- United States

- /

- Software

- /

- NasdaqGS:QLYS

Does the Recent Share Slide Make Qualys a Bargain in 2025?

Reviewed by Bailey Pemberton

If you are eyeing Qualys stock right now and wondering whether it deserves a place in your portfolio, you are not alone. This cybersecurity firm has been on a bit of a rollercoaster, with the share price dipping 4.1% in the last week and sliding 2.9% over the past month. Year-to-date performance sits at -5.7%, but zoom out to a five-year view and the story shifts, revealing a much more robust 31.2% rise. Short-term chop like the recent slide is nothing new, often reflecting shifts in risk appetite or broader market churn around tech stocks. Meanwhile, steady long-term gains suggest underlying business strength, but the real question is, at this price, is Qualys undervalued?

That is where our valuation checks come in. For Qualys, we run six fundamental valuation tests and the stock gets a value score of 4, indicating it is undervalued in four out of six measures. This is a strong sign that there could be more to the story than the recent stumbles on the price chart might imply.

Let us break down how each valuation approach can help you judge whether Qualys is offering value today, but stick around until the end for an even more insightful way to look at what this company might be worth.

Why Qualys is lagging behind its peers

Approach 1: Qualys Discounted Cash Flow (DCF) Analysis

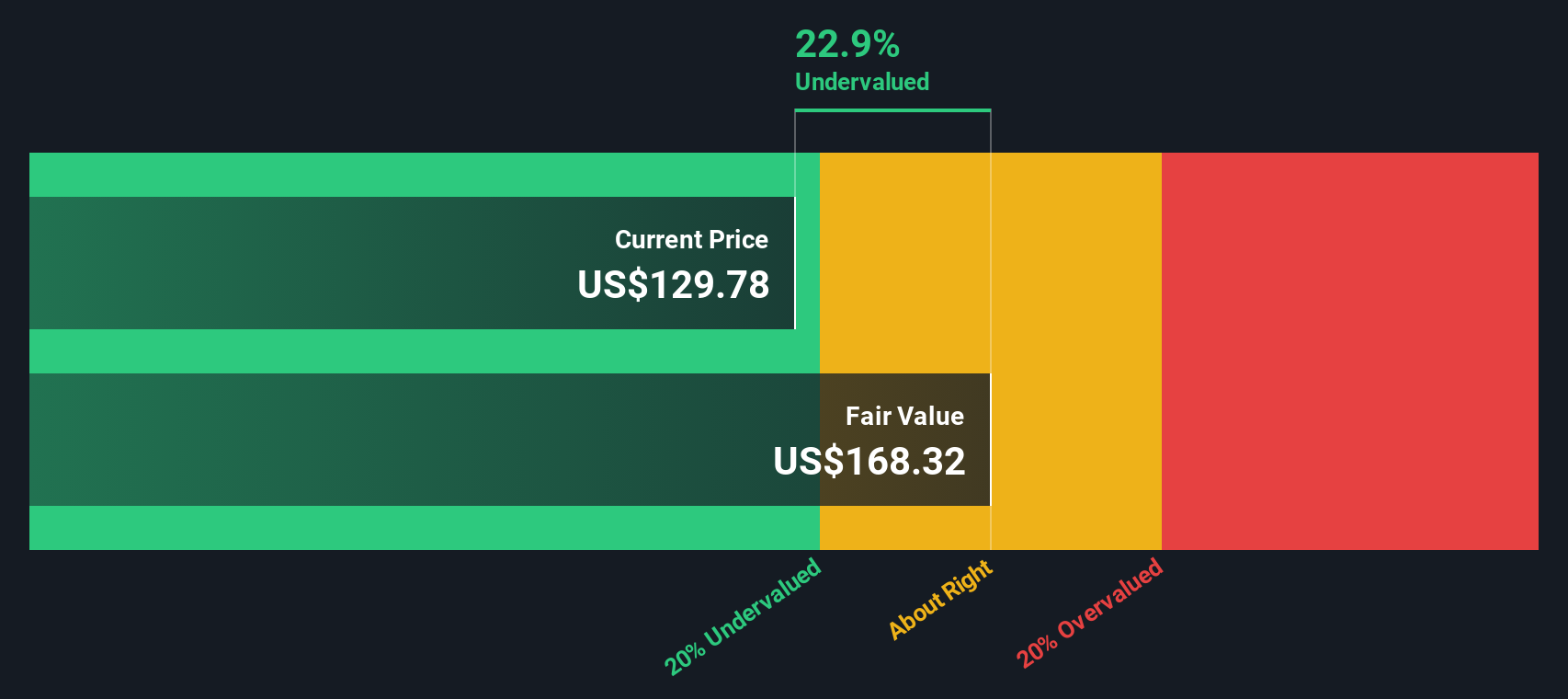

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For Qualys, this method relies on current and forecasted Free Cash Flow as a key input.

Qualys generated $241.63 million in Free Cash Flow over the last twelve months. Analyst forecasts suggest this will grow steadily, with projections reaching around $334.85 million by 2029. While direct analyst estimates are provided for the next five years, future growth beyond that is extrapolated by Simply Wall St, reflecting ongoing expansion but at a moderating pace. All figures are reported in US Dollars.

By compiling these forecasts, the DCF model arrives at an intrinsic value of $168.18 per share for Qualys. At current market prices, this represents a 22.1% discount, which suggests Qualys stock is undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Qualys is undervalued by 22.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Qualys Price vs Earnings

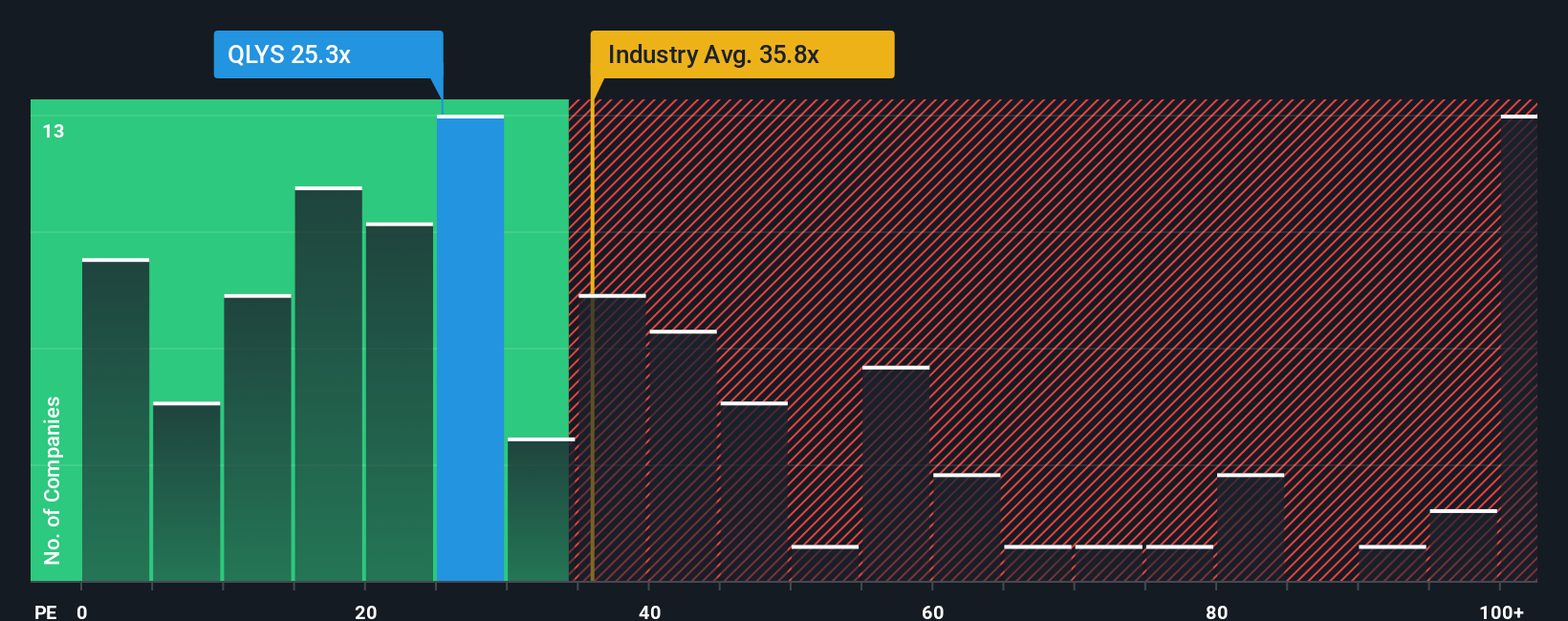

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Qualys because it connects what investors are willing to pay today with how much the company is actually earning. When a business is generating consistent profits, the PE ratio becomes a go-to tool for understanding both market sentiment and the company’s future prospects.

A "normal" or "fair" PE ratio is shaped by expectations about future growth and the risks specific to the business or sector. Fast-growing or lower-risk companies often command higher PE ratios. Slower-growing or riskier businesses tend to trade at lower multiples.

Currently, Qualys trades at a PE ratio of 25x. For context, the average PE across the software industry is higher at 35.7x, and Qualys’ direct peers trade at an even loftier 47x. At first glance, this could make Qualys seem like a bargain. But looking at averages alone can be misleading, as they do not factor in each company’s unique earnings growth, margins, or risk profile.

This is where the Simply Wall St "Fair Ratio" comes in. This proprietary benchmark predicts what Qualys’ PE ratio should be, taking into account its growth trajectory, risk factors, profit margins, market cap and industry positioning. It is a much more tailored benchmark than simply comparing to the industry or peer group.

For Qualys, the Fair Ratio sits at 24.6x, nearly identical to its current PE of 25x. This suggests that, by this measure, the stock is trading right in line with the level justified by its financials and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Qualys Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story about a company’s future, mapping your personal view on its growth, profitability, and industry position into estimates. This turns what you believe about Qualys into clear numbers like revenue, earnings, and what you think is a fair value.

This Narrative framework connects how you see the company’s future to a set of forecasts and finally to your own idea of what Qualys is worth, making it simple for anyone to move from opinion to actionable insights. Available to millions of investors on Simply Wall St’s Community page, Narratives let you easily check whether your fair value is above or below today’s price, helping you decide when to consider buying or selling based on your own convictions.

Best of all, Narratives update dynamically as new events, earnings, or news change the outlook. This means your valuations and investment decisions stay relevant and up to date. For example, the most optimistic Narrative for Qualys puts fair value at $160 per share, while the most cautious sees it as low as $97, reflecting different investor outlooks about the company’s growth and risks.

Do you think there's more to the story for Qualys? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Qualys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QLYS

Qualys

Provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion