- United States

- /

- Software

- /

- NasdaqCM:RIOT

Why We're Not Concerned Yet About Riot Platforms, Inc.'s (NASDAQ:RIOT) 29% Share Price Plunge

Riot Platforms, Inc. (NASDAQ:RIOT) shares have had a horrible month, losing 29% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 64%, which is great even in a bull market.

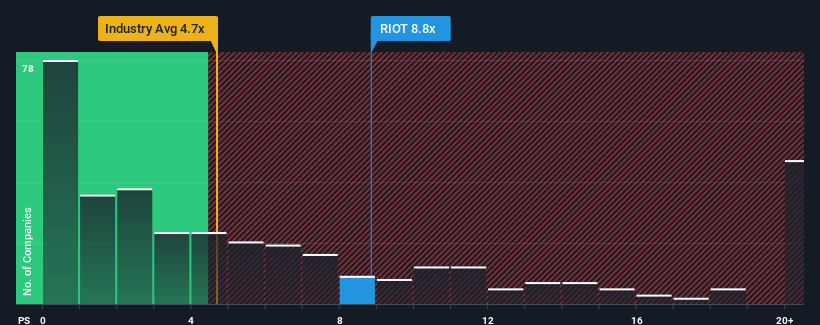

In spite of the heavy fall in price, Riot Platforms may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 8.8x, when you consider almost half of the companies in the Software industry in the United States have P/S ratios under 4.7x and even P/S lower than 1.8x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Riot Platforms

What Does Riot Platforms' Recent Performance Look Like?

Riot Platforms could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Riot Platforms will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Riot Platforms' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.6%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 59% over the next year. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Riot Platforms' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Even after such a strong price drop, Riot Platforms' P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Riot Platforms maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Riot Platforms has 4 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives