Simply Wall St Community placed Roper's fair value estimates between US$474 and US$732.57, based on four unique analyses. When considering risks around slowing organic growth in key sectors, these diverging opinions highlight the importance of comparing alternative viewpoints before making any investment decision.

Explore 4 other fair value estimates on Roper Technologies - why the stock might be worth 16% less than the current price!

Build Your Own Roper Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roper Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Roper Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roper Technologies' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROP

Roper Technologies

Designs and develops vertical software and technology enabled products in the United States, Canada, Europe, Asia, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives