- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms, Inc. (NASDAQ:RIOT) Looks Just Right With A 49% Price Jump

Riot Platforms, Inc. (NASDAQ:RIOT) shareholders have had their patience rewarded with a 49% share price jump in the last month. This latest share price bounce rounds out a remarkable 309% gain over the last twelve months.

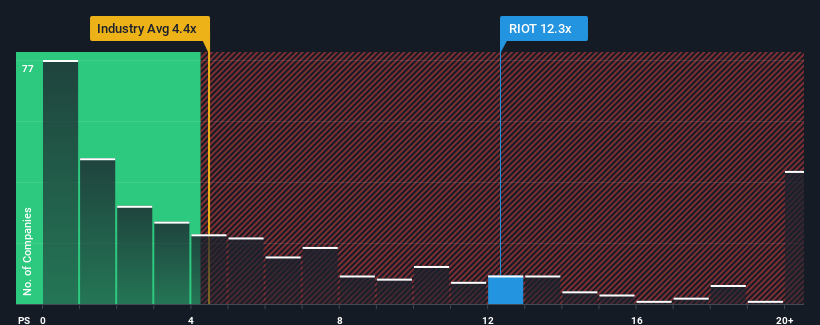

Since its price has surged higher, Riot Platforms may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 12.3x, when you consider almost half of the companies in the Software industry in the United States have P/S ratios under 4.4x and even P/S lower than 1.8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Riot Platforms

How Has Riot Platforms Performed Recently?

Riot Platforms hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Riot Platforms.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Riot Platforms' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 9.6% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Turning to the outlook, the next year should generate growth of 62% as estimated by the eleven analysts watching the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Riot Platforms' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Riot Platforms' P/S Mean For Investors?

Shares in Riot Platforms have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Riot Platforms' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You always need to take note of risks, for example - Riot Platforms has 4 warning signs we think you should be aware of.

If you're unsure about the strength of Riot Platforms' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Slight with limited growth.

Similar Companies

Market Insights

Community Narratives