- United States

- /

- Software

- /

- NasdaqCM:RDVT

Red Violet, Inc.'s (NASDAQ:RDVT) Business Is Trailing The Industry But Its Shares Aren't

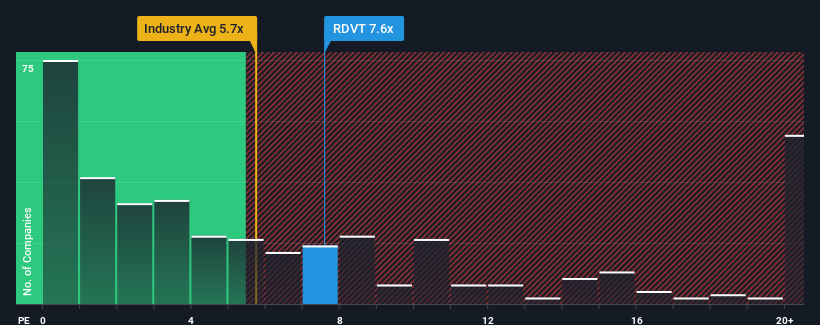

You may think that with a price-to-sales (or "P/S") ratio of 7.6x Red Violet, Inc. (NASDAQ:RDVT) is a stock to potentially avoid, seeing as almost half of all the Software companies in the United States have P/S ratios under 5.7x and even P/S lower than 2x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Red Violet

How Has Red Violet Performed Recently?

With revenue growth that's superior to most other companies of late, Red Violet has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Red Violet's future stacks up against the industry? In that case, our free report is a great place to start.How Is Red Violet's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Red Violet's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. Pleasingly, revenue has also lifted 69% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 18%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Red Violet's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Red Violet trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Red Violet that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RDVT

Red Violet

An analytics and information solutions company, specializes in proprietary technologies and applying analytical capabilities to deliver identity intelligence in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives