- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

Insiders are Buying PayPal (NASDAQ:PYPL) After the Decline - Fundamentals May Reveal Why

With its stock down 41% over the past three months, it is easy to disregard PayPal Holdings (NASDAQ:PYPL). But recent developments indicate that insiders have started buying up company stock, which is something they do if they feel that the company is undervalued. We are going to look at insider activity and the possible fundamentals underlying this behavior.

See our latest analysis for PayPal Holdings

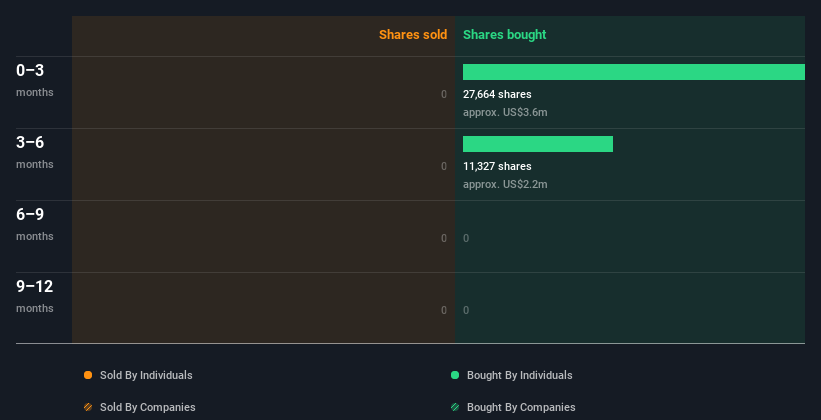

The Last 12 Months Of Insider Transactions At PayPal Holdings

The good news is, that in the last 12 months, insiders were buying or holding shares. While the recent drop might have surprised them, their buying activities indicate confidence in the stock.

Take a look at the most recent insider transactions HERE.

The Independent Chairman of the Board John Donahoe made the biggest insider purchase in the last 12 months. That single transaction was for US$2.0m worth of shares at a price of US$204 each . This could mean that an insider wanted to buy, even at a higher price than the current share price (being US$111), or simply that he expected a reversal around this price point.

In the last 12 months, the average price insiders paid for PayPal was about US$148 per share. This is nice to see since it implies that insiders might see value around current prices. Additionally, the insider activity is more frequent in the last quarter, around the drop, with the latest transaction happening on Feb 18th 2022, by Frank Yeary, who bought US$467k worth of stock at US$103 per share.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below.If you want to know exactly who sold, for how much, and when, simply click on the graph below!

While insider transactions give us a behavioral pattern for a stock, it is good to see if this matches the fundamentals of PayPal Holdings.

Looking at the company, here are the key fundamentals that stand out:

The return on equity (ROE) is 19.2% and higher than the cost of equity at 6.29%. This is important because the company creates excess value for equity investors of around 13%! Which means, that growth is more impactful on the value of the stock. Conversely, a decline in earnings is also amplified.

This ties-in with the forecasted revenue and earnings growth of 15.5% and 13.7% respectively. Both of these metrics are forecasted to grow faster than market metrics. You can get a detailed growth analysis here . Established stocks like PayPal tend to follow earnings movements and adjust accordingly, that is why bottom line growth may give a good perspective on the future of the price.

PayPal has also a very hefty profit margin of 16.4% in the last 12 months, which resulted in US$4.2b net profit over the period. Compared with the price, investors are paying some 31x per share for that profit (P/E = 31) . When we put things into perspective it shows that even with the latest decline, the stock might not be actually undervalued, since it is trading around industry average levels of 29.7x P/E.

Conclusion

The pairing of our fundamental analysis with insider transactions revealed, that insider optimism is present and likely betting on the future value of the company, rather than the current price.

It seems that the market is appropriately pricing PayPal on a P/E basis, but the return and growth metrics indicate that the company is creating value adding growth. This comes from the fact that PayPal is delivering a higher return than the cost of equity.

Keep in mind that we didn't analyze the risk factors for PayPal which may have a significant impact on the long-term future of the company!

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you're looking to trade PayPal Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives