- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms (RIOT): Assessing Valuation After Analyst Spotlight on Data Center and HPC Strategy Shift

Reviewed by Simply Wall St

Riot Platforms (RIOT) has been attracting attention after several analysts highlighted its shift from bitcoin mining to a broader data center and high-performance computing strategy. This move has put a spotlight on the company’s expansion in Texas and Kentucky.

See our latest analysis for Riot Platforms.

Riot Platforms’ 2025 has been a rollercoaster, with the share price up 32.7% year-to-date but down more than 35% in the last month alone following a heated period of expansion and leadership updates. Share price moves have been dramatic, and while recent volatility reflects market caution about Riot’s ability to monetize its high-performance computing buildout, the company’s three-year total shareholder return of over 226% shows that longer-term momentum hasn’t disappeared.

If Riot’s pivot toward data centers has you rethinking where big growth might come from next, now is the perfect time to widen your perspective and explore fast growing stocks with high insider ownership

But with shares still trading at a sharp discount to most analyst price targets and the company’s growth pivot in its early stages, is this a rare chance to buy Riot Platforms ahead of new catalysts? Or is the market already anticipating future gains?

Most Popular Narrative: 49% Undervalued

With a fair value set at $27.33 and the last close at $13.88, the most widely followed narrative sees plenty of upside left for Riot Platforms. The current price reflects skepticism, but the narrative outlines a pathway for much higher future earnings as the company expands beyond its roots.

The company's expansion of vertically integrated mining operations, with ongoing deployment of new, more efficient hardware and a continued focus on operational efficiency, supports increased hash rate and lower unit costs. This enhances Bitcoin production and potential gross profit even as mining difficulty rises.

Want to uncover what’s fueling this valuation? One growth lever stands out: Riot's path to bigger profit margins and adoption levels usually reserved for industry disruptors. The narrative’s secret sauce lies in ambitious projections for both revenue and profit. Dive in to see the figures other investors are betting on.

Result: Fair Value of $27.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks from Riot’s rapid pivot and volatile Bitcoin prices could quickly undermine even the most optimistic outlook for growth.

Find out about the key risks to this Riot Platforms narrative.

Another View: Are Shares Actually Expensive?

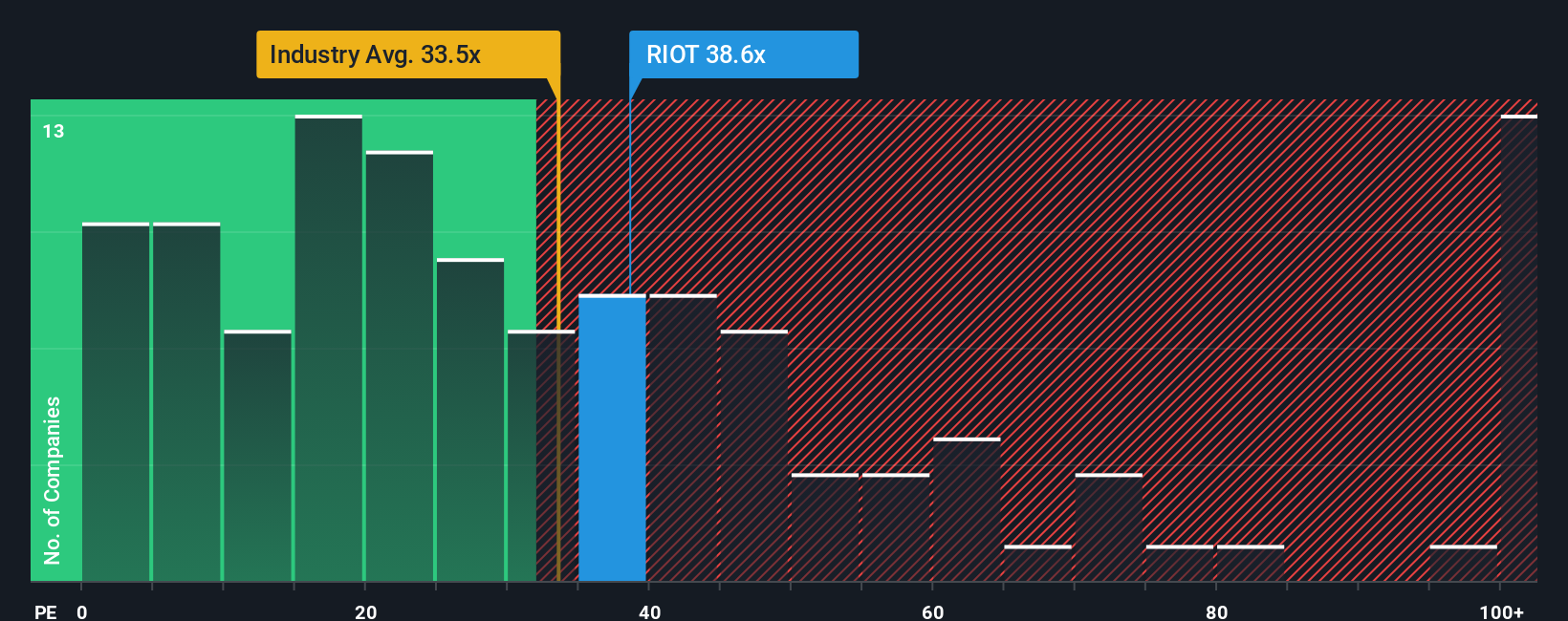

While the fair value narrative suggests Riot Platforms is deeply undervalued, a different lens tells a more cautious story. The company’s price-to-earnings ratio stands at 31.5x, which is not only above the US Software industry’s 30.4x but also significantly higher than its peer average of 21.1x. The fair ratio for Riot sits at just 6.6x, indicating that investors may be paying a substantial premium in anticipation of Riot delivering on its ambitious growth story. Could this gap mean investors are getting ahead of fundamentals, or is there truly more upside to come?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Riot Platforms Narrative

If the current narratives don’t match your outlook or you prefer to dig into the numbers independently, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Riot Platforms research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means always keeping your options open, so don’t let today’s opportunities pass you by. The market never waits. Expand your watchlist with some high-potential picks.

- Capture future gains by checking out these 920 undervalued stocks based on cash flows, which is packed with solid businesses priced below their true worth.

- Tap into the next wave of innovation through these 26 AI penny stocks, featuring companies that are leveraging artificial intelligence to transform entire industries.

- Power up your passive income by targeting these 14 dividend stocks with yields > 3%, which offers robust yields above 3% and strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success