- United States

- /

- Software

- /

- NasdaqGS:PRGS

What Is Progress Software Corporation's (NASDAQ:PRGS) Share Price Doing?

Progress Software Corporation (NASDAQ:PRGS), might not be a large cap stock, but it saw a decent share price growth in the teens level on the NASDAQGS over the last few months. As a small cap stock, which tends to lack high analyst coverage, there is generally more of an opportunity for mispricing as there is less activity to push the stock closer to fair value. Is there still an opportunity here to buy? Let’s examine Progress Software’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

See our latest analysis for Progress Software

Is Progress Software still cheap?

Good news, investors! Progress Software is still a bargain right now according to my price multiple model, which compares the company's price-to-earnings ratio to the industry average. I’ve used the price-to-earnings ratio in this instance because there’s not enough visibility to forecast its cash flows. The stock’s ratio of 23.63x is currently well-below the industry average of 59.1x, meaning that it is trading at a cheaper price relative to its peers. Although, there may be another chance to buy again in the future. This is because Progress Software’s beta (a measure of share price volatility) is high, meaning its price movements will be exaggerated relative to the rest of the market. If the market is bearish, the company’s shares will likely fall by more than the rest of the market, providing a prime buying opportunity.

Can we expect growth from Progress Software?

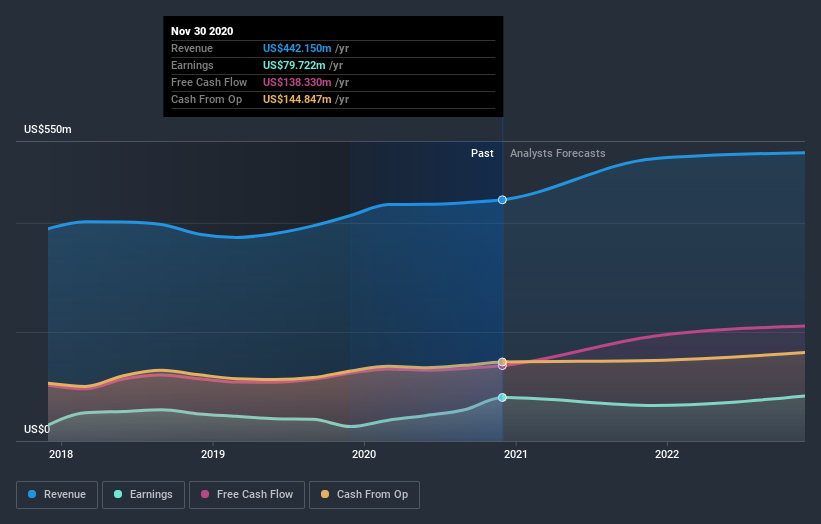

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. Though in the case of Progress Software, it is expected to deliver a relatively unexciting earnings growth of 3.7%, which doesn’t help build up its investment thesis. Growth doesn’t appear to be a main reason for a buy decision for the company, at least in the near term.

What this means for you:

Are you a shareholder? Even though growth is relatively muted, since PRGS is currently trading below the industry PE ratio, it may be a great time to accumulate more of your holdings in the stock. However, there are also other factors such as financial health to consider, which could explain the current price multiple.

Are you a potential investor? If you’ve been keeping an eye on PRGS for a while, now might be the time to make a leap. Its future profit outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy PRGS. But before you make any investment decisions, consider other factors such as the track record of its management team, in order to make a well-informed investment decision.

In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of Progress Software.

If you are no longer interested in Progress Software, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you’re looking to trade Progress Software, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:PRGS

Progress Software

Provides software products that develops, deploys, and manages artificial intelligence (AI) powered applications and digital experiences in the United States and internationally.

Good value with very low risk.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

My long-term take on Nike: A global sports brand with steady growth potential but margin challenges to solve.

QuantumScape: A Mispriced Deep‑Tech Inflection Point With Multi‑Billion‑Dollar Optionality

30 Baggers Silver Miner with Gold/VTM Optionality

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks