- United States

- /

- Software

- /

- NasdaqGS:PTC

PTC (PTC) Valuation in Focus Following Major AI Onshape Upgrade and Strong Earnings Outlook

Reviewed by Simply Wall St

PTC (PTC) just rolled out major AI upgrades for its cloud-native Onshape design platform, now embedding real-time AI support directly within users’ workflows. These enhancements arrive as investors track encouraging earnings momentum as the company heads into November.

See our latest analysis for PTC.

PTC shares are having a steady year, with the latest close at $204.67 and an 11.84% year-to-date share price return. These healthy gains echo upbeat sentiment around its AI-driven product launches and leadership refresh. Its 11.46% one-year total shareholder return is a solid showing, while longer-term holders have seen impressive compounding, with total shareholder returns of over 80% across three years and 138% over five years. This momentum underscores rising confidence in PTC’s platform and vision.

If PTC’s rapid AI adoption has you thinking bigger, it might be the perfect moment to expand your scope and discover See the full list for free.

With shares near all-time highs and analysts still projecting double-digit gains, the big question is whether PTC remains undervalued or if the market has already priced in hopes for accelerated AI-fueled growth ahead.

Most Popular Narrative: 8.9% Undervalued

PTC’s narrative fair value stands at $224.68, a solid premium to its last close of $204.67. This gap has investors weighing whether PTC’s profit margin expansion and recurring revenue model could justify more upside soon.

Ongoing policy uncertainty, SaaS transition challenges, churn risk in ServiceMax, rising competition, and foreign currency exposure threaten revenue stability and margin growth. Catalysts About PTC: Operates as a software company in the Americas, Europe, and the Asia Pacific. What are the underlying business or industry changes driving this perspective? PTC is seeing accelerating adoption of AI-driven capabilities across its product suite (for example, Creo 12, Arena Supply Chain Intelligence), positioning it to capitalize on manufacturers' need for advanced product data and lifecycle management. This leverages the growing demand for automation and smart connected products and should support expansion in ARR and future top-line growth.

Want to know what’s fueling PTC’s impressive price target? Analysts are betting big on highly recurring revenues, expanding margins, and a future profit multiple that spotlights long-term transformation. Which bold numbers power this calculation? Take a deeper look to find out.

Result: Fair Value of $224.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing global policy uncertainty and competition from industry heavyweights could quickly change the direction of PTC’s trajectory and challenge these optimistic forecasts.

Find out about the key risks to this PTC narrative.

Another View: Multiples Suggest a Premium Price

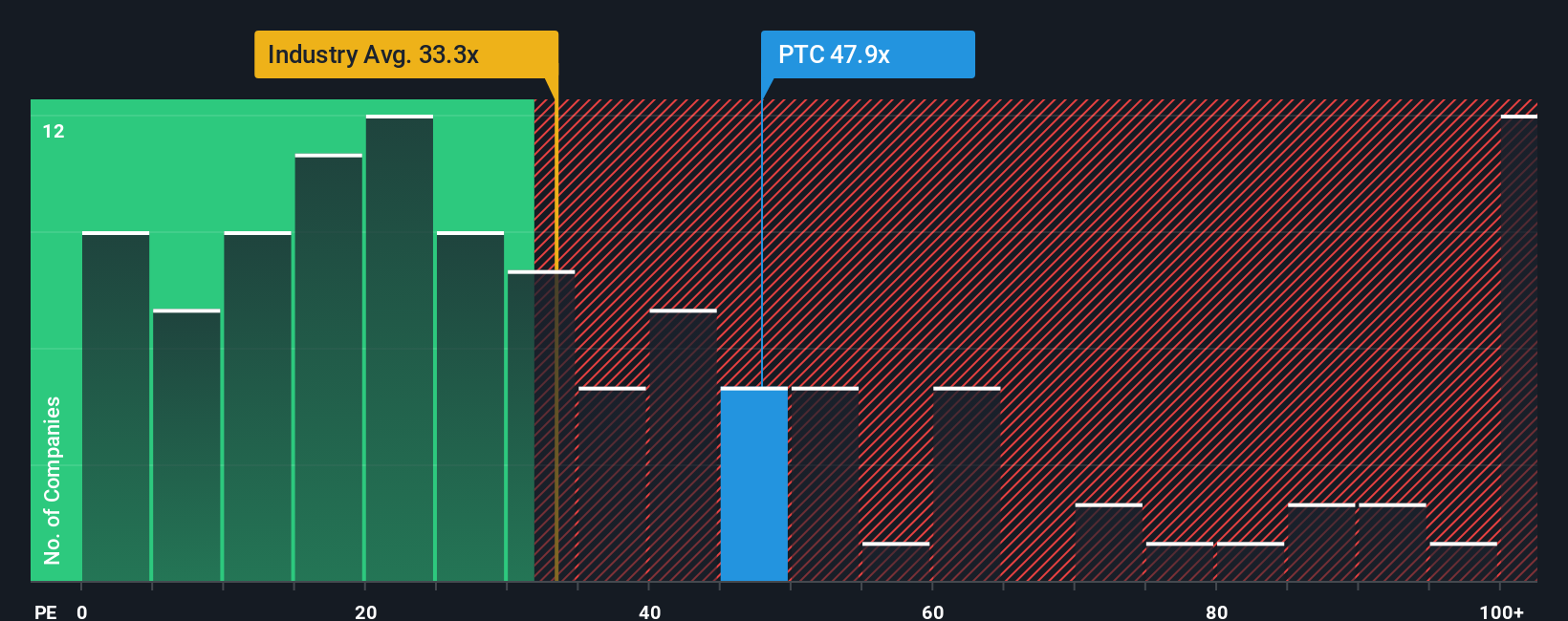

While the consensus price target points to upside, looking at earnings multiples tells a different story. PTC’s price-to-earnings ratio is 47.8x, much higher than both the US Software industry average (34.3x) and even its peer group (64.2x). The fair ratio estimate is 34.2x.

This gap highlights that investors are paying a sizable premium for PTC compared to typical software peers. The question remains: is the market overestimating PTC’s earnings potential, or could the premium be justified by its AI push and future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PTC Narrative

If you want to challenge these perspectives or prefer your own in-depth analysis, you can craft a custom PTC narrative in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding PTC.

Looking for more investment ideas?

Expand your portfolio by acting on top opportunities today. You could miss out on trend-setting stocks unless you search smarter with these focused ideas below.

- Power up your passive income by reviewing these 17 dividend stocks with yields > 3% offering reliable yields above 3% and rewarding consistent shareholders.

- Ride the AI revolution by scanning these 27 AI penny stocks positioned to benefit from transformative artificial intelligence breakthroughs and fast-growing demand.

- Capitalize on value by targeting these 876 undervalued stocks based on cash flows where prices look attractive compared to their estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTC

PTC

Operates as software company in the Americas, Europe, and the Asia Pacific.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives