- United States

- /

- Software

- /

- NasdaqGS:RDWR

Radware (RDWR): Evaluating an Expensive Cybersecurity Stock After Its Recent Quiet Share Price Climb

Reviewed by Simply Wall St

Radware (RDWR) shares have been quietly grinding higher recently, leaving investors wondering what is driving the move and whether the current price still offers a reasonable entry point.

See our latest analysis for Radware.

That steady climb to a share price of $23.87 sits against a mixed backdrop, with a 30 day share price return of 6.37 percent but a 90 day decline of 13.01 percent, while the 3 year total shareholder return of 23.10 percent suggests long term momentum is still quietly building.

If Radware has you rethinking your tech exposure, this could be a handy moment to explore high growth tech and AI stocks for other potential opportunities riding similar structural trends.

With revenues still growing, a modest profit base, and the share price sitting well below analyst targets, is Radware an underappreciated cybersecurity compounder, or is the market already baking in the next leg of its growth story?

Price-to-Earnings of 62.2x: Is it justified?

Radware's last close at $23.87 implies a rich price-to-earnings multiple of 62.2x, placing the stock firmly in expensive territory versus peers.

The price-to-earnings ratio compares what investors are paying today with the company’s current earnings. It is a useful lens for a newly profitable software name where bottom line momentum and scalability matter. At over 60 times earnings, the market is effectively front loading expectations for sustained profit expansion rather than paying for what Radware currently earns.

That optimism stands in contrast to Radware's earnings track record, with profits having declined by around 20 percent annually over the past five years and only recently swinging back into the black. Against that backdrop, a 62.2x multiple signals that investors are willing to overlook patchy historic profitability and instead price in a cleaner, more durable earnings profile ahead.

The premium looks even starker in a sector context, with Radware valued at 62.2x earnings compared to 24.8x for its direct peers and 31.5x for the broader US software industry. This level suggests the market is assigning the company a leadership style valuation, not a turnaround discount.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 62.2x (OVERVALUED)

However, elevated expectations leave little room for error. Any slowdown in revenue growth or margin expansion is likely to pressure this premium valuation.

Find out about the key risks to this Radware narrative.

Another View Using Our DCF Model

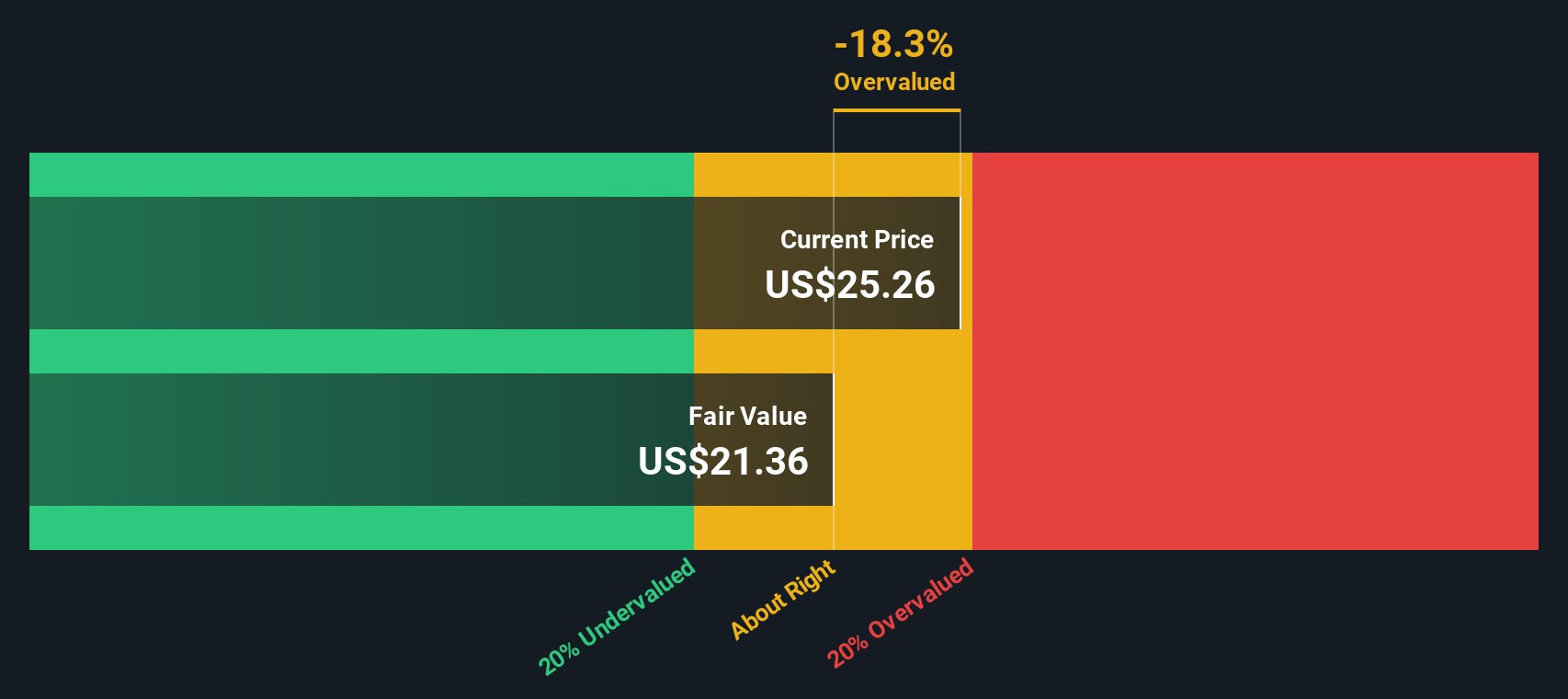

Our DCF model paints a cooler picture, with an estimated fair value of about $17.10 per share, meaning Radware looks overvalued at current levels. If cash flows matter more than near term momentum, today’s price could already be borrowing from tomorrow’s returns.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Radware for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Radware Narrative

If this perspective does not fully align with your own work, or you would rather interrogate the numbers directly, you can build a tailored view in just a few minutes: Do it your way.

A great starting point for your Radware research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by running a few quick screens on Simply Wall St so you never miss where the smart money moves next.

- Capture potential upside by scanning these 916 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Target future growth engines by reviewing these 24 AI penny stocks positioned at the forefront of transformative technology shifts.

- Support your income strategy by filtering for these 13 dividend stocks with yields > 3% that can contribute to long term portfolio returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RDWR

Radware

Develops, manufactures, and markets cyber security and application delivery solutions for cloud, on-premises, and software defined data canters.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion