- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

Why The Value of PayPal (NASDAQ:PYPL) Depends on Growth and Dealing With Competitors

Key takeaways:

- Profitability is expected to slump in 2023, and then slowly recover.

- Investors that view significant growth in the company may find it to be undervalued, but must wait for the company to perform.

- Competitors are pressing on the market share of PayPal, but the company is profitable - giving it more resilience than smaller companies in financial downturns.

Investors in PayPal Holdings, Inc. (NASDAQ:PYPL) have lost 67% in the last 12 months, and the stocks seems to have stabilized around $90 per share. Today, we will re-evaluate PayPal on a fundamental basis, and see if the stock is fairly priced.

The Business

PayPal is a digital payments' processor for consumers and merchants. People can pay and receive money using PayPal, and the company strives to expand the reach of customers using the platform. Their business model consists of taking a % from each transaction.

Check out our latest analysis for PayPal Holdings

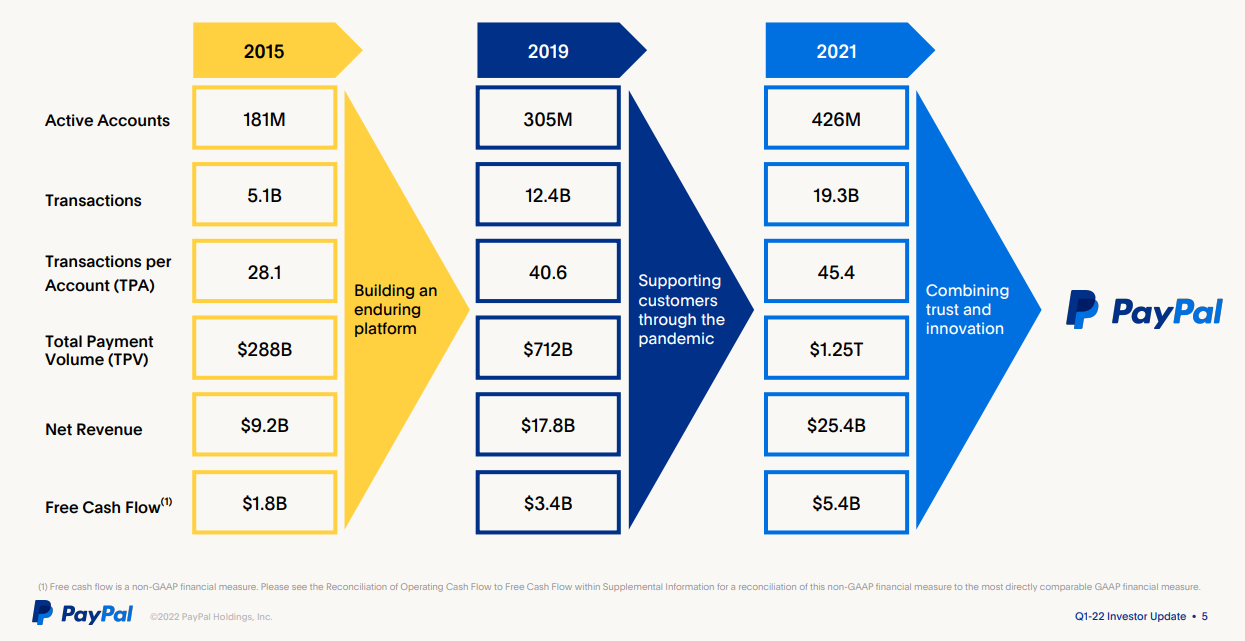

The company currently has 430 million active accounts, and in Q1 has processed $323b in total payments. The deck below shows how PayPal has progressed with their KPIs over the past few years:

We can see that the company experienced substantial growth in active accounts, total payments processes, and consequently grew both revenues and free cash flows. This is part of the reason why many investors were bullish on the company in the last few years.

One of the key questions for PayPal now, is how much more can the company grow and expand in market share?

While it is easy to extrapolate growth, some investors may consider that the company is nearing maturity and expect a sustainable growth rate, in-line with the growth of the online payment processing industry - which is expected to grow at a 14.5% CAGR up to 2027.

Fundamentals

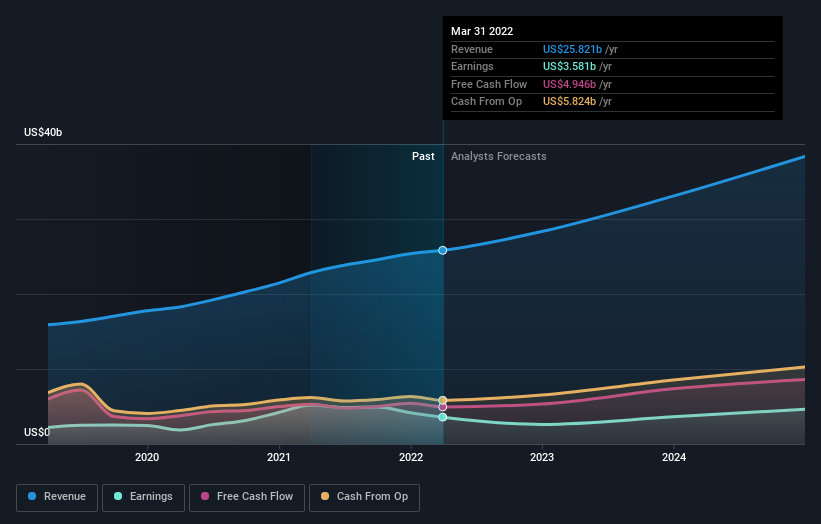

PayPal has $25.8b revenue in the last 12 months, up 12.7% from $22.9b a year ago. The company is profitable and making $3.58b in net income and $4.95b in free cash flows.

The difference between free cash flows and net income can be partly found in adding back unrealized losses to investments, depreciation and stock based compensation. While depreciation is not a cash expense, investors may want to be cautious when the company has significant (unrealized) loses from investments and is largely using stock based compensation to finance employees.

The company has a net margin of 13.9%, which gained a bump during 2021, but is now slowly reverting to historical averages.

Next we need to analyze growth, and for that we can use the predictions made from Paypal's 48 analysts:

Looking at the average predictions, we see that analysts expect revenues of $28.3b in 2022. This implies a 9.7% growth compared to the last 12 months. Unfortunately, the bottom line does not look as good. Net income is expected to decrease by 27% to $2.6b, yielding a $2.25 EPS.

Value Implications

There are a few approaches we can take to estimate the fair value of the stock.

One is to look at the price target from analysts. The average price target for PayPal is $121, suggesting that there is some upside for the company. Additionally, we can look at the spread of price targets, and see that the most bullish point is $220 per share, while the most bearish is at US$82.

Next, we can use an intrinsic DCF valuation model. Our approach follows analysts' expectations for future cash flows and makes some assumptions for risk. With this approach, we get an intrinsic value for PayPal at $161 - implying that the stock is some 46% undervalued. The key characteristic of this model, is that analysts assume that PayPal is a growing company and will continue bottom line expansion in the next 4 years. You can view the details of the model in our company report.

Finally, we can see how well is the company priced based on current performance. We see that PayPal has a trailing 12-month PE ratio of 28x, roughly in line with the industry. While this also implies some growth ahead, it also shows us that investors are not willing to price the stock as an overperformer vs others in the industry. This can be due to the fact that there are now many competitors in the payment processing segment, and it is hard to predict which companies will emerge as market leaders in the future.

The Bottom Line

One of the key issues for PayPal, is its future growth. Investors that believe that there is more high growth for the company ahead will be inclined to view the stock as undervalued. However, even these investors will have to wait after the projected 2023 earnings slump for the value to materialize.

Investors that are bearish may be more inclined to view PayPal as a maturing company, which will grow at a lower, sustainable rate. This poses an additional risk, as the company must remain on the cutting edge in order to compete against all the new FinTech companies in the payment processing space, which will likely grow their market share.

The plus side for PayPal is that it is profitable with a net margin of 14%. This gives it an advantage ahead of the competition, as newer companies will find it hard to become truly profitable, while the company has some margin of safety should it find itself in harder times.

You should always think about risks though. Case in point, we've spotted 2 warning signs for PayPal Holdings you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives