- United States

- /

- Software

- /

- NasdaqGS:PTC

What PTC (PTC)'s Aerospace & Defense Startup Program Launch Means For Shareholders

Reviewed by Simply Wall St

- Earlier this month, PTC announced the launch of its Aerospace & Defense Startup Program, offering eligible startups complimentary access to advanced product development tools such as Creo+, Onshape, Codebeamer+, and Arena cloud-based solutions, alongside enhanced industry mentorship opportunities.

- This move highlights PTC’s commitment to accelerating innovation in aerospace and defense, while the newly announced onboarding of Nimble as a cloud-native client underscores increasing adoption of its platforms for next-generation product design and management.

- We’ll explore how the new Aerospace & Defense Startup Program may influence PTC’s investment narrative by expanding its industry ecosystem.

PTC Investment Narrative Recap

To own PTC stock, an investor needs to believe in the company’s ability to grow its cloud-native platform adoption and deepen its ecosystem, especially as digital transformation persists in regulated industries. While PTC’s new Aerospace & Defense Startup Program showcases innovation and may reinforce its position in this market, it does not materially change the short-term catalysts or mitigate the biggest risk: hesitancy among enterprise customers could still delay large deals and ARR growth if macro pressures persist.

The most relevant recent announcement is Nimble’s decision to fully transition to PTC’s Onshape and Arena cloud platforms, reflecting increasing client trust in PTC’s scalable solutions. This move aligns with the company’s goal of driving higher-quality pipeline velocity, which remains central to immediate revenue growth while the broader customer base weighs digital transformation initiatives.

Yet, even as momentum builds for cloud adoption, increased macroeconomic uncertainty and slow decision-making among key customers remain risks investors should watch out for because...

Read the full narrative on PTC (it's free!)

PTC's narrative projects $3.1 billion in revenue and $731.1 million in earnings by 2028. This requires 10.3% yearly revenue growth and a $290.7 million increase in earnings from the current $440.4 million.

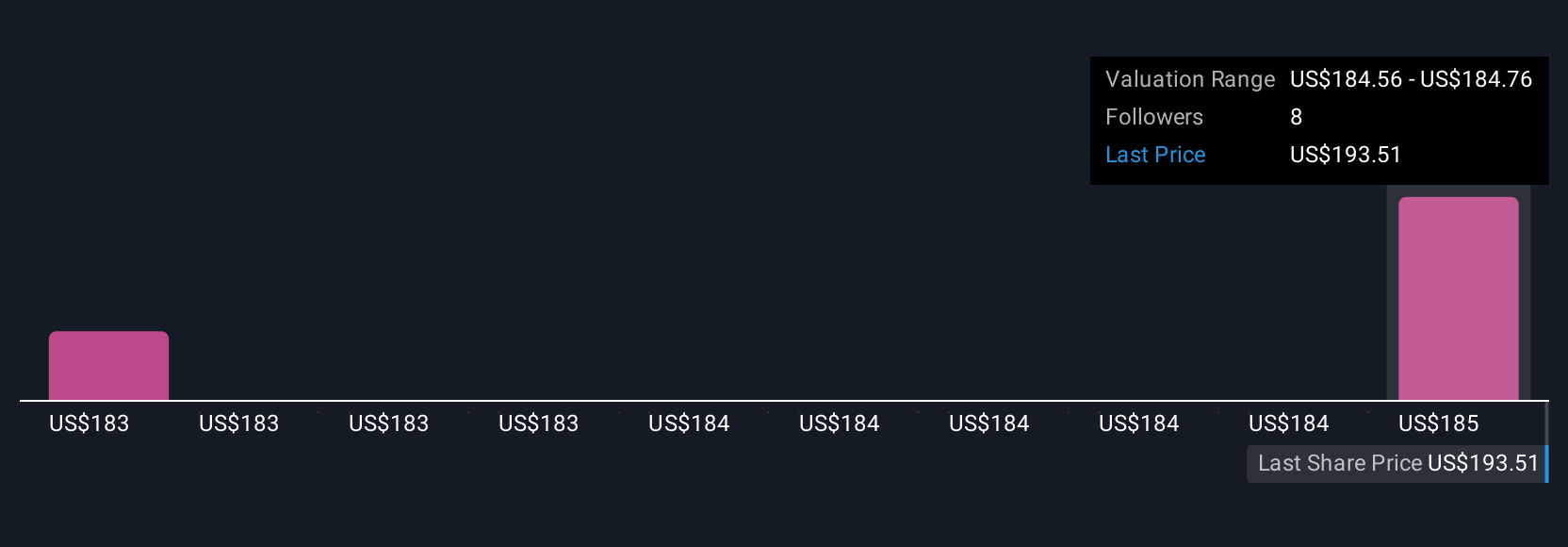

Uncover how PTC's forecasts yield a $184.76 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Community members at Simply Wall St set PTC’s fair value estimates between US$181.96 and US$184.76, with two distinct views represented. While some see upside amid expanding cloud programs, watch for how lingering macroeconomic and client caution might shape future earnings.

Explore 2 other fair value estimates on PTC - why the stock might be worth as much as $184.76!

Build Your Own PTC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PTC research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free PTC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PTC's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTC

PTC

Operates as software company in the Americas, Europe, and the Asia Pacific.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives