- United States

- /

- Software

- /

- NasdaqGS:ROP

Does Roper Technologies Present Opportunity After Acquisition News and 21% Price Slide?

Reviewed by Bailey Pemberton

- Ever wonder if Roper Technologies is actually a bargain or if the market is missing something? You are not alone in wanting to know whether now is a smart entry point.

- Despite some recent turbulence, shares are down 0.6% over both the past week and month, and have fallen 13.7% year-to-date, bringing the one-year decline to 21.3%.

- There has been renewed market speculation around software and industrial technology players after management’s recent acquisition announcements and strong momentum in automation news. Both developments set the stage for potential re-rating in the sector.

- On the valuation front, Roper Technologies scores a solid 6 out of 6 on undervaluation checks, but numbers are just the beginning. We will break down what this means through various valuation lenses and reveal an even more insightful approach at the end of this article.

Find out why Roper Technologies's -21.3% return over the last year is lagging behind its peers.

Approach 1: Roper Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by forecasting its future cash flows and discounting them back to today's value. This approach helps investors gauge what a business is truly worth based on the cash it is expected to generate.

For Roper Technologies, the current Free Cash Flow stands at $2.4 Billion. Analyst forecasts suggest continued growth, projecting Free Cash Flow to reach nearly $3.9 Billion by 2028. While formal analyst estimates typically go out five years, longer-term projections are extrapolated to provide a fuller picture of future potential. Ten-year forecasts estimate Free Cash Flow will surpass $6.4 Billion by 2035, all in US dollars.

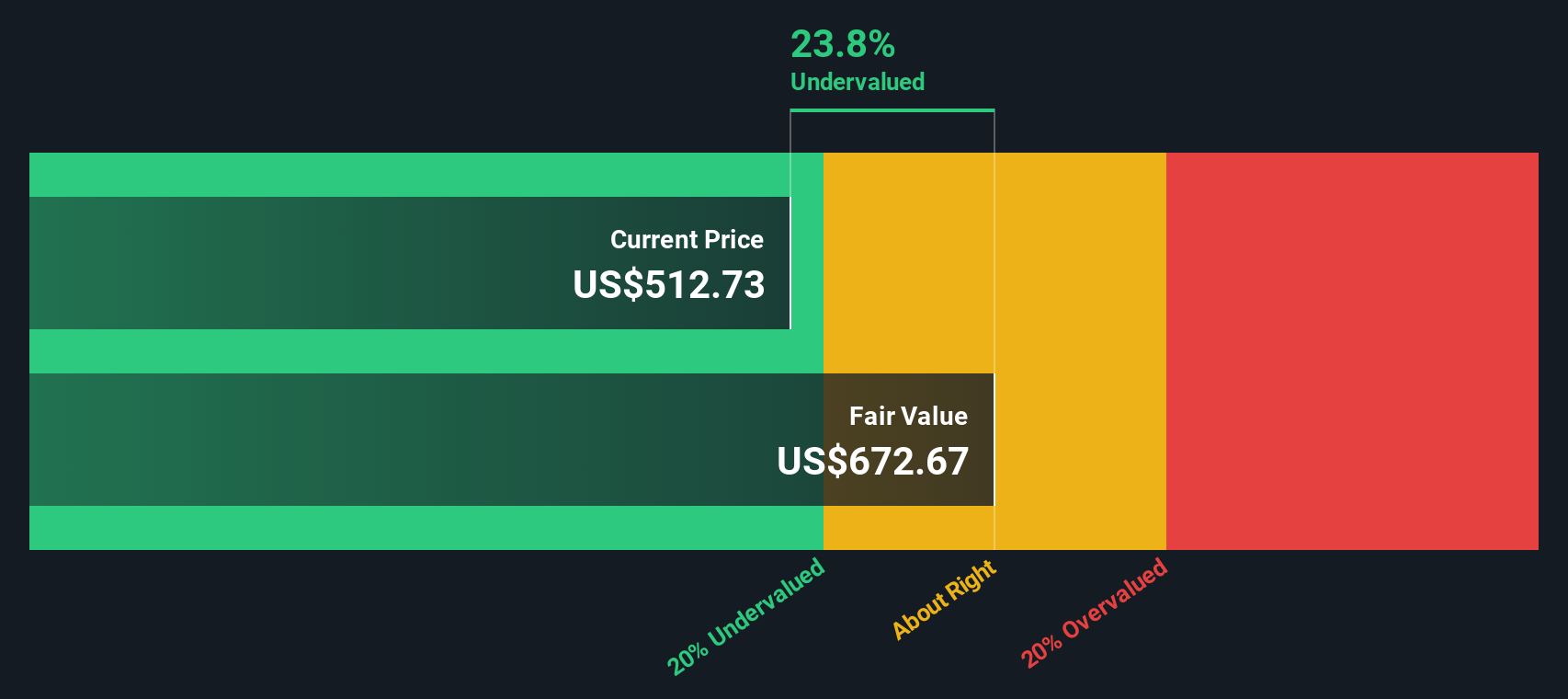

Based on these cash flow projections, the DCF analysis calculates an intrinsic value of $724.95 per share for Roper Technologies. Compared to the current share price, this reveals a 38.8% discount, indicating that the stock is significantly undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Roper Technologies is undervalued by 38.8%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Roper Technologies Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies, providing a quick way to assess how much investors are willing to pay for each dollar of a company's earnings. It is especially relevant for Roper Technologies, given the company’s consistent track record of profitability and positive earnings growth.

Generally, higher growth expectations or lower perceived risk justify a higher PE ratio, as investors anticipate more robust earnings in the future. In contrast, if risks are higher or earnings prospects muted, the "normal" or fair PE should be lower to compensate for uncertainty.

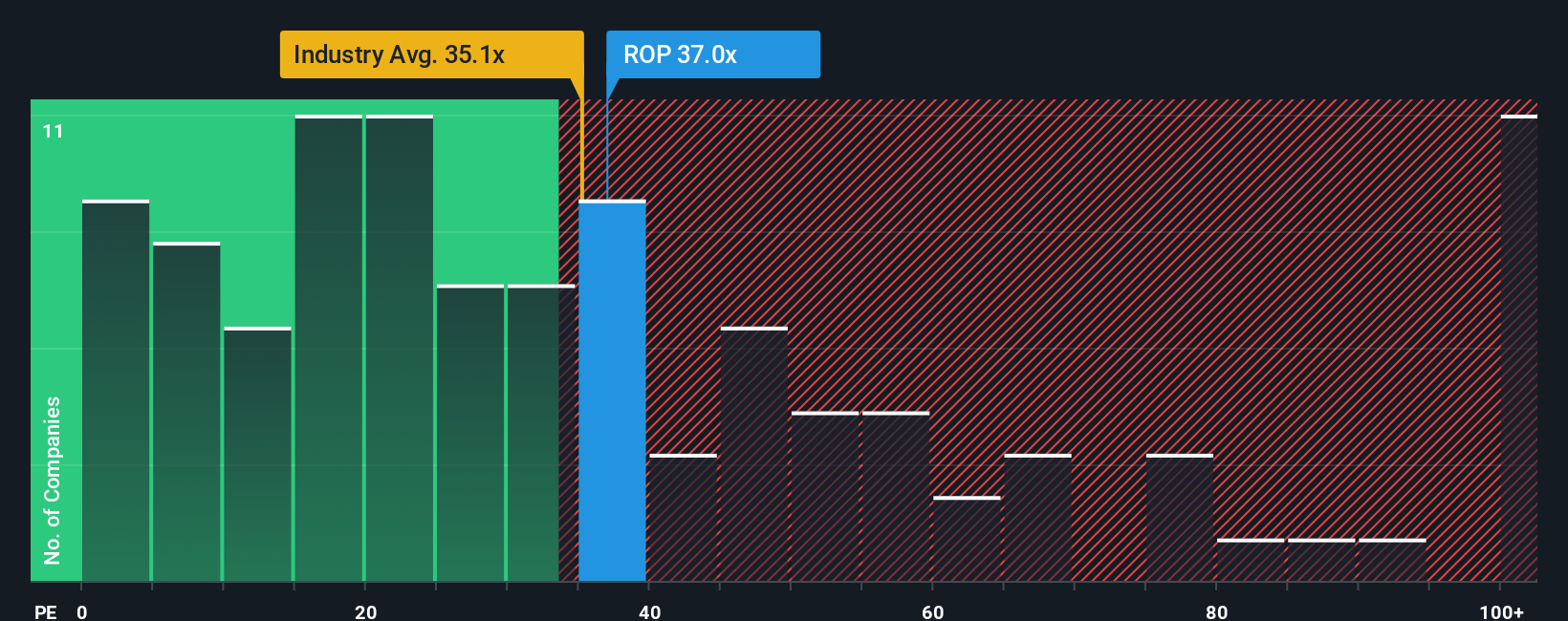

Currently, Roper Technologies trades at a PE ratio of 30.41x. This sits slightly below the Software industry average of 31.95x and is significantly lower than its peer group average of 54.05x. However, raw comparisons can be misleading without considering the company’s unique attributes.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. The Fair Ratio calculates the PE you would expect for Roper Technologies, based on variables like growth outlook, profit margins, industry, risk profile, and company size, rather than just relying on what other companies are trading at. For Roper Technologies, the Fair Ratio is 33.18x, reflecting its earnings quality and growth prospects.

Comparing the actual PE of 30.41x to the Fair Ratio of 33.18x, the stock appears moderately undervalued on this basis. The gap suggests the market is pricing in less growth or higher risk than warranted by the data.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

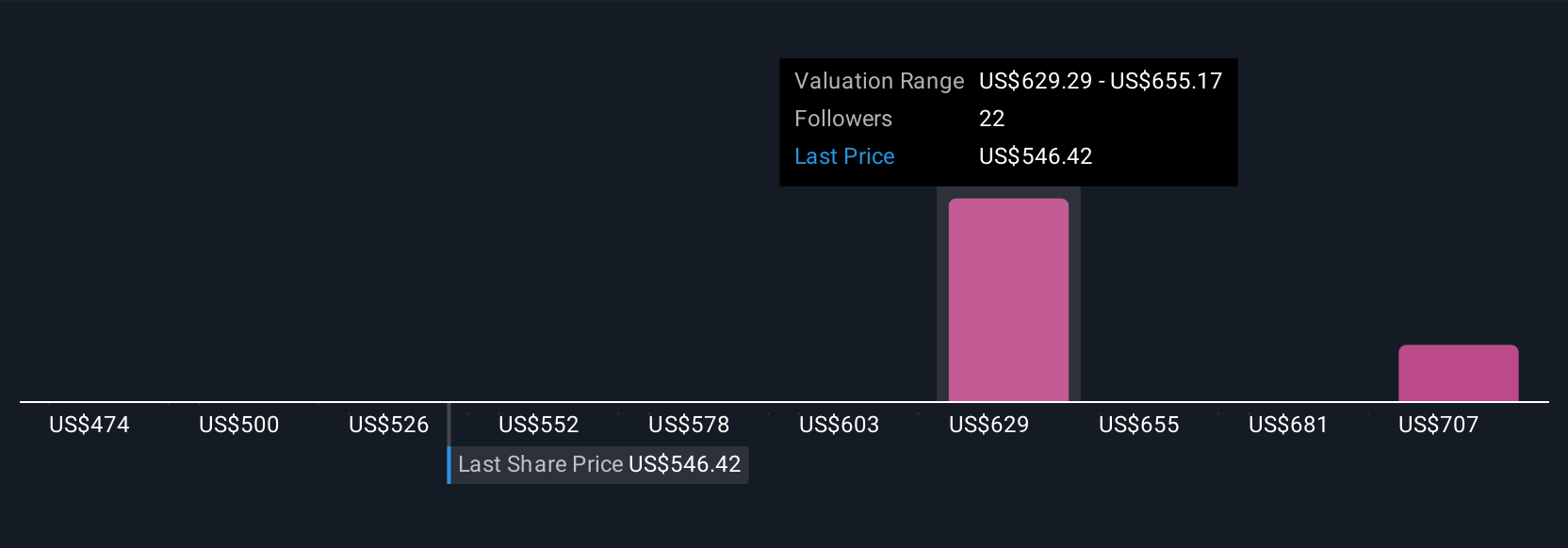

Upgrade Your Decision Making: Choose your Roper Technologies Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your story for a company: an easy, approachable way to combine your perspective on Roper Technologies’ future with the numbers that matter, like revenue growth, profit margins, and what you believe the shares are worth. Narratives connect a company's business story to a financial forecast, which then generates a fair value. This can help you make clear buy or sell decisions by directly comparing your fair value to today’s share price.

These Narratives are available to all investors on Simply Wall St’s Community page, used by millions, and they update dynamically as new earnings or news are released. This helps keep your investment view current without any extra work. For example, one investor’s Narrative, focused on continued AI-driven SaaS margin expansion and stable recurring revenue, might justify a higher fair value. Another investor, more cautious about Roper’s M&A risks and regulatory headwinds, could set a much lower valuation. As the highest analyst price target is $714.0 and the lowest is $460.0, Narratives allow you to see and compare these perspectives instantly, empowering smarter investment decisions tailored to your own view.

Do you think there's more to the story for Roper Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROP

Roper Technologies

Designs and develops vertical software and technology enabled products in the United States, Canada, Europe, Asia, and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Very Bullish

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Very Bullish

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026