- United States

- /

- Software

- /

- NasdaqGS:PTC

Why PTC (PTC) Is Up 21.4% After Nimble Adopts Cloud Platform and Index Inclusion

Reviewed by Simply Wall St

- PTC recently announced that Nimble will fully replace its legacy design and quality systems with PTC's cloud-native Onshape CAD, PDM, Arena PLM, and QMS platforms, following a rapid 60-day evaluation and decision process.

- This client transition, alongside PTC's inclusion in multiple Russell 1000 indices in late June 2025, highlights increased demand for its cloud solutions and raises its profile among institutional investors.

- We'll explore how Nimble's shift to PTC's cloud-native platforms underscores the company's momentum and strengthens its broader investment story.

PTC Investment Narrative Recap

To be a PTC shareholder, you need conviction in the company’s ability to drive digital transformation as clients like Nimble move toward cloud-native solutions for greater collaboration and system efficiency. While Nimble’s rapid adoption of PTC software highlights growing demand, the most important near-term catalyst remains the adoption speed of cloud and AI-driven platforms across the client base, with the biggest risk still largely tied to macroeconomic uncertainty and customer caution on major digital investments.

Among recent developments, PTC’s addition to major Russell 1000 indices in late June stands out. This increases visibility with institutional investors and may reinforce momentum, aligning with the demand signals behind deals like Nimble’s, but does not lessen the risk of slower decision-making if customers pause spending in a weakening economy.

On the other hand, investors should be mindful that even in periods of strong client wins like this one, the risk of customers delaying longer-term commitments due to macroeconomic pressures could...

Read the full narrative on PTC (it's free!)

PTC's narrative projects $3.1 billion in revenue and $731.1 million in earnings by 2028. This requires 10.3% yearly revenue growth and a $290.7 million increase in earnings from $440.4 million today.

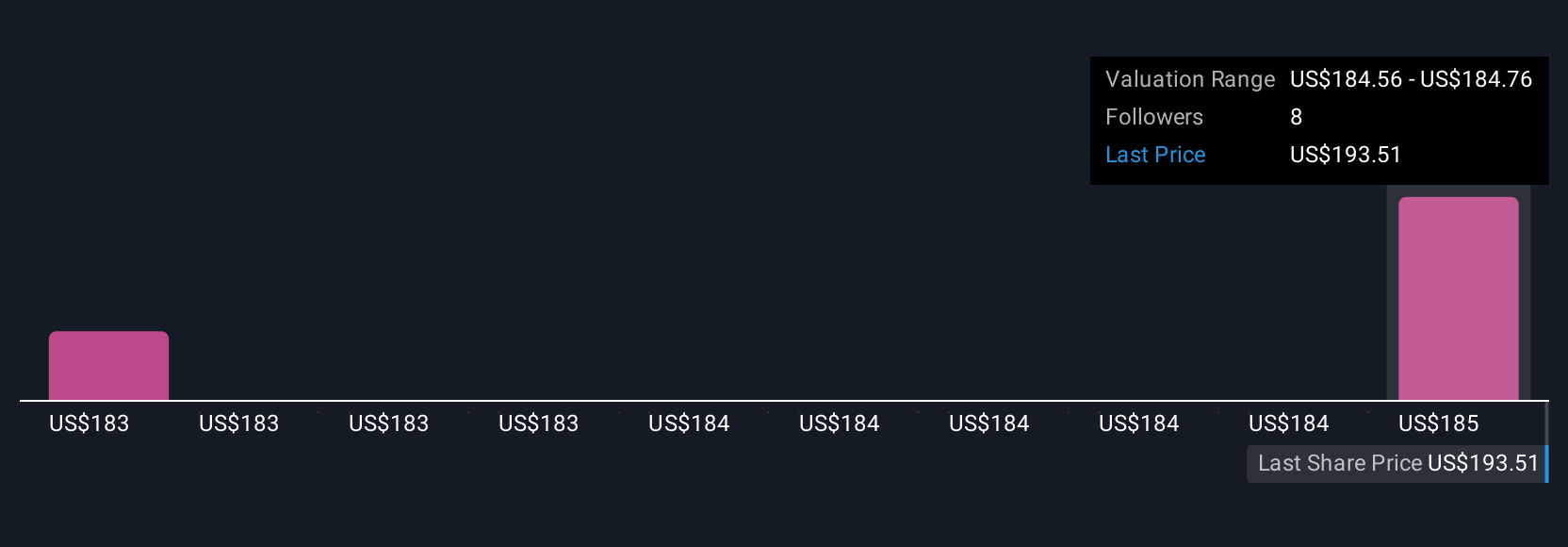

Uncover how PTC's forecasts yield a $184.76 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered just 2 fair value estimates for PTC, ranging narrowly from US$182.79 to US$184.76. Keep in mind, while some expect robust client interest to build tailwinds, the real challenge may come if demand softens and customer contract timing slows, be sure to consider every angle.

Build Your Own PTC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PTC research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free PTC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PTC's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTC

PTC

Operates as software company in the Americas, Europe, and the Asia Pacific.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives