- United States

- /

- Software

- /

- NasdaqGS:QLYS

The total return for Qualys (NASDAQ:QLYS) investors has risen faster than earnings growth over the last five years

If you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see the share price rise faster than the market. Unfortunately for shareholders, while the Qualys, Inc. (NASDAQ:QLYS) share price is up 25% in the last five years, that's less than the market return. The last year has been disappointing, with the stock price down 4.6% in that time.

Although Qualys has shed US$525m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

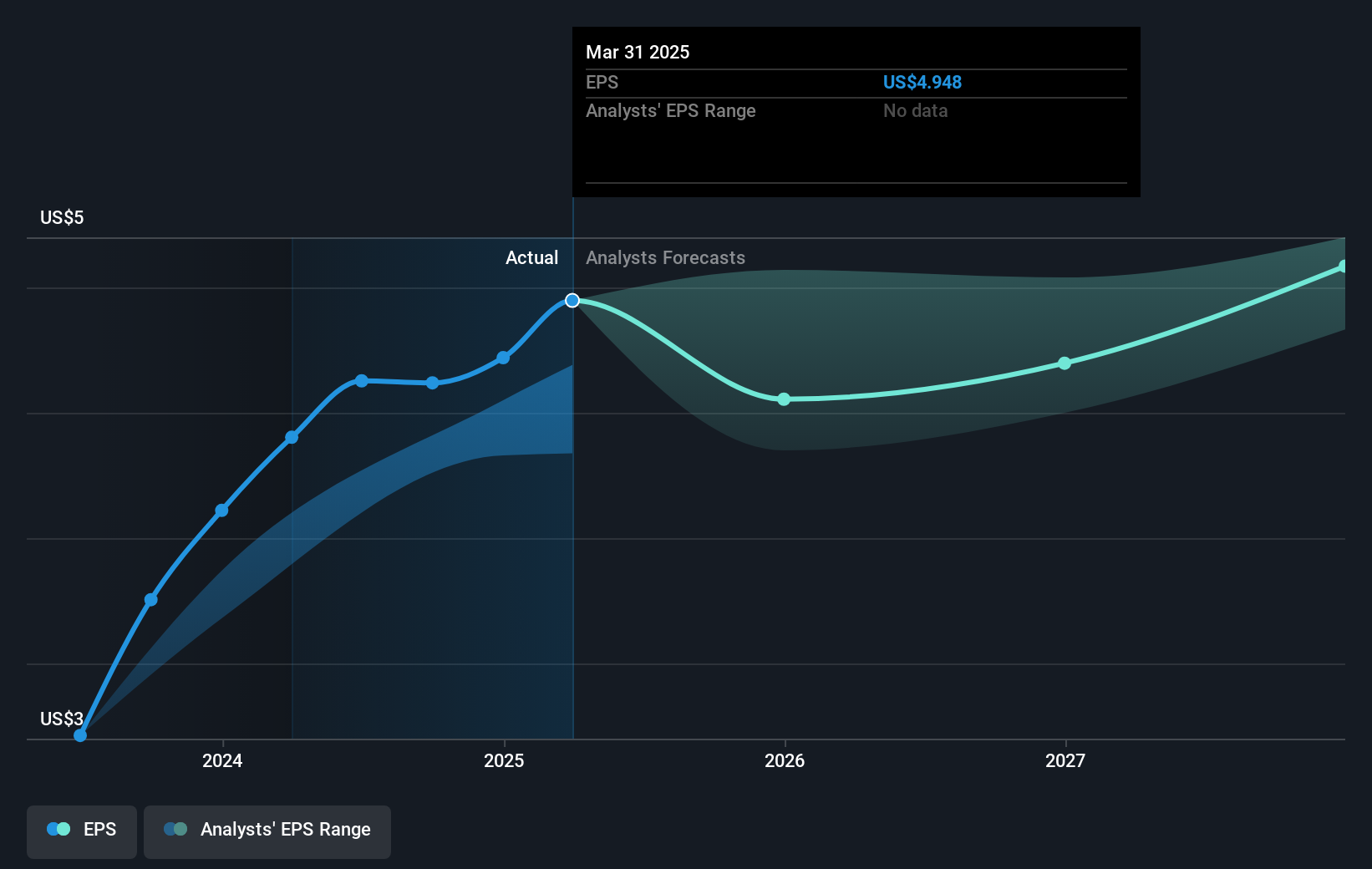

During five years of share price growth, Qualys achieved compound earnings per share (EPS) growth of 21% per year. The EPS growth is more impressive than the yearly share price gain of 5% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Qualys has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Qualys will grow revenue in the future.

A Different Perspective

Qualys shareholders are down 4.6% for the year, but the market itself is up 13%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 5%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before spending more time on Qualys it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Qualys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:QLYS

Qualys

Provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026