- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms (NasdaqCM:RIOT) Drops 22% As Bitcoin Production Decreases

Reviewed by Simply Wall St

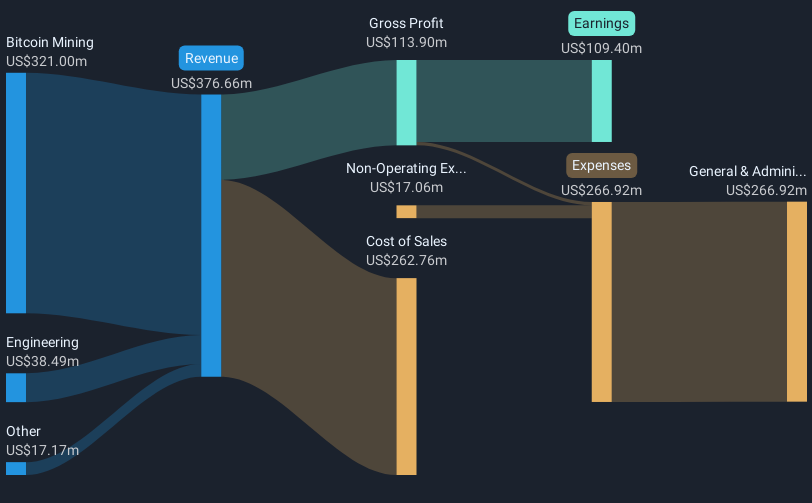

Riot Platforms (NasdaqCM:RIOT) experienced a 21.92% decline in its share price over the past month, during a period marked by several key developments. The company's announcement of a significant decrease in Bitcoin production, from 6,626 BTC in 2023 to 4,828 BTC in 2024, may have influenced investor sentiment. Additionally, Riot Platforms added three new members to its Board of Directors, reflecting a strategic shift towards enhancing expertise in data centers and asset management. Amid these internal changes, the broader market also presented challenges, with major indexes showing mixed performance and the tech-heavy Nasdaq Composite declining. This environment of market volatility, influenced by economic conditions such as the potential impact of tariffs announced by the Trump administration, likely contributed to investor caution. While Riot Platforms saw a slight month-to-month increase in Bitcoin production, it was not sufficient to offset concerns about its overall performance, leading to the decline in shareholder returns.

Dig deeper into the specifics of Riot Platforms here with our thorough analysis report.

Over the past five years, Riot Platforms has delivered a very large total return of 667.38%, reflecting a period of transformative change for the company. As Riot moved towards greater operational scale, significant infrastructure investments were made, such as energizing a new substation at the Corsicana Facility in April 2024, which aimed to boost self-mining capacity. Additionally, Riot's market participation expanded as the company was added to several Russell indices in June 2023, enhancing its market visibility.

Despite these long-term gains, Riot's recent performance has faced headwinds. The production drop from 6,626 Bitcoin in 2023 to 4,828 in 2024 highlighted operational challenges. Meanwhile, the December 2024 announcement of a US$525 million fixed-income offering, targeted for Bitcoin acquisition, indicated continued aggressive capital strategies. In the past year, Riot underperformed the US Market, which returned 16.9%, potentially reflecting investor concerns during this period of adjustment and strategizing.

- Unlock the insights behind Riot Platforms' valuation and discover its true investment potential

- Uncover the uncertainties that could impact Riot Platforms' future growth—read our risk evaluation here.

- Already own Riot Platforms? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Low with limited growth.

Similar Companies

Market Insights

Community Narratives