- United States

- /

- Software

- /

- NasdaqGS:PRGS

Progress Software Corporation's (NASDAQ:PRGS) Earnings Grew 16%, Did It Beat Long-Term Trend?

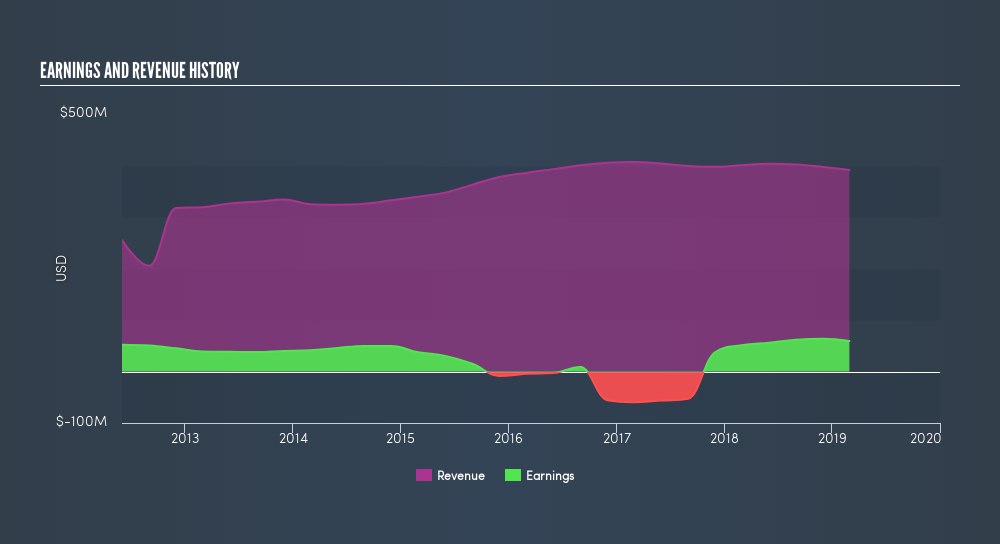

In this article, I will take a look at Progress Software Corporation's (NASDAQ:PRGS) most recent earnings update (28 February 2019) and compare these latest figures against its performance over the past few years, along with how the rest of PRGS's industry performed. As a long-term investor, I find it useful to analyze the company's trend over time in order to estimate whether or not the company is able to meet its goals, and eventually grow sustainably over time.

View our latest analysis for Progress Software

Did PRGS's recent earnings growth beat the long-term trend and the industry?

PRGS's trailing twelve-month earnings (from 28 February 2019) of US$59m has jumped 16% compared to the previous year.

Furthermore, this one-year growth rate has exceeded its 5-year annual growth average of 0.2%, indicating the rate at which PRGS is growing has accelerated. How has it been able to do this? Let's see whether it is merely attributable to industry tailwinds, or if Progress Software has experienced some company-specific growth.

In terms of returns from investment, Progress Software has fallen short of achieving a 20% return on equity (ROE), recording 19% instead. However, its return on assets (ROA) of 10% exceeds the US Software industry of 5.7%, indicating Progress Software has used its assets more efficiently. And finally, its return on capital (ROC), which also accounts for Progress Software’s debt level, has increased over the past 3 years from 6.9% to 20%.

What does this mean?

While past data is useful, it doesn’t tell the whole story. Companies that have performed well in the past, such as Progress Software gives investors conviction. However, the next step would be to assess whether the future looks as optimistic. I suggest you continue to research Progress Software to get a more holistic view of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for PRGS’s future growth? Take a look at our free research report of analyst consensus for PRGS’s outlook.

- Financial Health: Are PRGS’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 28 February 2019. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:PRGS

Progress Software

Develops, deploys, and manages artificial intelligence (AI) powered applications and digital experiences in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion