- United States

- /

- Software

- /

- NasdaqGS:PTC

PTC (NasdaqGS:PTC) Launches AI-Powered CAD Solutions Tailored For Government Compliance

Reviewed by Simply Wall St

PTC (NasdaqGS:PTC) saw a 4.9% share price increase over the past week, a move that may have been supported by the launch of its new Onshape offerings, including the AI Advisor and Onshape Government. These innovations enhance design productivity and address regulatory compliance, positioning the company strongly in the CAD market. This aligns well with broader market trends where tech stocks have led gains. While the S&P 500 rose 6.8%, PTC's focused advancements in real-time collaboration and efficiency could have bolstered its market position amid a generally rising market.

The recent innovations in PTC's Onshape offerings, coupled with the introduction of AI-driven solutions like the AI Advisor and Onshape Government, are poised to impact the company's narrative significantly. These advancements enhance design productivity and regulatory compliance, aligning with PTC's focus on digital transformation and AI capabilities. Such developments might fuel revenue growth, as analysts project an annual revenue increase of 10.1% over the next three years, potentially bolstering the company's competitive standing in the CAD market.

Over a longer-term span of five years, PTC's total return, including share price and dividends, stood at a considerable 118.75%. However, looking at a one-year window, PTC underperformed the US Software industry, which returned 1%. This discrepancy highlights the importance of evaluating both immediate reaction to innovations and historical performance trends.

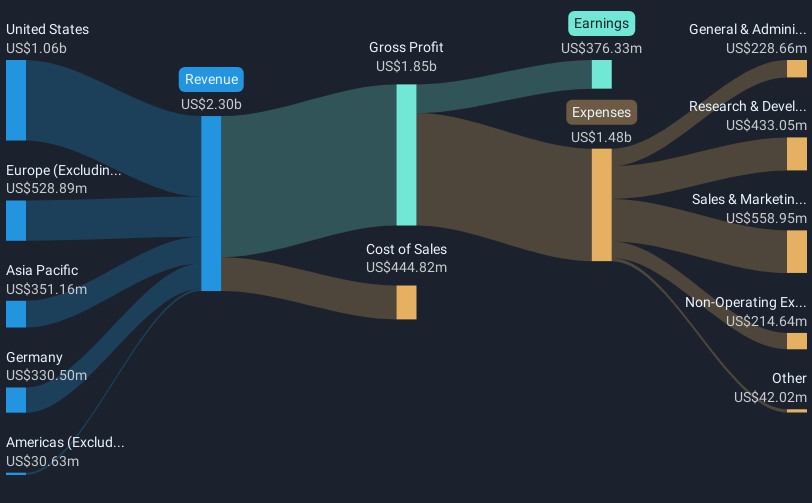

The recent 4.9% share price increase puts PTC on a trajectory closer to the analyst consensus price target of US$206.97, which suggests a substantial upside from the current share price of US$136.74. While the price target reflects a 33.9% potential increase, actual outcomes will largely depend on the successful execution and market acceptance of PTC's new offerings, as well as consistent revenue and earnings performance. With earnings currently at US$392.18 million and forecasted to rise, the impact of AI integration and digital transformation strategies are key watchpoints for future performance.

Learn about PTC's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTC

PTC

Operates as software company in the Americas, Europe, and the Asia Pacific.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives